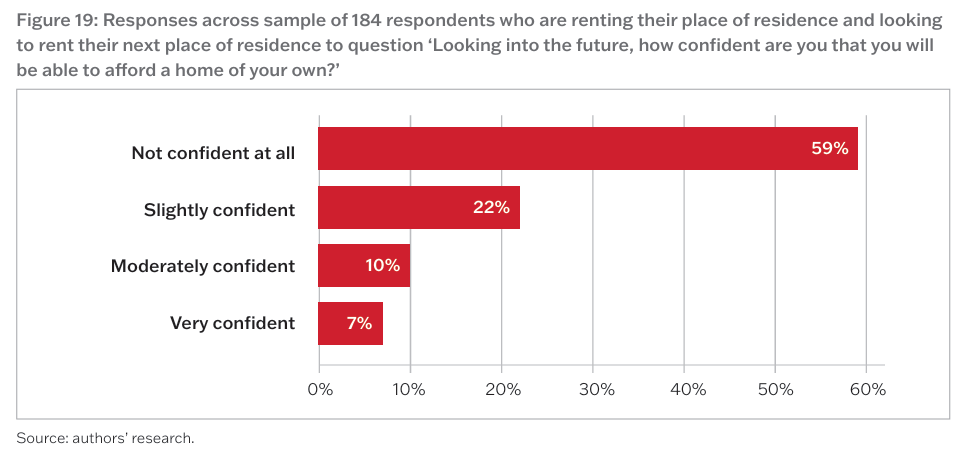

Last week, the Australian Housing and Research Institute (AHURI) released a survey showing that while 78% of renters want to purchase a home, 59% do not believe that it is possible.

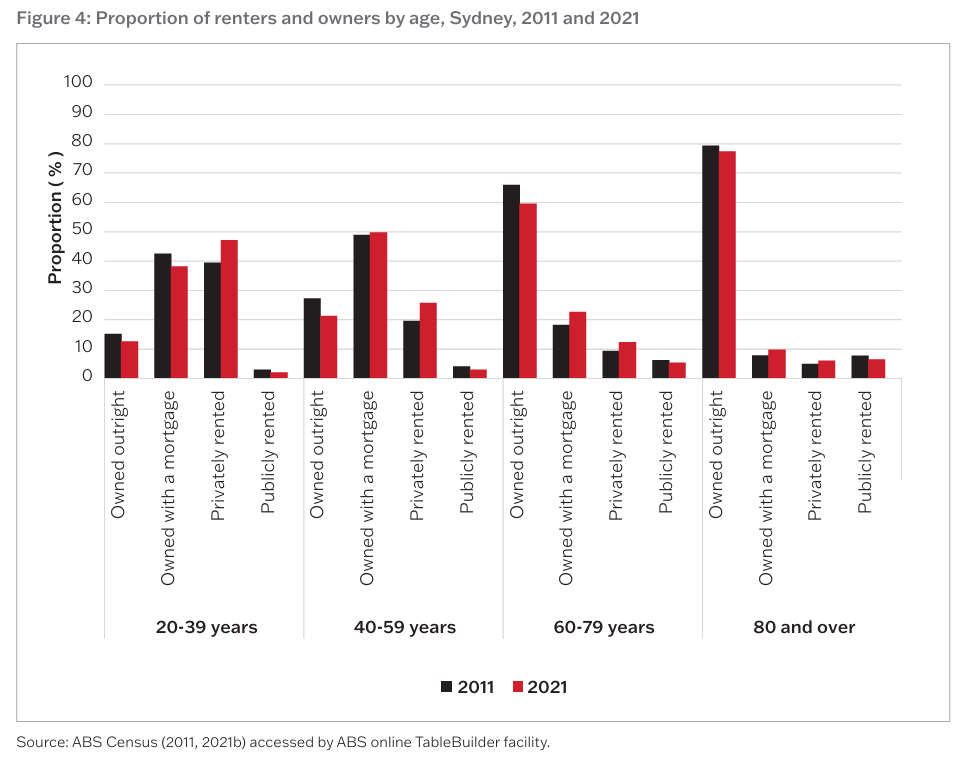

The study also showed that the proportion of people renting in the private market increased the most for 20-39-year-olds, followed by 40-59-year-olds between 2011 and 2021.

