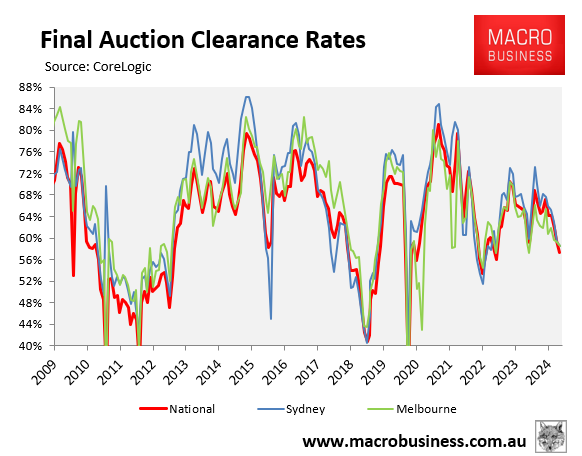

Australia’s auction market has stalled in recent months, with monthly average clearance rates across Sydney and Melbourne falling to year-lows.

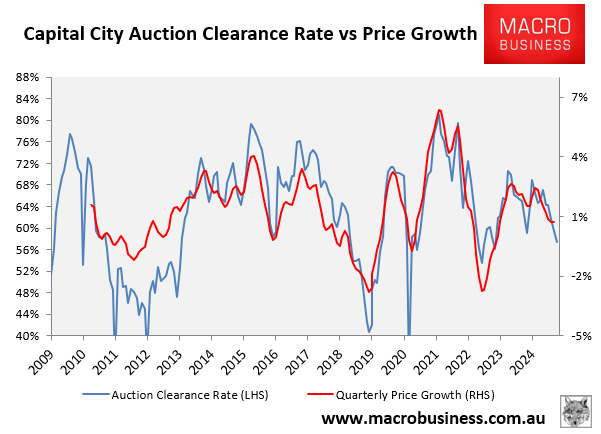

As illustrated below, the decline in clearance rates has pulled down price growth across the combined capital cities.

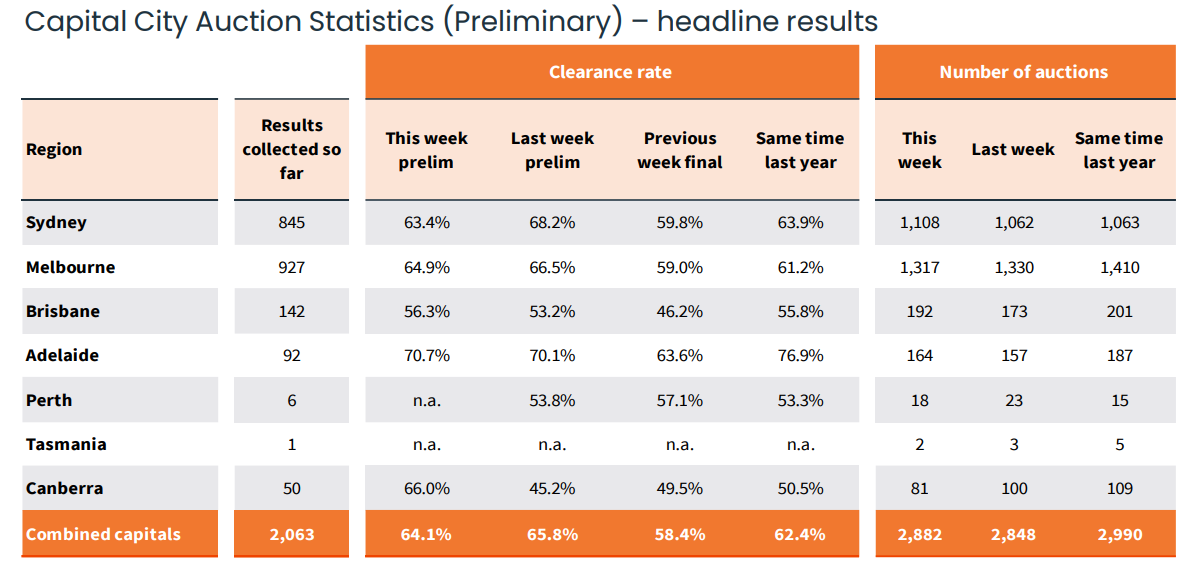

This weekend’s combined capital city preliminary clearance rate was the third lowest of the year to date, coming in at only 64.1%, compared to 65.8% the week prior (revised down to 58.4% on final numbers).

Source: CoreLogic

Melbourne’s preliminary clearance rate was 64.9%, down from 66.5% last week (revised down to 59.0% at final numbers).

In Sydney, only 63.4% of auctions were reported as successful based on the early collection, the second lowest preliminary clearance rate so far this year (after the first week of October came in at 62.7%).

Commenting on the results, leading auctioneer Tom Panos noted that homes are selling for significantly less in Sydney than a few months ago.

“I’m seeing result after result of properties selling significantly lower than what they could have gotten a few months ago”, Panos said in his weekend wrap.

“There are buyers out there that are wasting this golden opportunity to secure a property at a much lower figure than what they were paying a few months ago”.

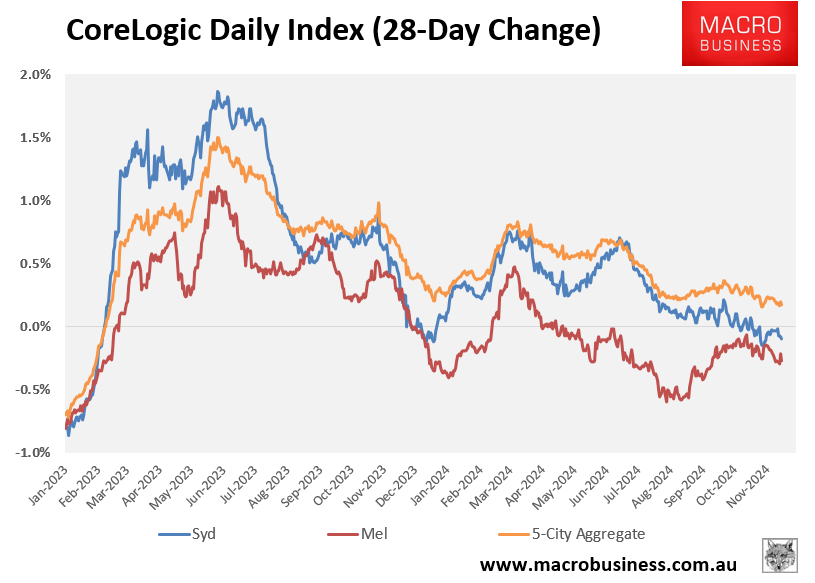

CoreLogic’s daily dwelling values index supports Panos’ view, with Sydney and Melbourne recording falling prices.

Both markets will struggle until the Reserve Bank of Australia commences an interest rate easing cycle.