Asian stock markets have seen a big boost across the region as Chinese stimulus seems to be working with a very solid services PMI, but Melbourne Cup Fever could not overshadow a tight RBA that held at today’s meeting, pulling down local stocks as a result. The USD remains in limbo land as everyone and his dog awaits the outcome of the US election – will be have a Felon-in-Chief? The Australian dollar has remained slightly below the 66 cent level despite the “hold for a little longer” response from today’s RBA meeting.

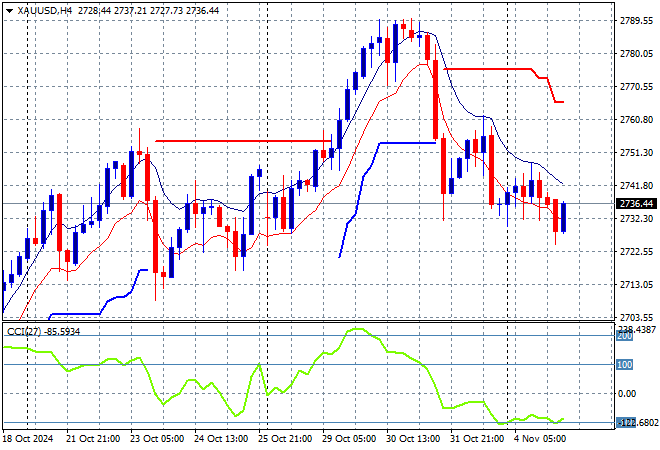

Oil futures are pushing slightly higher on the weaker USD with Brent crude staying above the $75USD per barrel level while gold is trying to recover from its falls last week but is not putting on significant runs with a hold at the $2740USD per ounce level:

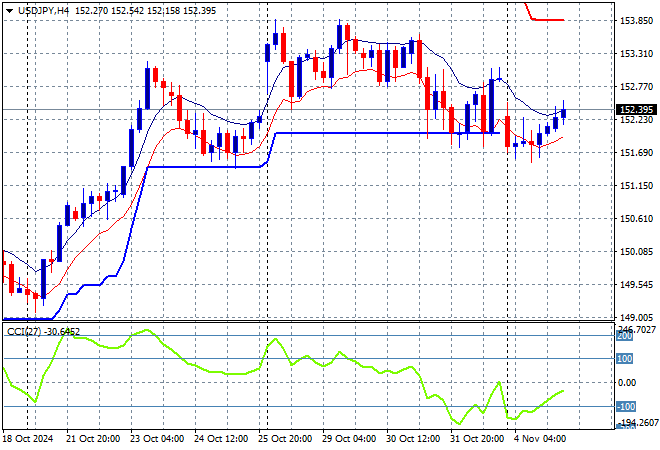

Mainland Chinese share markets are up strongly going into the close with the Shanghai Composite gaining nearly 2% to extend beyond the 3300 point level while the Hang Seng Index has extended some 1.5% to 20871 points. Japanese stock markets returned from their holiday with the Nikkei 225 lifting 1.4% to close at 38600 points while trading in the USDPY pair has seen a return to USD strength to extend back above the 152 level:

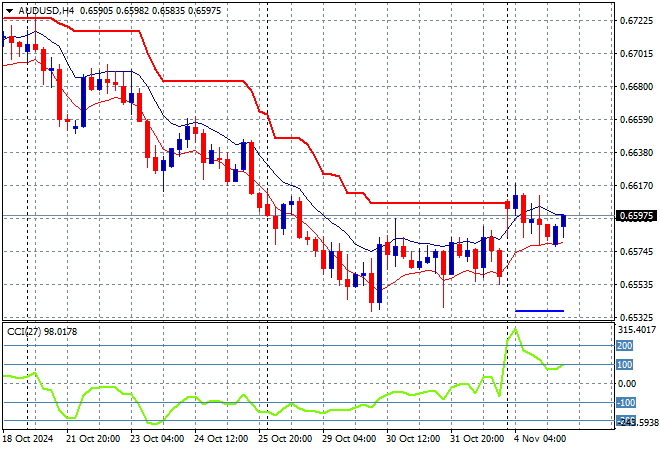

Australian stocks were the worst performers in the region as the ASX200 closed more than 0.4% lower at 8131 points while the Australian dollar jumped ever so slightly on the RBA meeting but failed to get above the 66 cent level to remain below the start of week high:

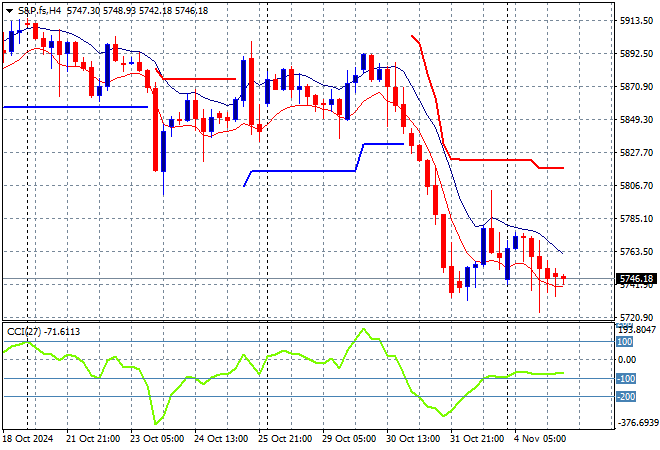

S&P and Eurostoxx futures are barely moving as we head into the London session soon with the S&P500 four hourly chart showing momentum trying to recover from grossly oversold settings as the 5900 point zone becomes a memory:

The economic calendar will be dominated by the US elections tonight and probably the rest of the week!