The Reserve Bank of Australia (RBA) ‘s interest rate decision last week was undeniably “hawkish”.

The RBA explicitly stated that “underlying inflation is too high” at 3.5% and admitted that it underappreciated the strength of public spending, which has inflated aggregate demand and kept unemployment low.

The NAB business survey was released on Tuesday and contained positive information regarding underlying inflation.

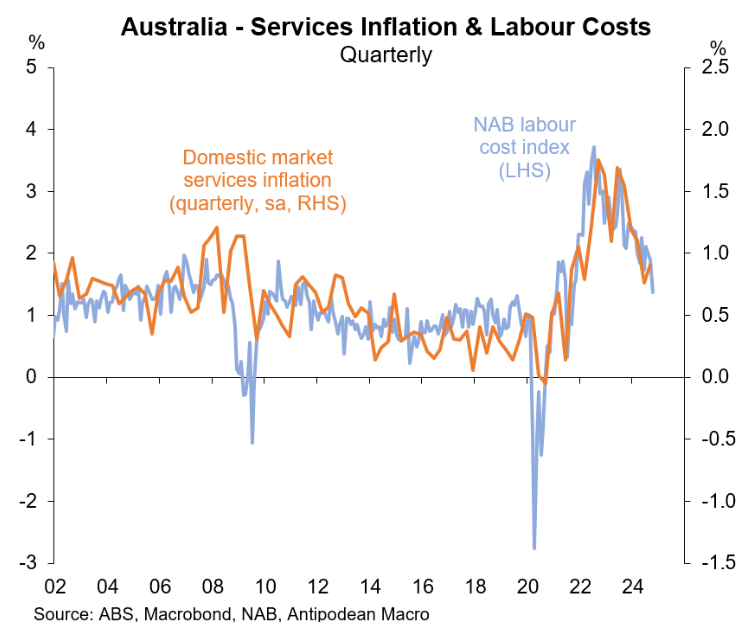

As illustrated in the following charts from Justin Fabo at Antipodean Macro, Australian businesses noted that labour cost growth slowed further in October.

This, according to Fabo, is a good indicator of trends in Australia’s domestic market services inflation and is pointing to further disinflation.

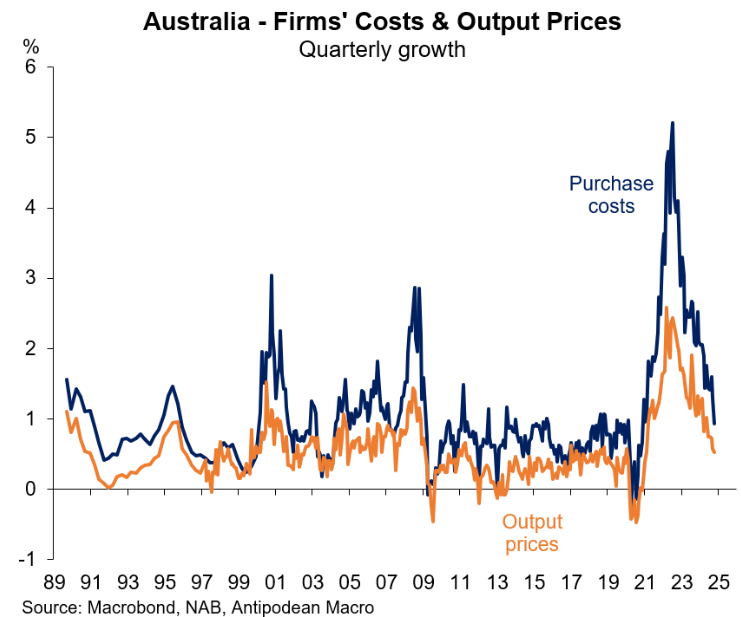

Fabo also noted that Australian businesses reported slower growth in output prices and purchase costs in October. In fact, the growth in purchase costs declined to the 2000-2019 average.

