The RBA minutes are out and again it is making absolutely no sense.

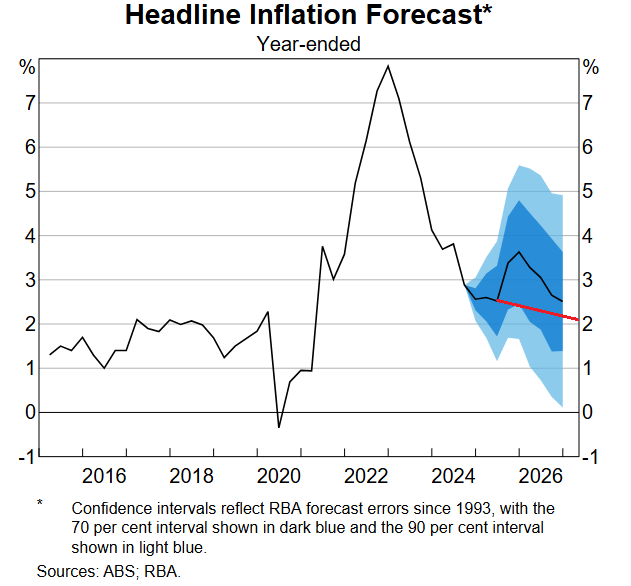

Looking ahead, headline inflation was forecast to remain temporarily within the 2–3 per cent target range until the September quarter 2025, when the scheduled end to energy rebates would see it pick up. Inflation was not expected to return sustainably to the target until 2026, as the level of aggregate demand and aggregate supply move into better balance. Members noted that the outlook for underlying inflation was little changed since the August meeting, with services inflation projected to decline alongside further gradual easing in labour market conditions and an expectation that goods prices would continue to rise at a modest pace.

Here’s the RBA’s chart of headline inflation. Without energy rebates rolling off, the headline rate of inflation will have been perfectly within the range and falling for seven months before a cut(in February).

If the energy rebates are renewed, as they almost certainly will be in an election year, then inflation will undershoot in 2026.

Since when was monetary policy based on making stupid political bets?