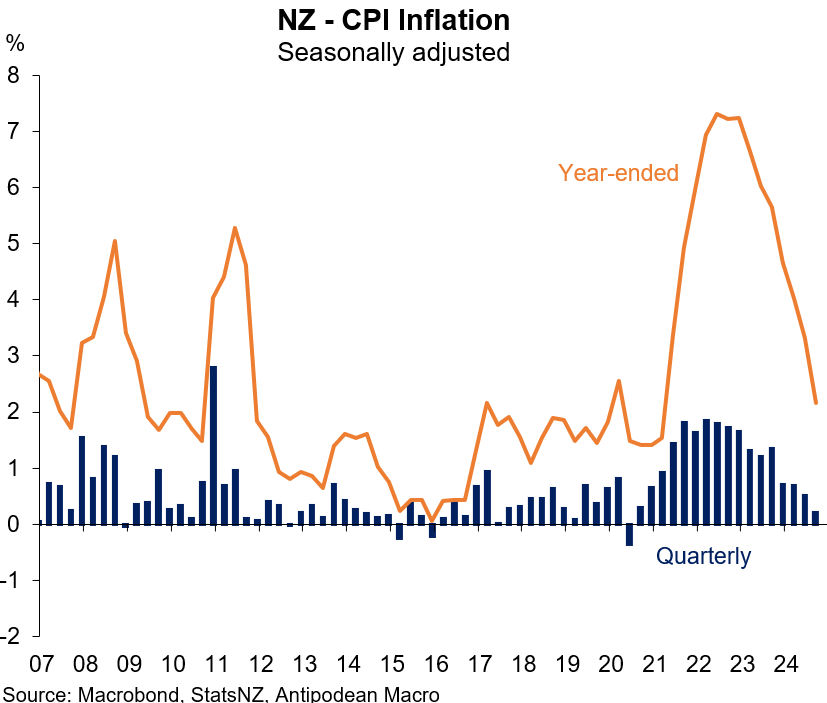

The latest consumer price index (CPI) data for New Zealand showed that headline inflation had fallen to only 2.2% in the year ended Q3 2024, tracking within the Reserve Bank’s inflation target of 1% to 3%.

This would suggest that the Reserve Bank has slayed the inflation dragon.

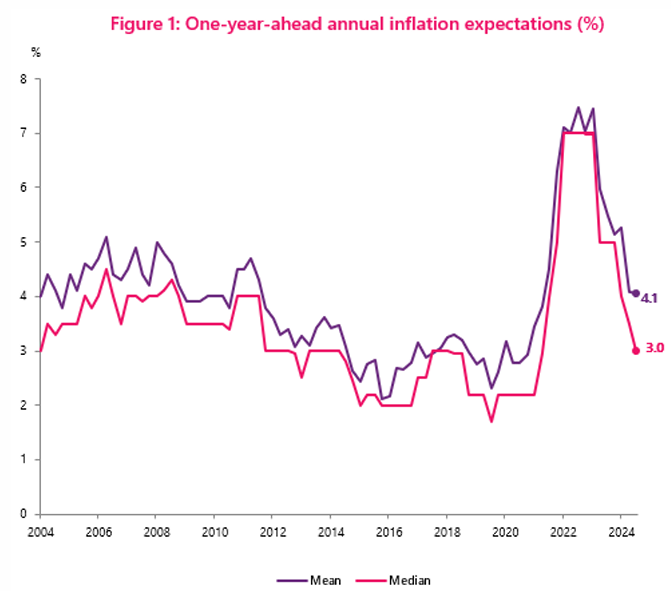

However, the latest Reserve Bank survey suggests that New Zealand households do not believe that inflation has been beaten.

The survey of around 1000 households began on the same day as Statistics New Zealand’s CPI inflation release on 16 October 2024.

The mean household expectation for one-year-ahead annual inflation remained unchanged at 4.1% in the Q3 2024 quarter.

Source: Reserve Bank of New Zealand

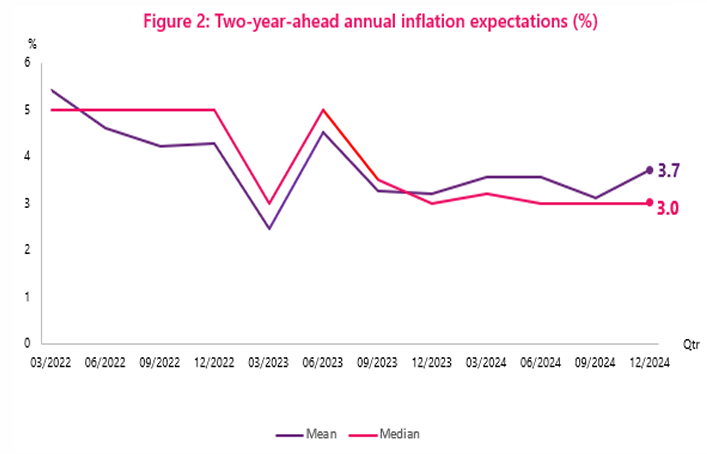

The mean two-year-ahead annual inflation expectation increased from 3.1% to 3.7% in the Q3 2024 quarter.

