Australian capital city home values have risen for 18 months after recording a 0.2% increase in October, the smallest monthly gain since home prices started rising in February 2023.

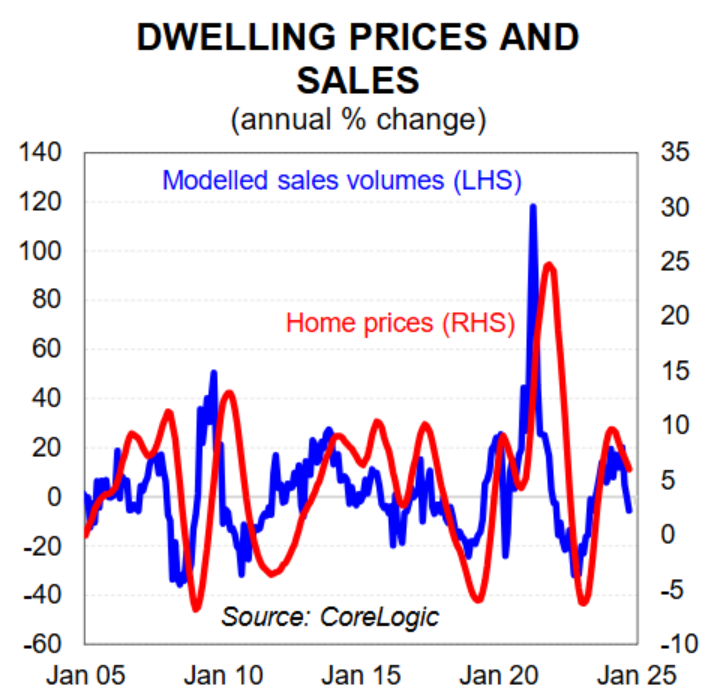

Momentum is slowing as sales volumes fall, advertised stock levels lift, auction clearance rates soften, and affordability constraints bite.

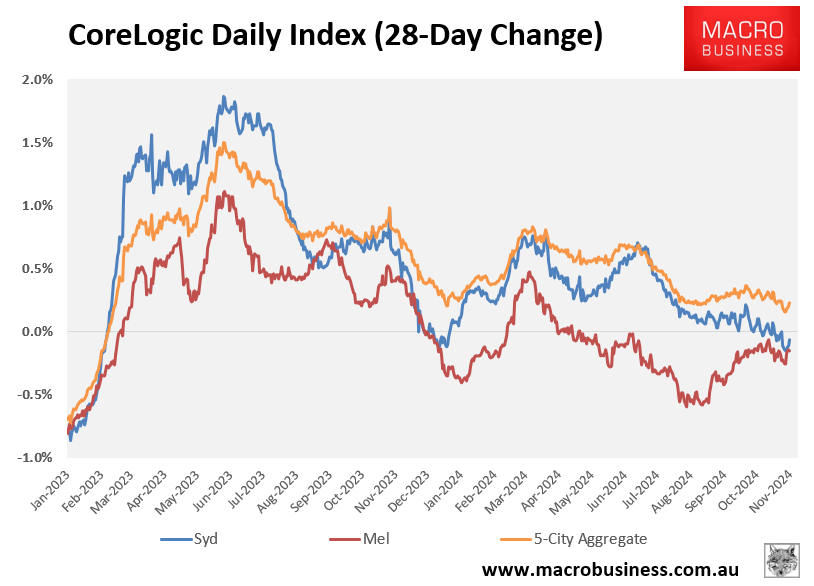

The slowdown in momentum is being driven by Australia’s two largest capital city markets, Sydney and Melbourne.

According to CoreLogic’s daily dwelling values index, Sydney and Melbourne have recorded declines of -0.1% and -0.2%, respectively, over the past 28 days.