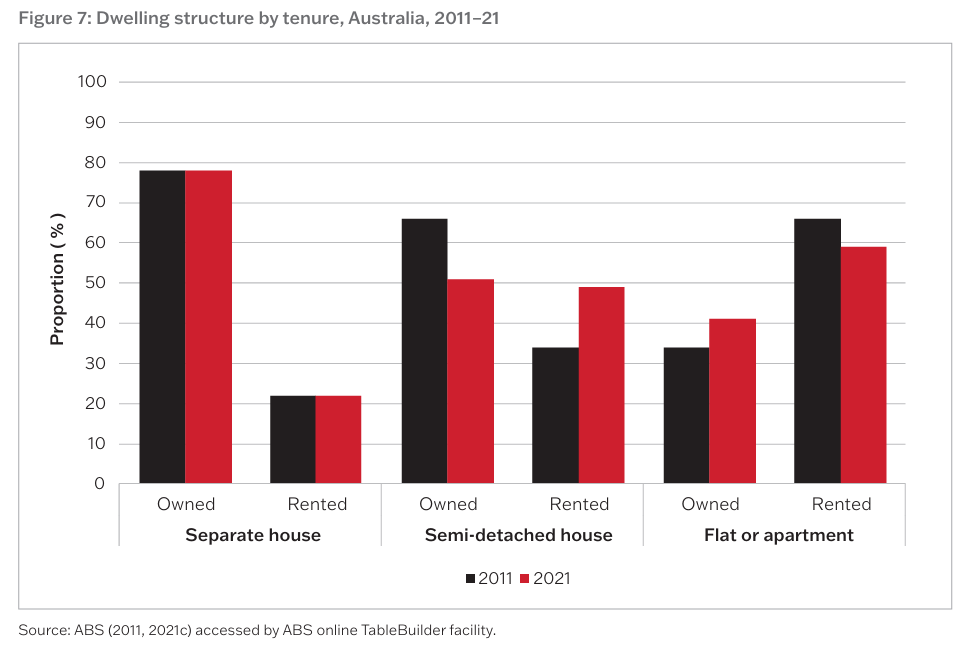

All of the growth in renting households occurred in the higher density market, namely apartments and townhouses.

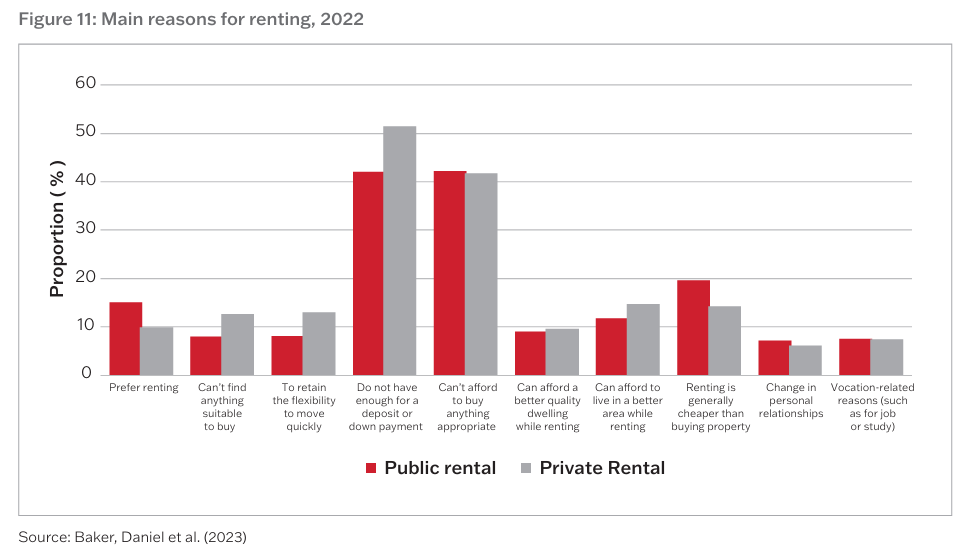

The main reasons given for households renting were financial, related to the poor affordability of housing.

