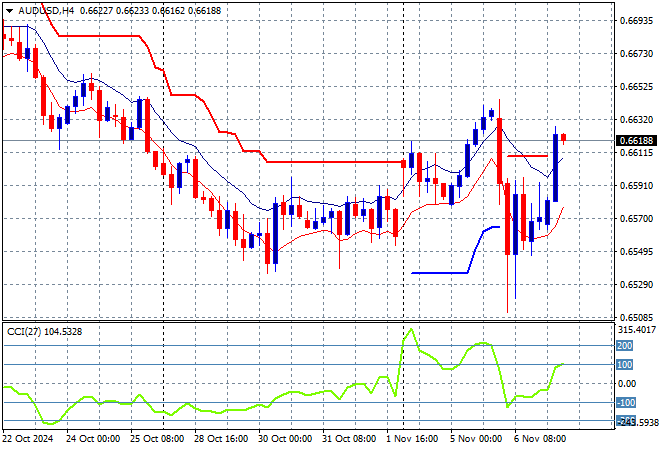

Asian stock markets are mainly up across the region with Chinese shares leading the charge in the post US election mood with the USD pulling back slightly against most of the undollars after a mammoth surge overnight. The Australian dollar recovered the most with a swift move above the 66 cent level.

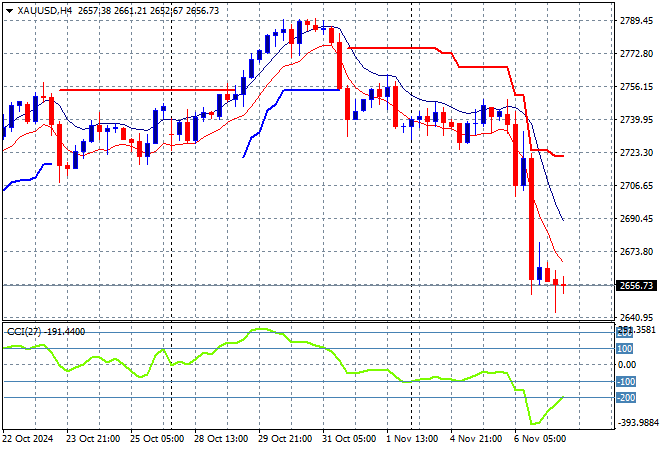

Oil futures are holding steady despite the stronger USD with Brent crude hovering around the $75USD per barrel level while gold is still failing to recover from its steep falls overnight to remain well below the $2700USD per ounce level:

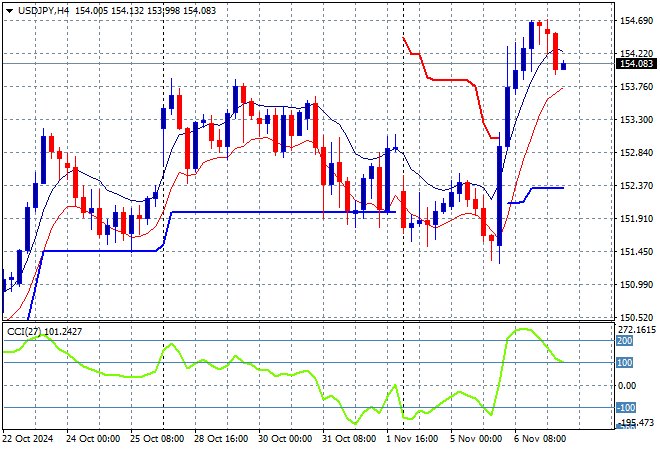

Mainland Chinese share markets are up strongly going into the close with the Shanghai Composite lifting more than 2% to extend beyond the 3400 point level while the Hang Seng Index has also lifted, currently up more than 1.3% to 20819 points. Japanese stock markets are being pushed around by BOJ machinations again with the Nikkei 225 down 0.3% to close at 39346 points while trading in the USDPY pair has seen some overdone strength pulling back to the 154 level:

Australian stocks were the relative worst performers in the region again as the ASX200 closed just 0.3% higher at 8226 points while the Australian dollar was able to recover later in the session to have a little look above the 66 cent level:

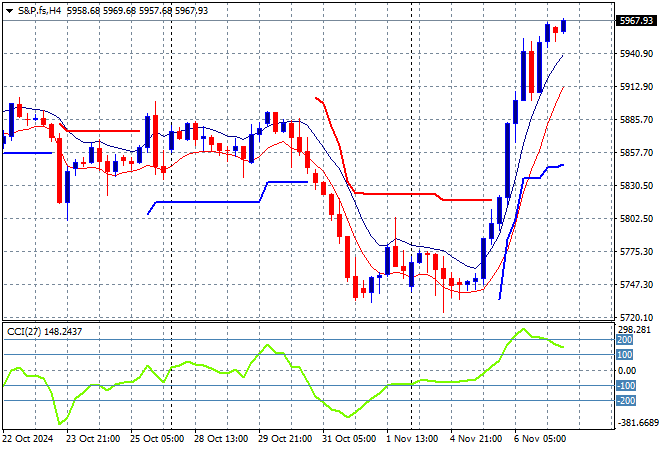

S&P and Eurostoxx futures are still lifting as we head into the London session with the S&P500 four hourly chart showing momentum still in overbought mode as price looks to push through the 6000 point area and go to the moon:

The economic calendar has two big ones tonight – the BOE and Fed interest rate meetings, were cuts are expected.

…..And furthermore…..

Pie has nailed it (language warning)