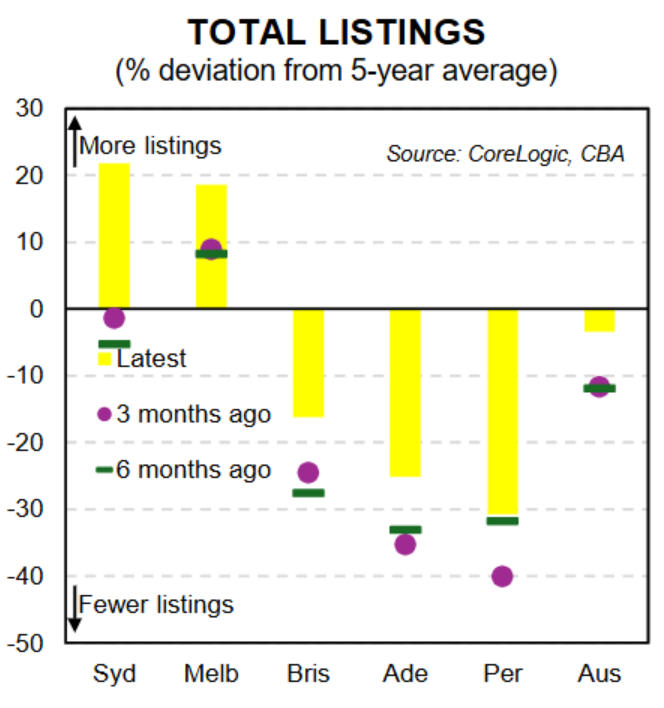

A sharp rise in for-sale listings has driven the decline in Sydney and Melbourne values. In both capital cities, advertised stock levels have lifted above five-year averages, as illustrated below by CBA.

At the same time as listings have increased, particularly in Sydney and Melbourne, the number of sales has softened, which generally leads to a fall in home prices.

CBA also notes that lower sales volumes are also seeing a lift in the median days on the market for homes for sale.

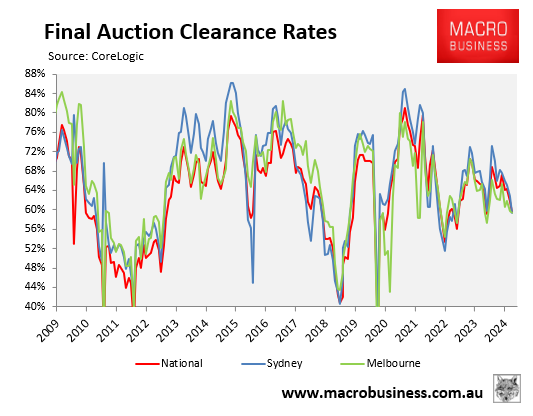

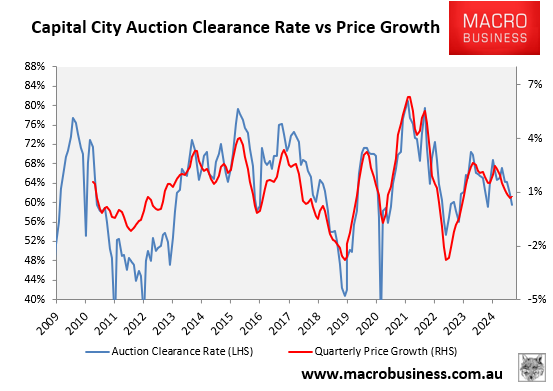

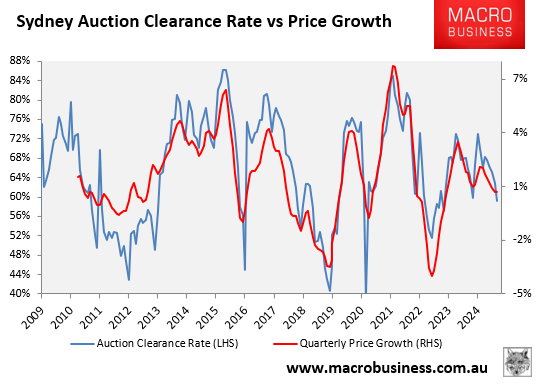

The weaker buyer sentiment is also reflected in the auction market, where clearance rates have fallen sharply on rising volumes.

