CBA Senior Economist Stephen Wu has released the bank’s forecasts for the upcoming monthly CPI indicator.

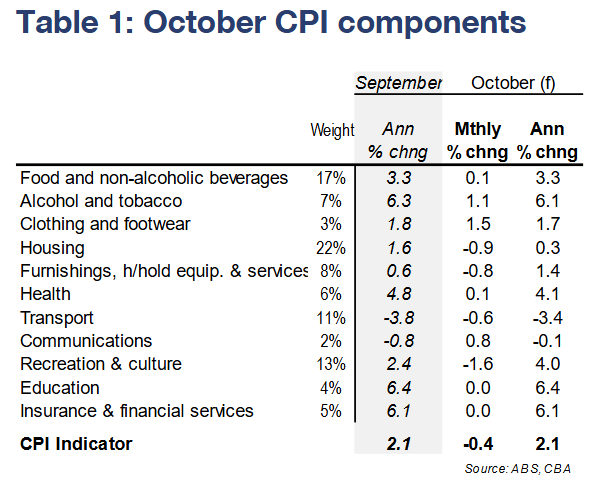

CBA expects the monthly indicator to record annual headline inflation of 2.1% in October, near the bottom of the Reserve Bank of Australia’s (RBA) target range of 2% to 3%.

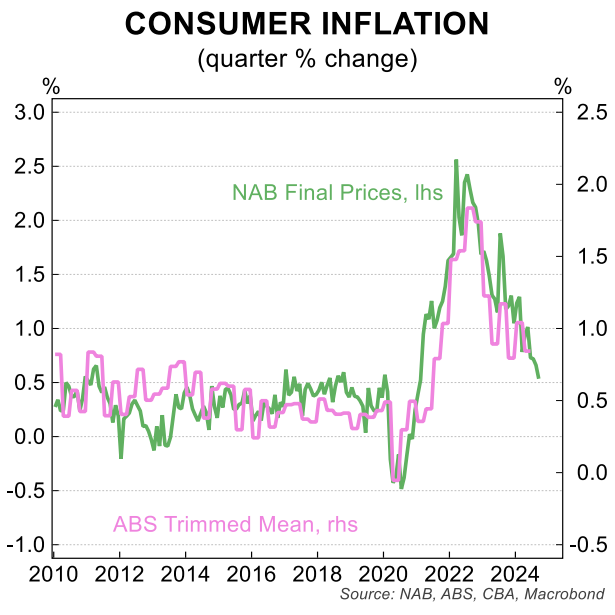

Wu notes that other measures of inflation have shown a disinflationary pulse. These include the final prices in the NAB Business survey, and output prices in the S&P Global Australia PMI survey.

“Together with other surveys, they suggest the balance of risks for inflation sits on the downside”, noted Wu.

Government subsidies will have a significant impact on the monthly CPI indicator.

CBA forecasts that there will be a final, large decline in electricity prices of ~12%/mth, as well as a 0.3%/mth fall in rents owing to the increase in Commonwealth Rent Assistance (CRA).

That said, annual trimmed mean inflation is expected to have risen to 3.4% from 3.2%, reflecting less favourable base effects (i.e., large price falls a year ago not being repeated).

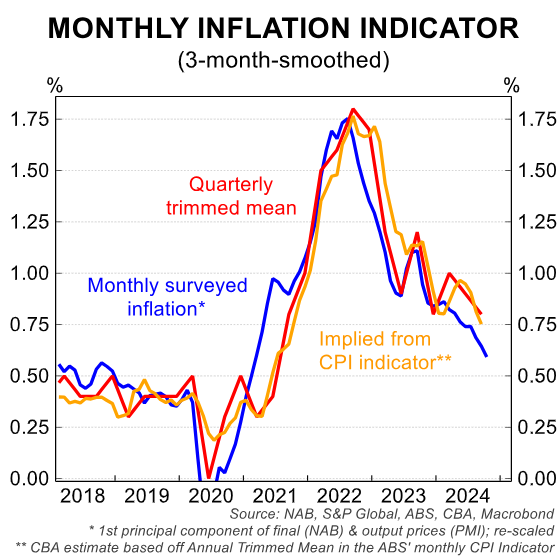

“It does not reflect a re-acceleration of inflationary pressures in the economy”, Wu said. But “it would put the monthly measure closer to the quarterly trimmed mean CPI increase of 3.5%/yr, which remains the RBA’s benchmark for underlying inflation in the economy”.

Regardless, Wu notes that a monthly inflation outcome broadly in line with its forecast would be consistent with the bank’s forecast for a 0.7% quarterly rise in the quarterly trimmed mean CPI in Q4 24.