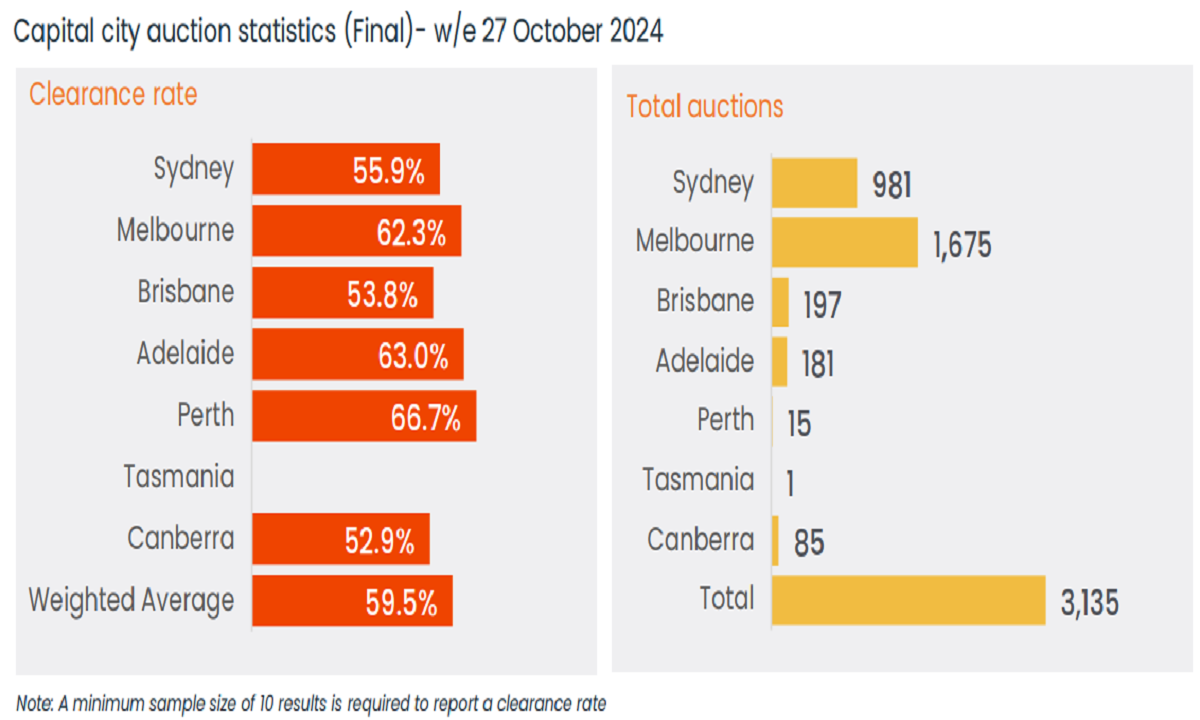

CoreLogic’s final auction results for last weekend were released, with the final capital city clearance rate falling to 59.5%.

Source: CoreLogic

It was only the third time this year that the national clearance rate has fallen below 60% and followed the 58.2% clearance rate recorded in the previous week, which was the worst result of the year.

Over the same week last year, 62.9% of reported auctions were successful.

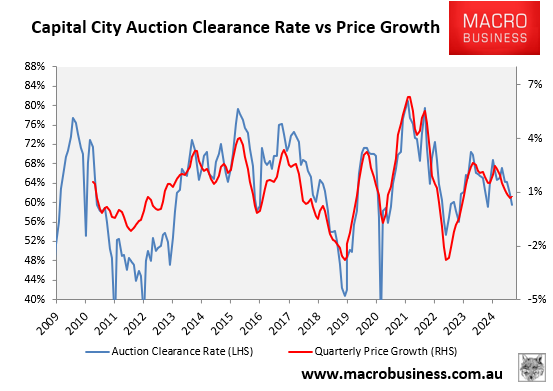

The decline in clearance rates nationally has negatively impacted house prices. PropTrack recorded capital city value growth of only 0.7% over the three months to October, the slowest quarterly growth rate since the three months to January 2023.

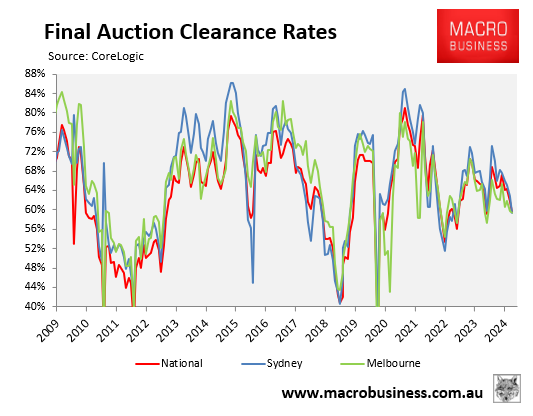

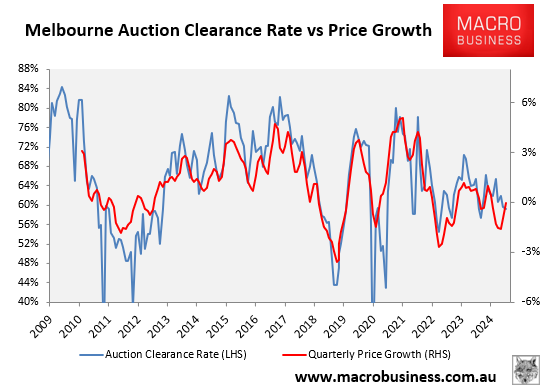

Melbourne’s clearance rate came in at 62.3% last week, after holding below 60% for the past five weeks. The rebound in Melbourne’s clearance rate has seen the rate of decline in values moderate.

