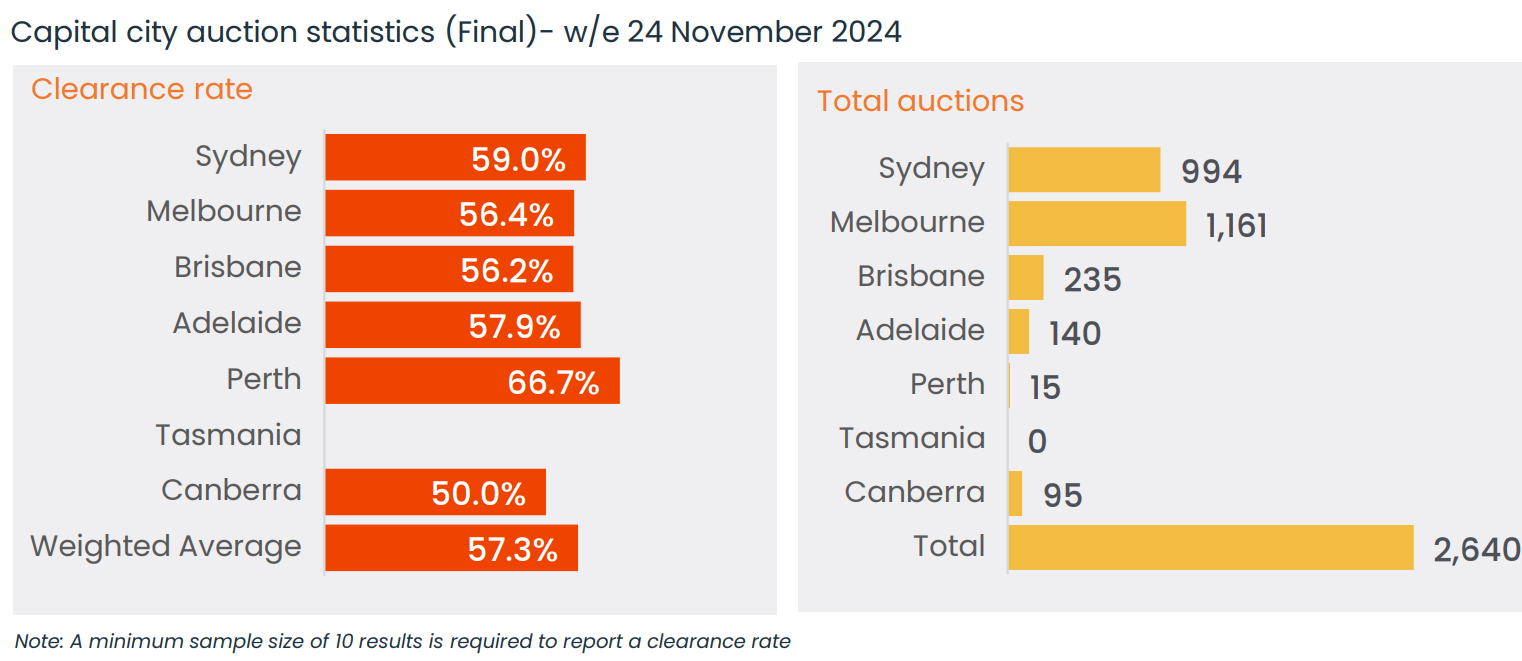

CoreLogic released its final auction results for last weekend, which were universally weak.

As illustrated below, clearance rates were below 60% across all capital cities except Perth.

Source: CoreLogic

Holding below the 60% mark for the sixth consecutive week, the combined capital city clearance rate was 57.3% last week, the same as the previous week (57.3%).

Melbourne’s clearance rate fell to 56.4%, surpassing the previous week’s (56.9%) and being the second lowest this year.

Sydney’s final clearance rate was 59.0% last week, well below the 63.9% rate recorded at the same time last year.

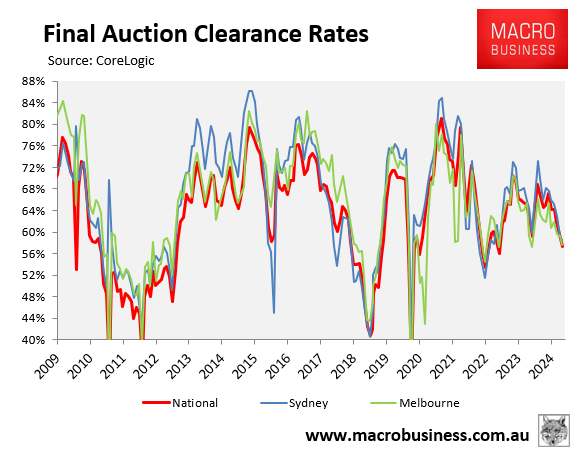

The following chart plots clearance rates on a monthly average basis across Sydney, Melbourne, and nationally.

Sydney’s monthly average clearance rate (58%) is the lowest since December 2022, Melbourne’s (58%) is the lowest since December 2023, whereas the national average clearance rate (57%) is the lowest since August 2022.