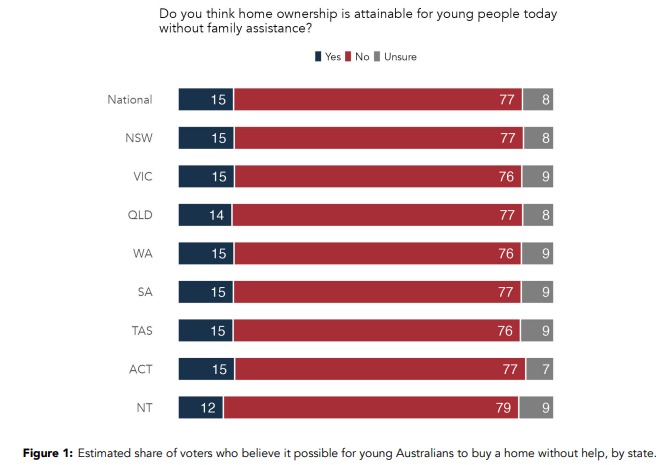

A separate survey from Accent Research, released this month, showed that only 15% of respondents believed that it is possible for younger Australians to purchase a home without financial assistance.

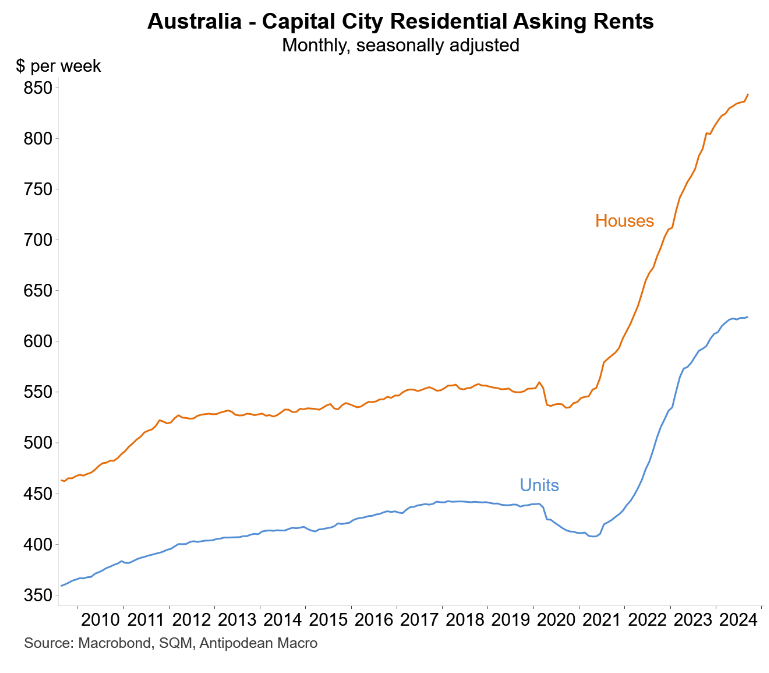

CoreLogic research director Tim Lawless stated that strong rental growth has made the aspiration of home ownership more difficult to achieve.

“If they’re contributing more of their income to rent, rather than saving for a deposit, it would make it harder to get into a home”, he said.

“I do think the surge we’ve seen has had an impact on people’s ability to get into the marketplace”.

Lawless noted that even if growth stalled, rents would remain structurally higher than they were before the pandemic.

“I wouldn’t expect rents to come down materially”, he said.

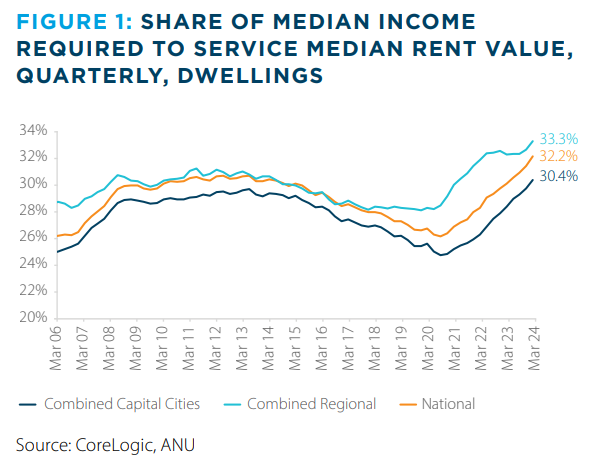

Lawless’ comments follow CoreLogic research in April showing that the share of median income spent on rent had hit a record high of 32.2% nationally and 33.3% across the combined capital cities.

