The latest ANZ/CoreLogic housing affordability report has revealed the “impossible” barriers facing Australian first-home buyers.

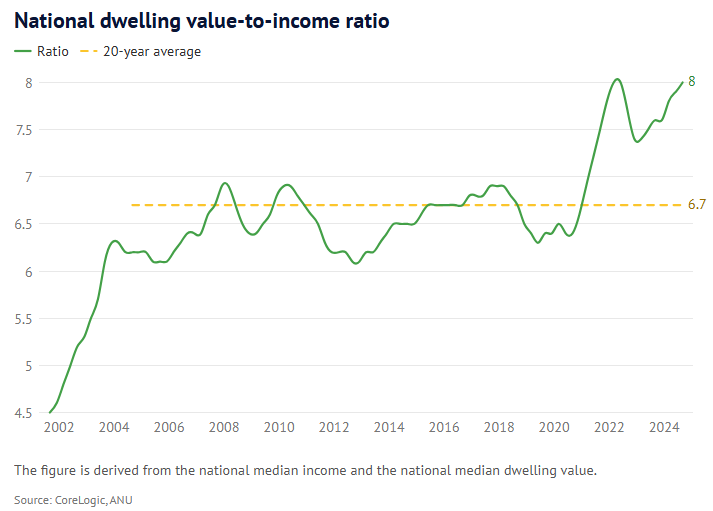

The national dwelling value-to-rent ratio hit an equal record high of eight in the September quarter of 2024.

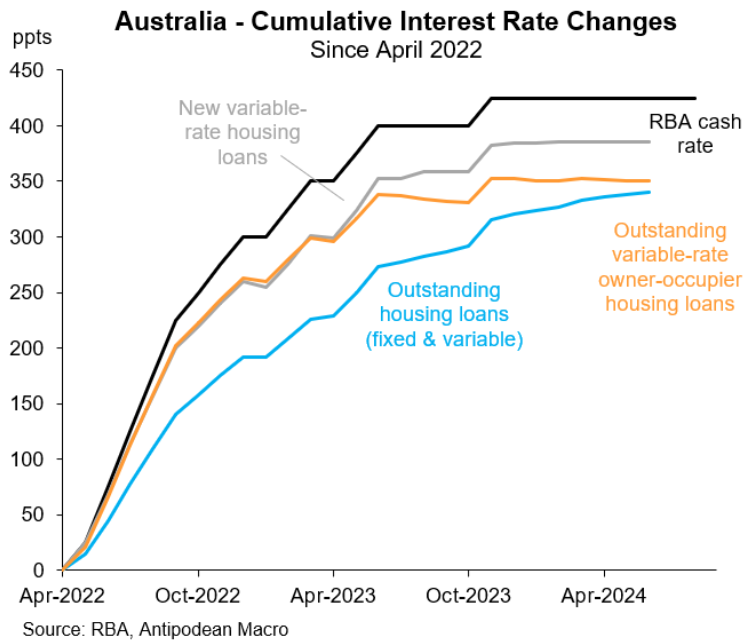

At the same time, Australian mortgage rates have roughly doubled from the pandemic low.

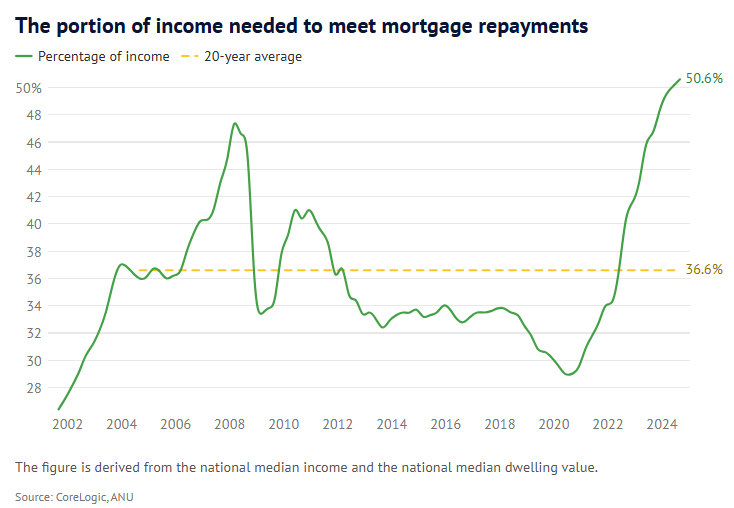

The combination of higher prices and mortgage rates has pushed the percentage of median household disposable income spent on mortgage repayments on a median-priced home to a record high of 50.6% nationally.