The final national clearance rate was recorded below 60% over the past two weeks, the lowest results recorded this year.

This decline in the national auction clearance rate has been reflected by home prices slowing to a crawl.

The slowdown has been especially severe in Sydney, which recorded its lowest clearance rate of the year (55.9%) last week.

CoreLogic’s preliminary auction results for the weekend just gone fell to 63.4%, which was the lowest preliminary clearance rate so far this year (down from 66.8% the week prior, which was revised down to 59.5% on final numbers).

The finalised auction clearance rate has held below 60% for three of the past four weeks and is likely to settle below 60% again once the collection of auction results is finalised on Wednesday.

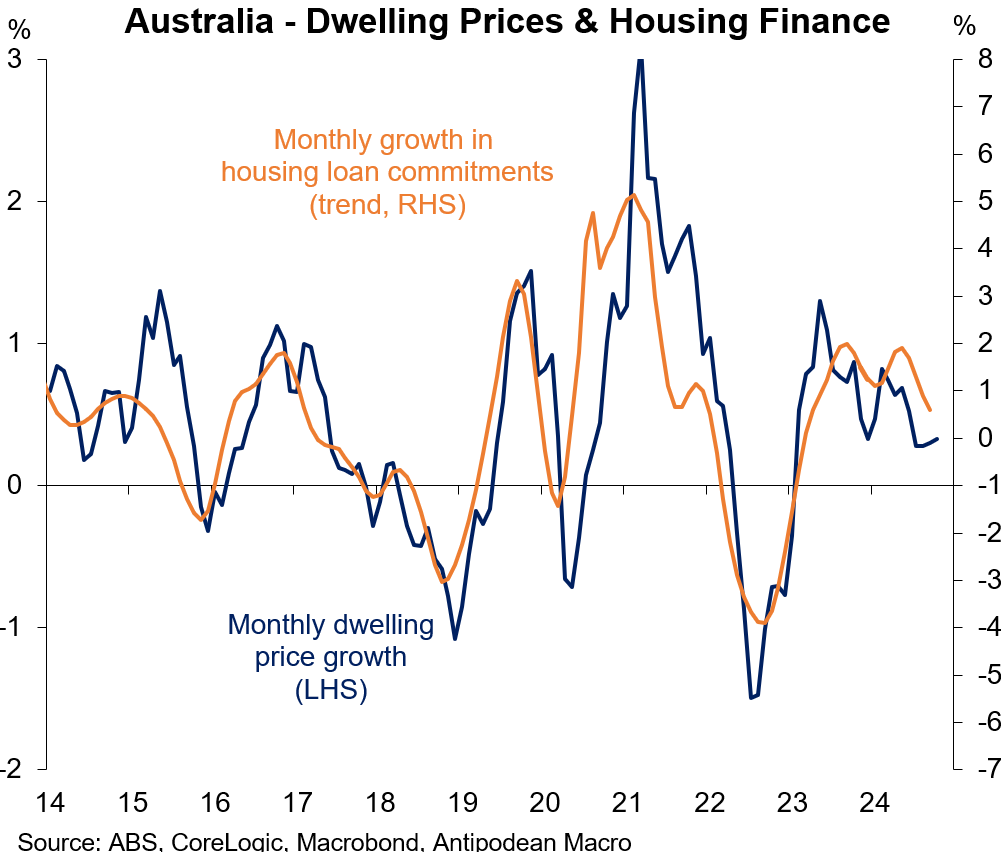

Finally, the growth in new mortgages is following home price growth lower, as illustrated below by Justin Fabo at Antipodean Macro.

After 18 months of gains, home prices nationally appear to be peaking, with Sydney and Melbourne driving the shift in momentum.