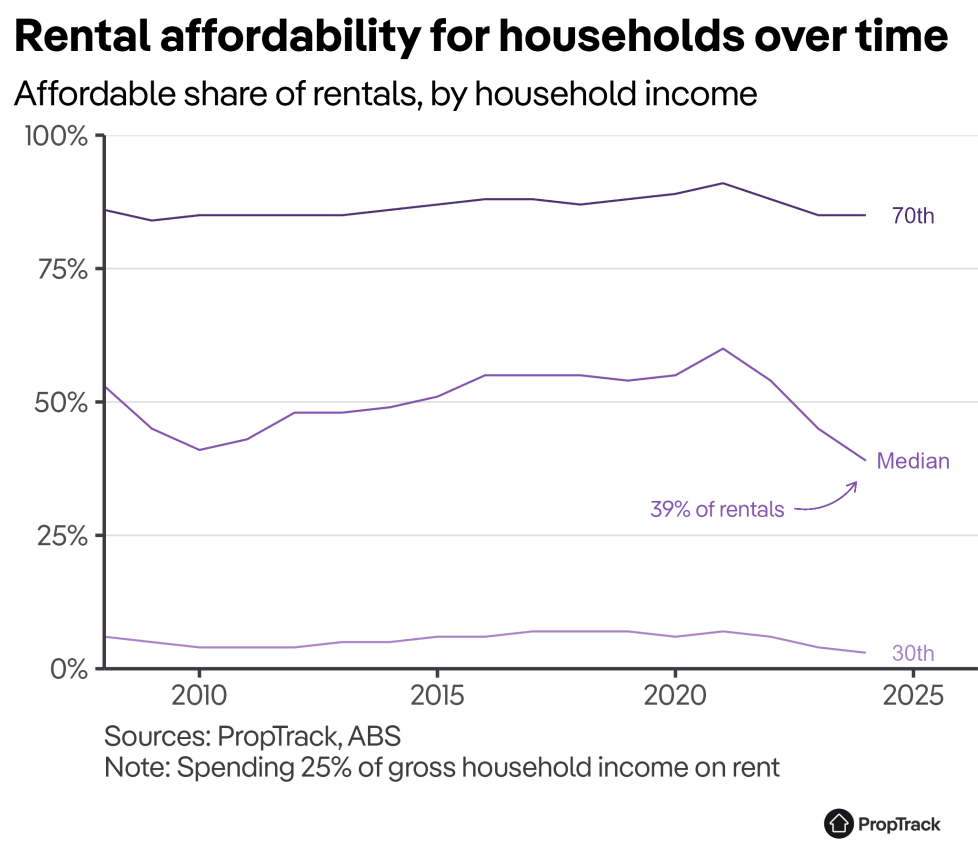

Separate analysis from PropTrack in May also showed that rental affordability had hit an all-time low.

Tenant advocacy group Better Renting published its Cost of Renting report last week, which showed that renters are facing the equivalent of the ‘hunger games’, following a 10% median increase in rents year-on-year.

Better Renting executive director Joel Dignam said that tight vacancy rates meant that most tenants had no bargaining power and were unable to locate a cheaper rental when facing an increase.

The survey also found that tenants were cutting back on essentials to pay higher rents.

