Goldman has the right idea about iron ore in the short-term.

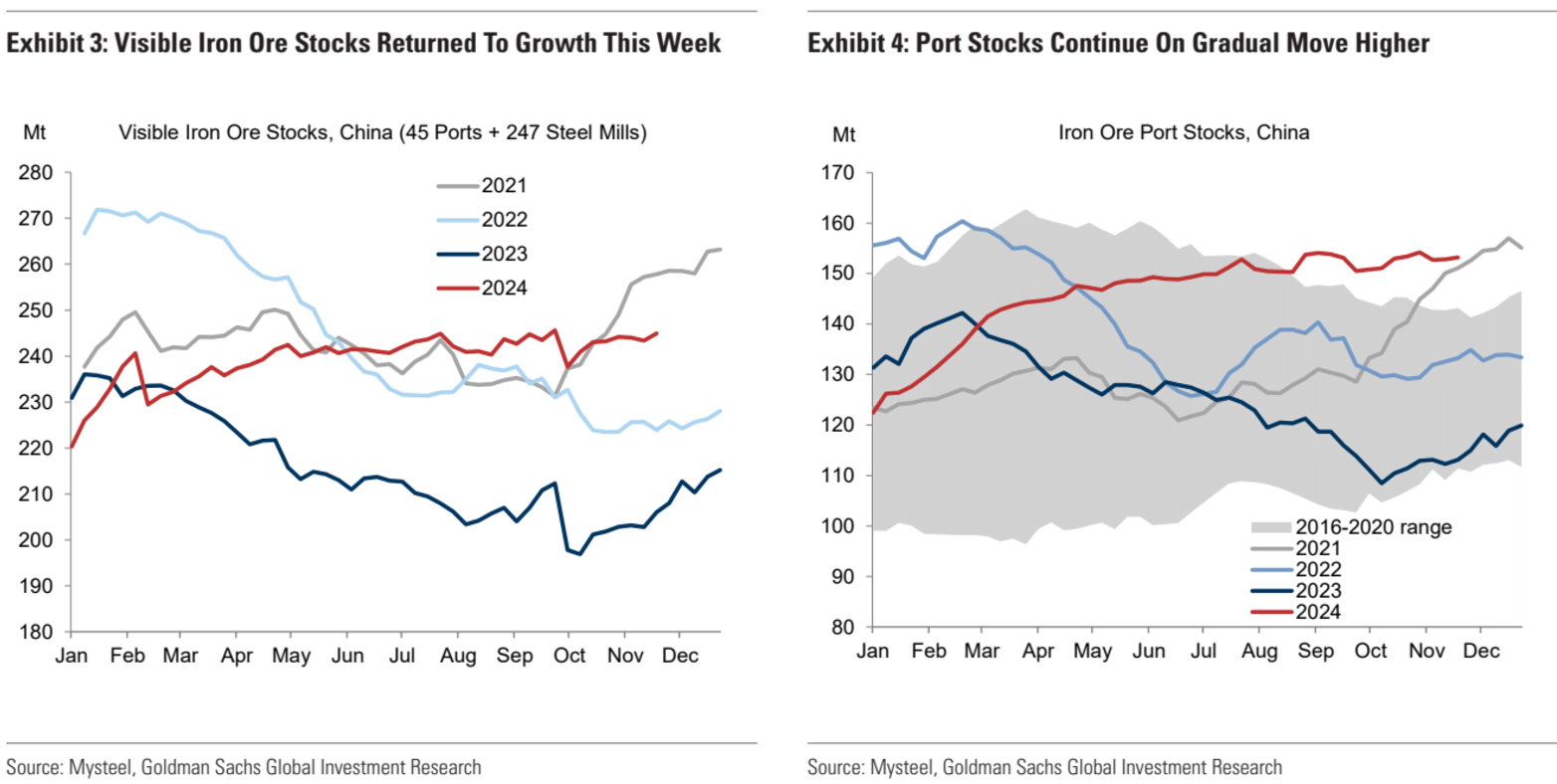

While iron ore stocks at Chinese ports remain elevated as arrivals into China have surged, high levels of consumption could provide temporary support to iron ore prices.

We believe that the counter-cyclical rise in Chinese steel production seen in recent weeks could be a sign of front-loading manufacturing and exports ahead of potential US tariffs next year for two reasons.

Advertisement