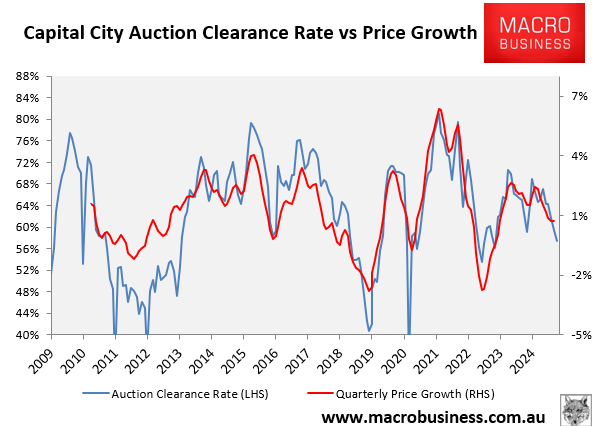

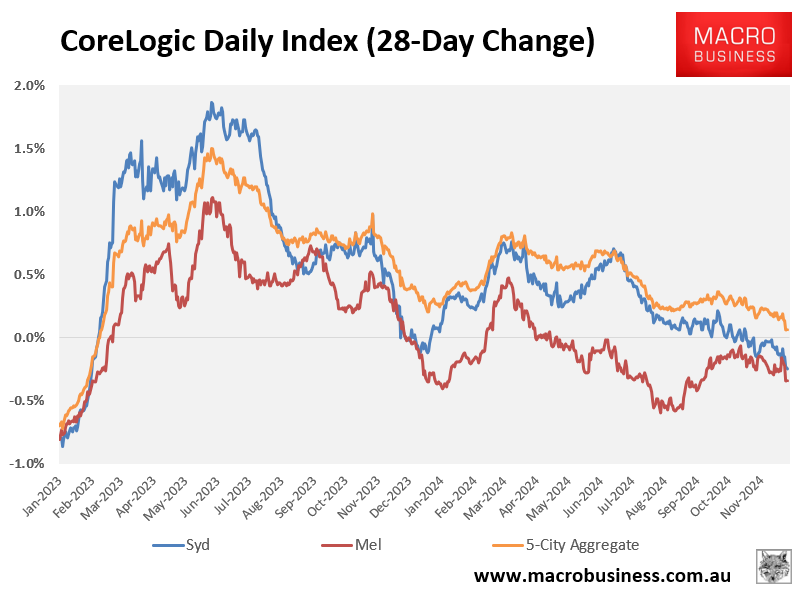

The next chart illustrates that the auction clearance rate has traditionally been a solid indicator of dwelling value growth.

This is certainly the case for Sydney and Melbourne, which are both recording falling dwelling values on a rolling 28-day basis.

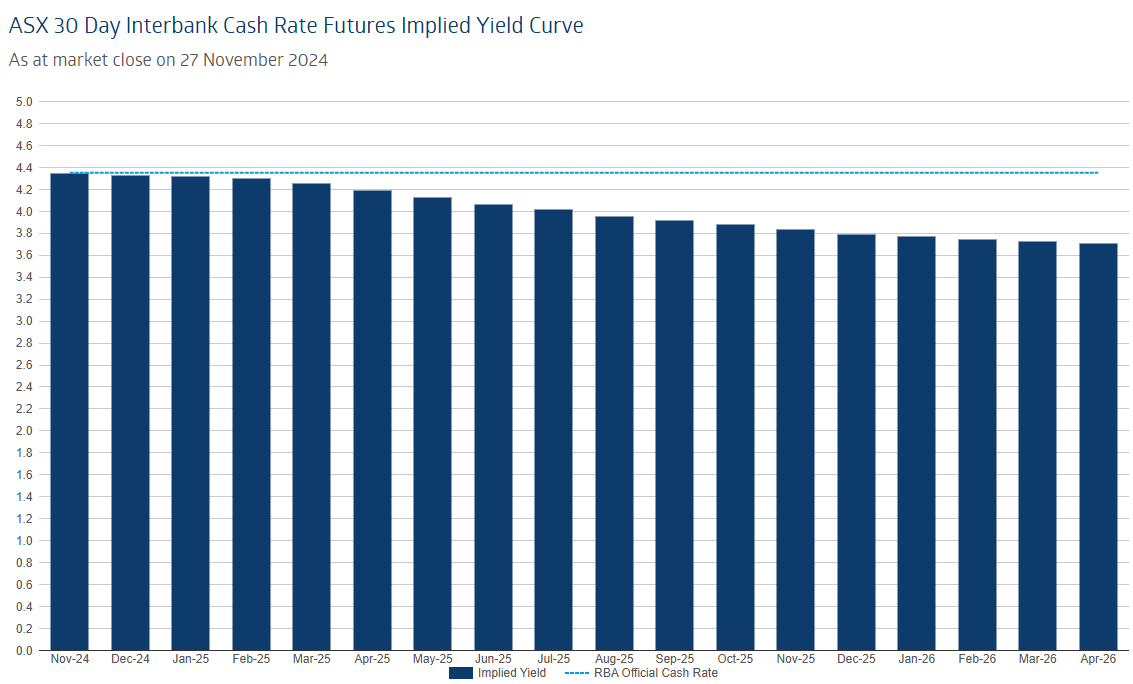

Momentum is unlikely to change until the Reserve Bank of Australia cuts interest rates.

The futures market is projecting a rate cut in May 2025.