In contrast, Sydney’s final clearance rate plummeted to 55.9% last week, the lowest clearance rate the city has recorded all year. Last week’s result was 8.3% lower than the same week last year (64.2%).

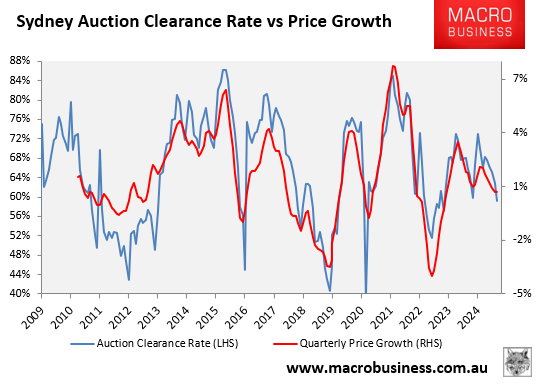

As illustrated below, the decline in Sydney’s final auction clearance rate has pulled value growth sharply lower and is the main driver behind the fall in the national clearance rate.

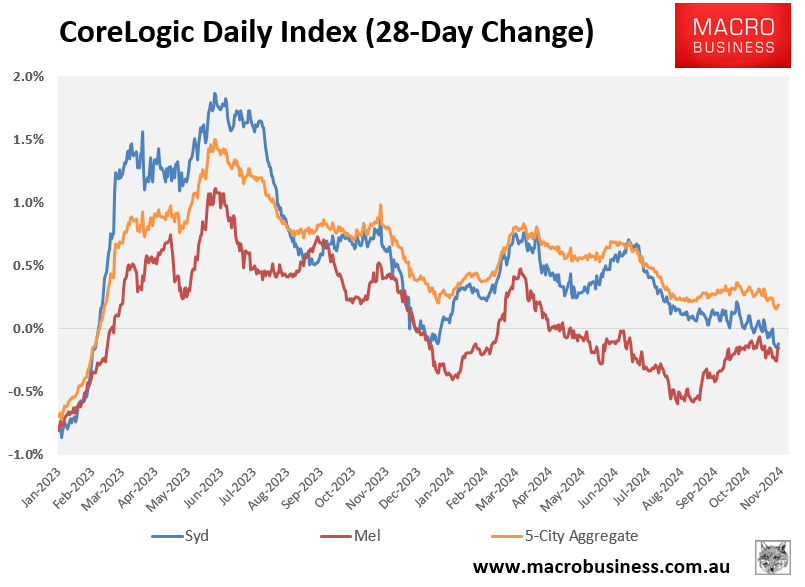

The following chart plots CoreLogic’s daily dwelling values index on a 28-day average basis across Sydney, Melbourne, and at the 5-city aggregate level.

As you can see, both major capitals are now recording value declines, which are reflected in their auction results.

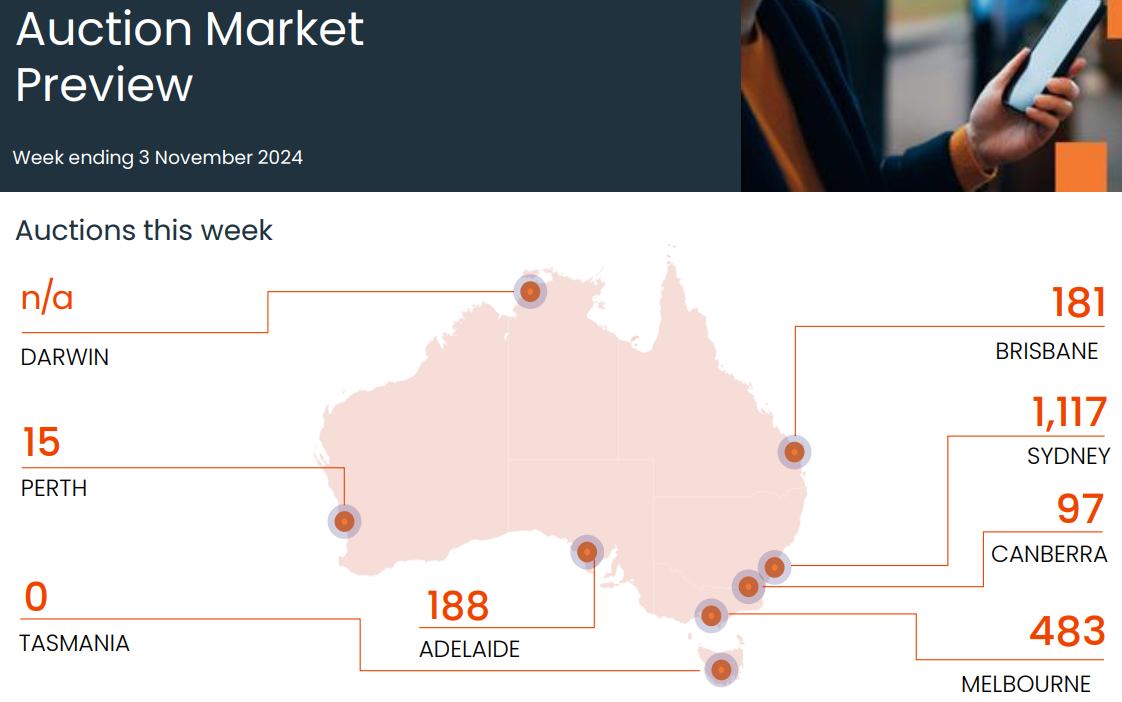

Auction activity nationally will slow this weekend owing to the Melbourne Cup.

There are 2,081 capital city homes scheduled for auction this week, down from 3,135 auctions held across the combined capitals last week.

Melbourne is scheduled to host only 483 auctions this week, whereas Sydney will host 1,117 auctions.

Source: CoreLogic