Source: Reserve Bank of New Zealand

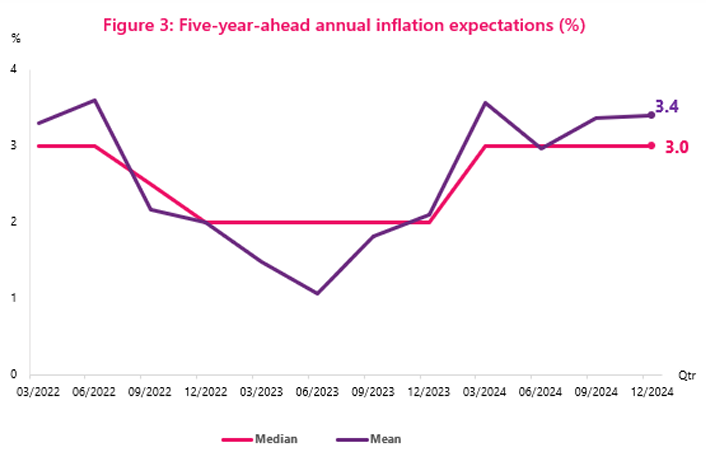

The mean five-year-ahead annual inflation expectation also remained unchanged at 3.4%.

Source: Reserve Bank of New Zealand

The separate Reserve Bank Survey of Expectations, which featured the views of business leaders and professional forecasters, also showed an increase in expectations of future inflation.

While expectations for one-year-ahead annual inflation decreased by 35 basis points from 2.40% to 2.05%, Two-year-ahead inflation expectations increased from 2.03% to 2.12%. Five-year-ahead and ten-year-ahead inflation expectations also increased to 2.24% and 2.19%, respectively.

The Reserve Bank would prefer to see expectations fall in line with actual inflation, as anticipation of higher future inflation can become self-fulfilling.

Indeed, one of the most important challenges in managing actual inflation is to reduce inflation expectations.

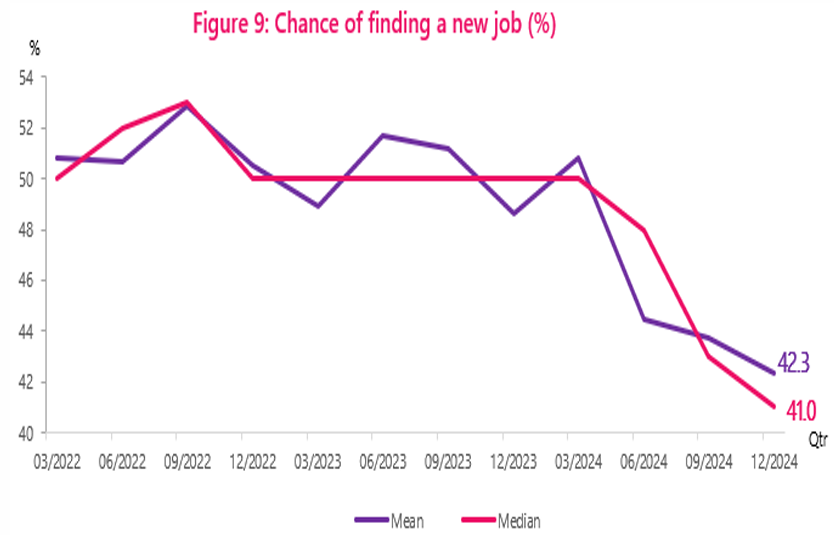

Meanwhile, New Zealand households also believe that it has become harder to find a job.

Respondents were asked on a scale of 0 (i.e. not at all likely) to 100 (i.e. extremely likely) the chance they would find a new job in the next 3 months if they lost their job this coming month.

On average, respondents believed there was a 42.3% chance they would find a new job in the next three months if they lost their job. This decreased from the previous quarter (43.8%) and was the third consecutive quarterly decline in respondent employment expectations.

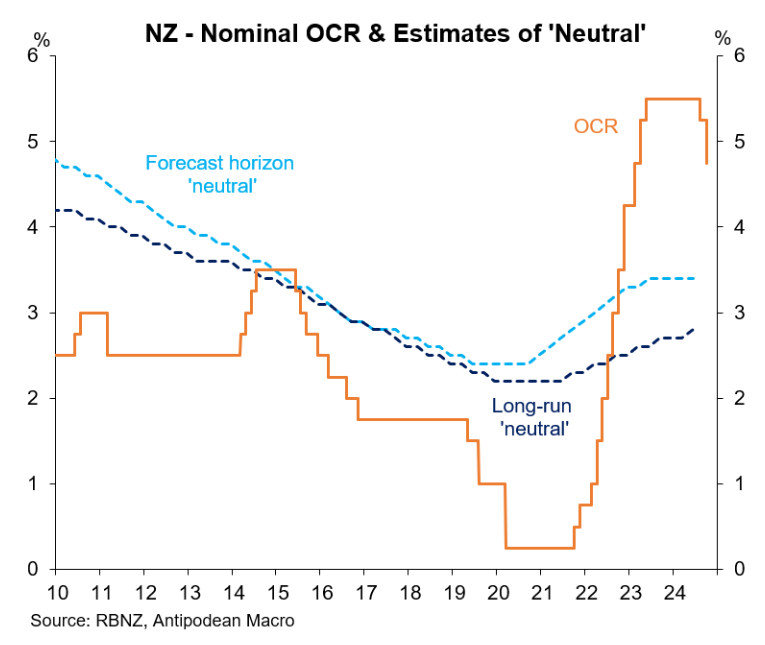

Despite the higher inflation expectations, the Reserve Bank is widely tipped to cut the official cash rate next week by at least 50 basis points, which would following the 0.75% of cuts already delivered.

Indeed, the Reserve Bank has deemed that monetary policy is currently highly restrictive.