Morgan Stanley with the note.

Gauging Potential Economic Implications of Higher Tariffs

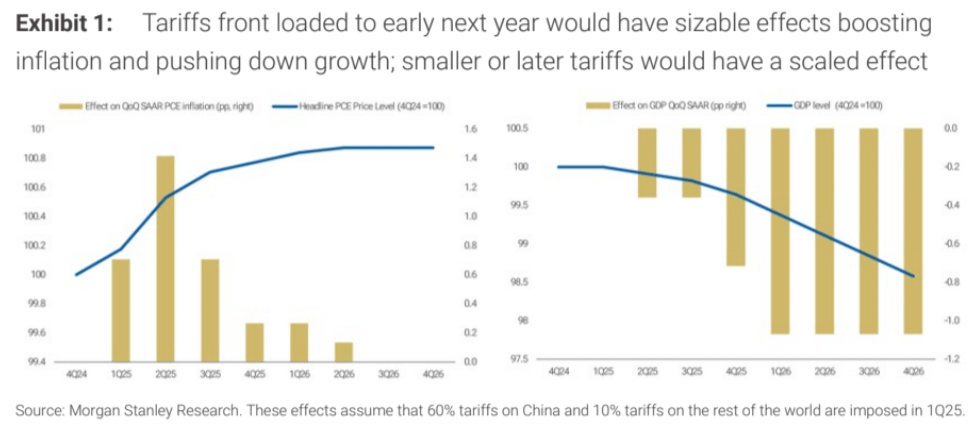

Although future trade policy is heavily debated heading into the US election, our Global Economics team believes the market may still be underappreciating the degree to which higher tariffs, if implemented, could affect the US economy.

They estimate that if 60% tariffs on China and 10% tariffs on the rest of the world are imposed in 1Q25, headline US Personal Consumption Expenditure (PCE) prices could be driven up quickly, and real GDP growth could be subject to a delayed drag.

That said, our team believes the US economy is in a good place entering the election and can absorb uncertainty for a period of time —hence, they expect their outlook for 1Q25 to be relatively unchanged by the election results.

If this comes to pass, Australia can expect a deluge of cheap China goods.

Most notably EVs as Elon Musk gets his tariffs.