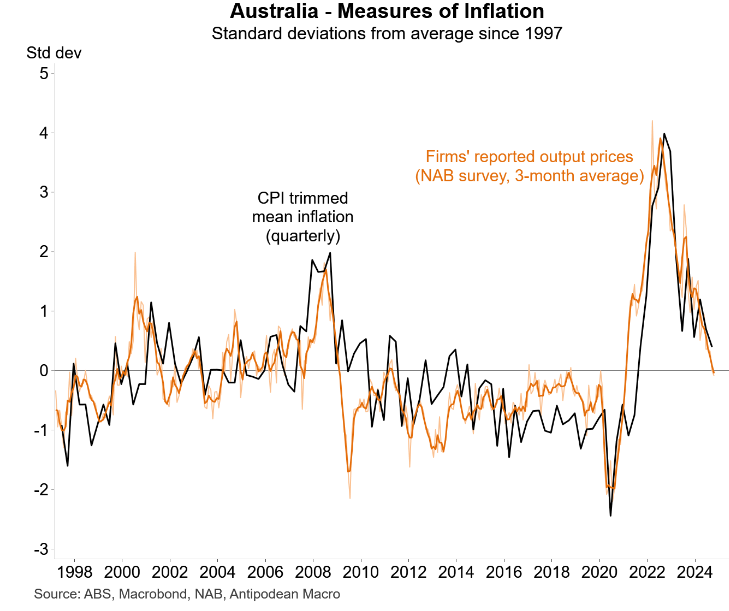

To top it off, Fabo plotted the above data on firm’s reported output prices against Australia’s trimmed mean inflation:

As you can see, the disinflation reported by the NAB business survey points to further disinflation in underlying inflation.

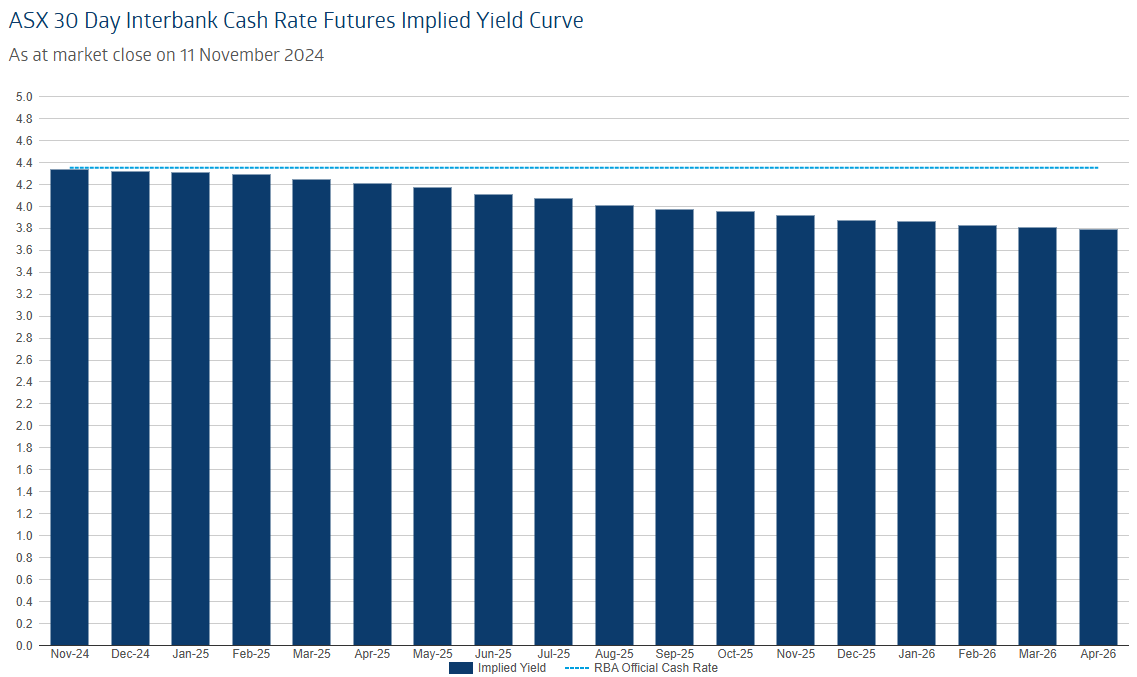

Futures markets are tipping that Australia’s first interest rate cut will mid-next year.

The Albanese government will be desperately hoping that the NAB business survey is indicative of broader inflationary pressures, prompting the RBA to cut rates well ahead of the May 2025 election.