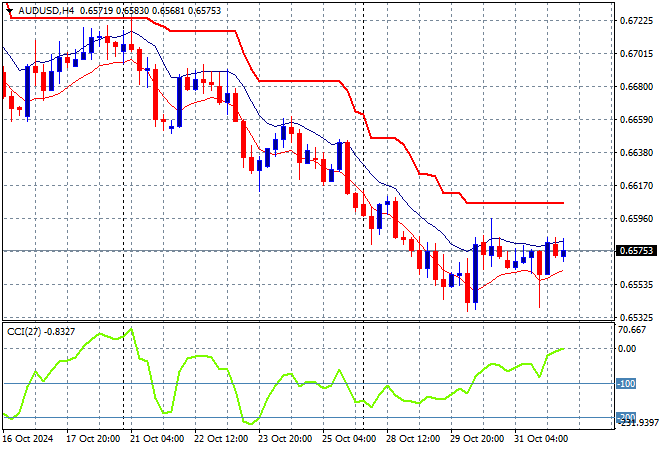

A slew of manufacturing PMIs across the region were almost ignored today as risk markets reacted instead to overnight movement in tech stocks on Wall Street with currencies only barely pushed around as Yen rallied then dipped on internal BOJ machinations. The Australian dollar remains just above the mid 65 handle as traders await tonight’s US non-farm payrolls aka unemployment print.

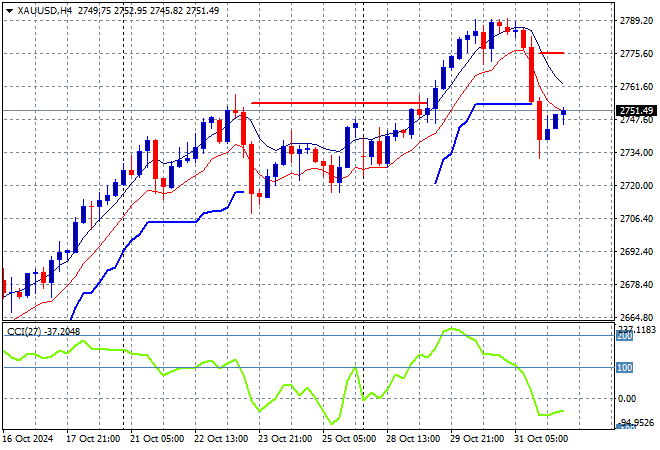

Oil futures are holding after their spike overnight with Brent crude just above the $74USD per barrel level while gold is trying to recover its overnight falls with a return back to some stability at the $2750USD per ounce level:

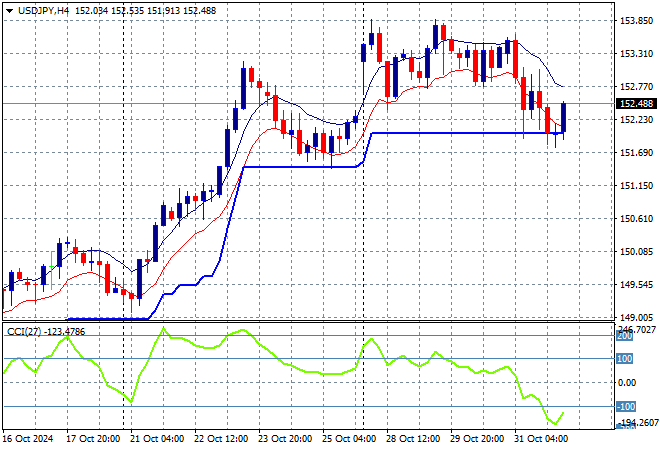

Mainland Chinese share markets are up modestly going into the close with the Shanghai Composite gaining more than 0.6% to be just under the 3300 point level while the Hang Seng Index has surged more than 1.5% higher to 20635 points. Meanwhile Japanese stock markets are falling back sharply in the wake of more BOJ comments around rate settings with the Nikkei 225 down more than 2% going into the close at 38201 points as the USDPY pair came back slightly to just below the mid 152 level:

Australian stocks were down again as the ASX200 is more than 0.5% lower going into the close, currently at 8113 points while the Australian dollar has firmed only slightly to hold just above the mid 65 cent level, as momentum tries to normalise after a long run down all month:

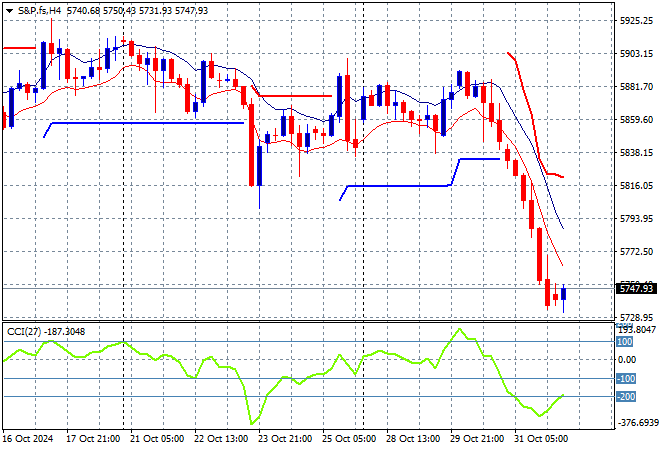

S&P and Eurostoxx futures are up slightly as we head into the London session soon with the S&P500 four hourly chart showing momentum trying to recover from grossly oversold settings as the 5900 point zone becomes a memory:

The economic calendar will focus squarely on the October non-farm payrolls aka US unemployment print tonight.