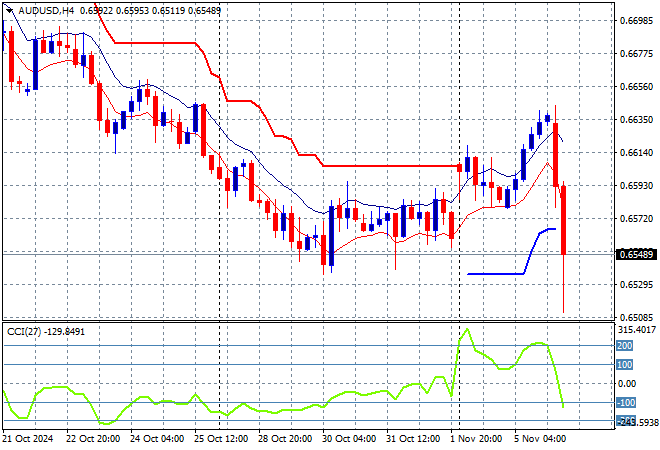

Asian stock markets have seen a big boost across the region as the US election results come in with a Trump win most likely, giving USD a big boost alongside other risk markets. Euro reversed course alongside Yen while Australian dollar has been slammed back below the 65 cent level.

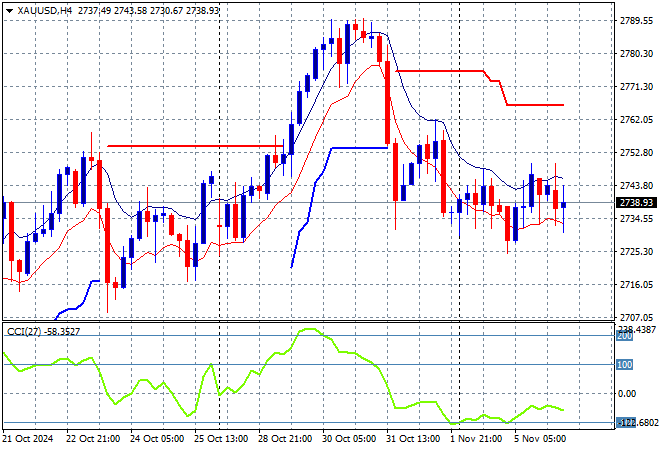

Oil futures are being pushed down on the stronger USD with Brent crude flipping below the $74USD per barrel level while gold is still failing to recover from its falls last week as it holds at the $2740USD per ounce level:

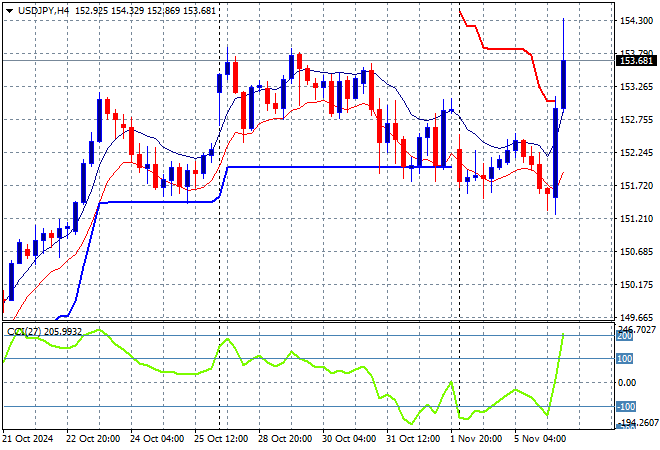

Mainland Chinese share markets are up slightly going into the close with the Shanghai Composite lifting some 0.4% to extend beyond the 3400 point level while the Hang Seng Index has flopped more than 2% lower to 20518 points. Japanese stock markets are far more boisterous with the Nikkei 225 lifting more than 2% higher to close at 39363 points while trading in the USDPY pair has seen a return to USD strength to extend well above the 153 level:

Australian stocks were the relative worst performers in the region but it wasn’t all bad news as the ASX200 closed more than 0.8% higher at 8199 points while the Australian dollar was slammed back to a new low below the mid 65 cent level on USD strength:

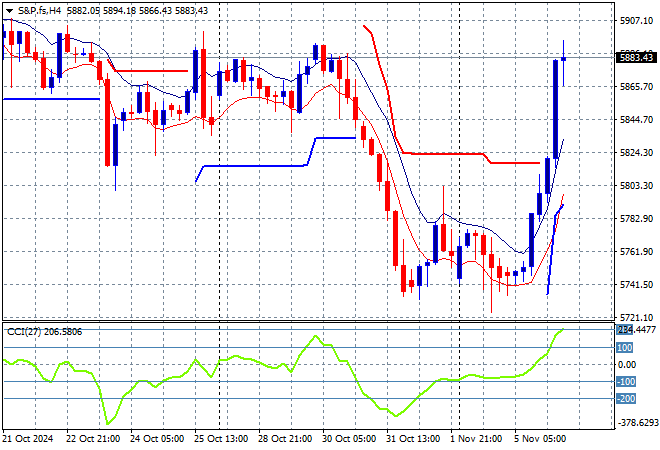

S&P and Eurostoxx futures have soared higher on the expectation of a Trump win as we head into the London session soon with the S&P500 four hourly chart showing momentum flipping straight into overbought mode as price looks to open around the 5900 point zone or higher:

The economic calendar will continued to be dominated by the outcome of the US elections