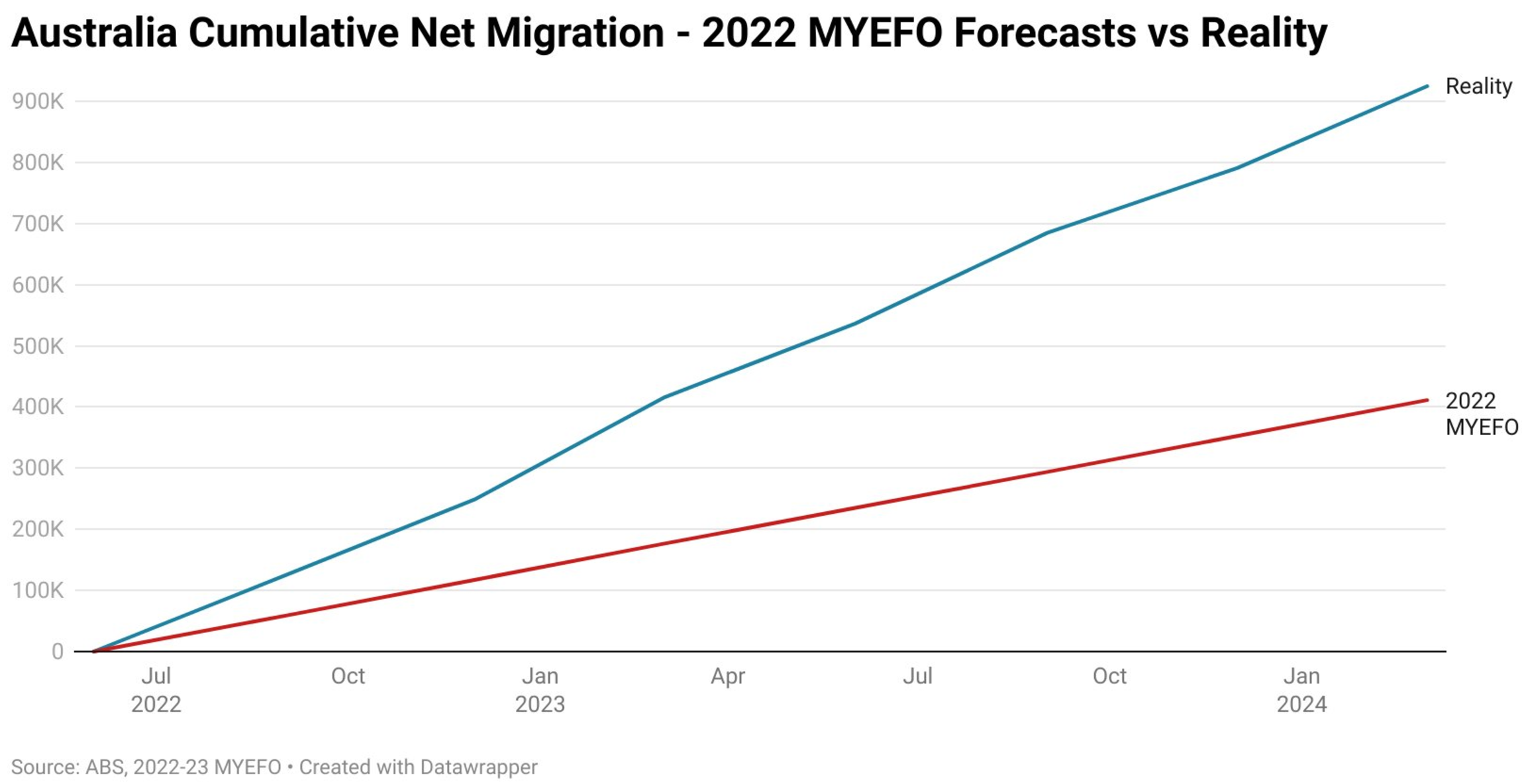

The federal government’s extreme immigration has underpinned the surge in rents. Net overseas migration over the first 21 months of the Albanese government was 513,000 higher than projected in the government’s first mini-budget in October 2022.

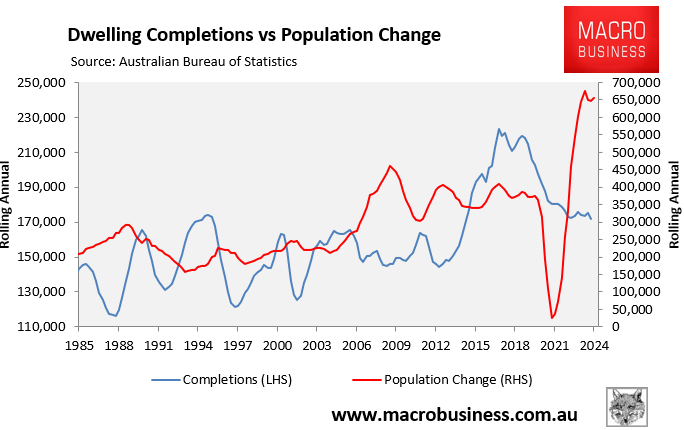

This surge in net migration has had a two-fold detrimental impact on first-home buyers.

- As Tim Lawless mentioned above, the increase in migration has forced up rents, making it more difficult for potential first-time home buyers to save a deposit.

- The surge in migration has also forced up home prices to record levels, pushing home ownership further out of reach.

So long as immigration remains high, the housing market will remain chronically undersupplied.

As a result, there will be upward pressure on prices and rents, turning more Australians into forever renters.