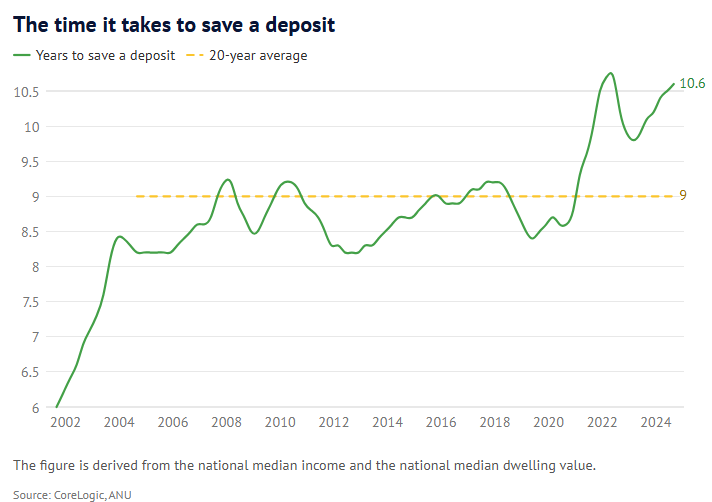

At the same time, the time taken to save a deposit is tracking near a record high of 10.6 years nationally, up from the 20-year average of nine years.

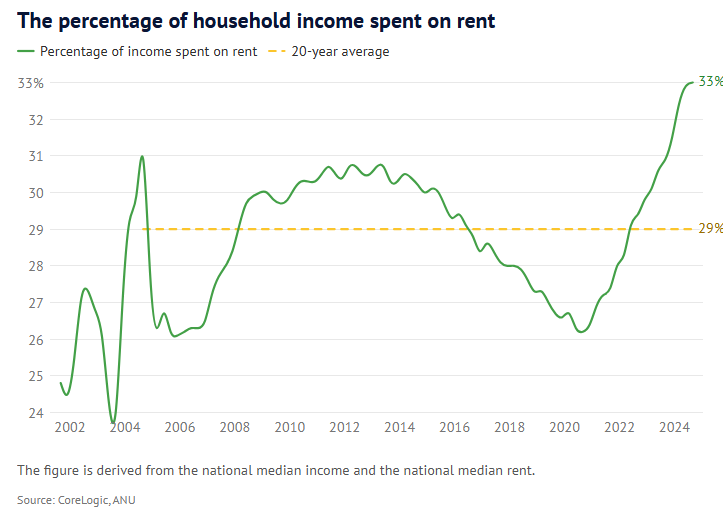

However, saving a deposit has become much harder due to rental affordability collapsing to a record low.

As illustrated below, the percentage of median household income spent on rent has hit a record high of 33%, up from the 20-year average of 29%.

In short, record high home values, high mortgage rates, and surging rents have combined to create a perfect storm of factors that has made home ownership a nearly impossible dream without family financial assistance.

CoreLogic’s head of research, Eliza Owen, commented that home ownership is “not realistic” for a median income household, which is about $101,000 across Australia, to put down a 20% deposit on the median-priced home at the average owner-occupier mortgage rate without assistance from the Bank of Mum and Dad.

“It’s basically impossible … at current mortgage rate levels”, she said. “Especially [for] those who don’t have access to intergenerational wealth and are just relying on their income to break into the market”.

“We can’t assume that everyone has a workaround to get into the housing market like the bank of mum and dad or moving somewhere cheaper, buying something smaller”.

“It really just highlights the damage the ongoing rise in prices is doing to people’s ability to get into the property market”, AMP chief economist Shane Oliver added.

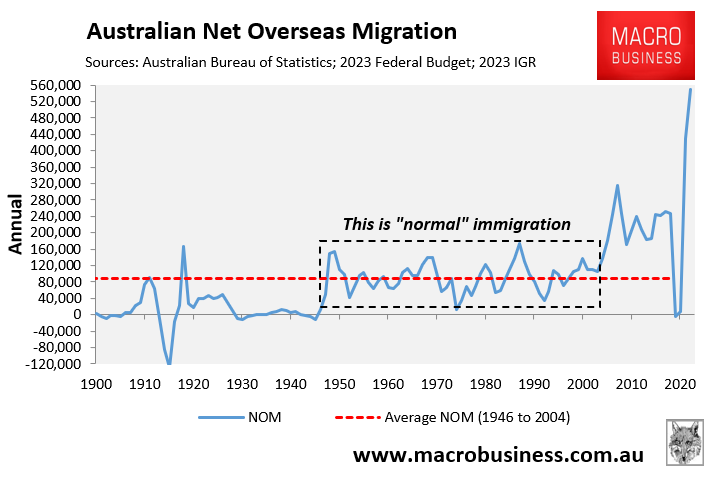

Excessive levels of immigration have made the situation much worse for first-home buyers via:

- Driving up rents, thereby making it much harder to save a deposit.

- Putting upward pressure on prices, increasing the deposit requirement and the amount that must be borrowed.

The number one solution to Australia’s housing affordability crisis is to reduce demand by slashing immigration to historical levels, as shown in the black box below.