Asian stock markets are somewhat mixed as we start a new trading week as all eyes remain on the PBOC and their stimulus trajectory going into the end of calendar year volatility. Australian stocks are yet to follow in their stead with some mild gains while the Australian dollar is still in recovery mode at just above the 65 cent level.

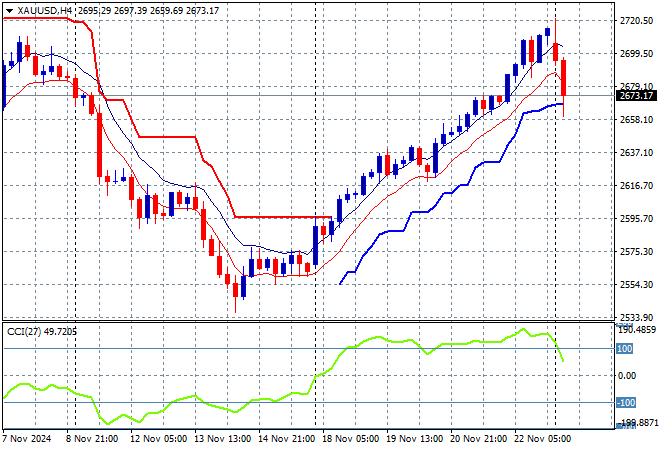

Oil futures are holding steady despite the weaker USD with Brent crude hovering around the $74USD per barrel level while gold is has failed to make good on its Friday night run, gapping lower over the weekend to cross well below the $2700USD per ounce level:

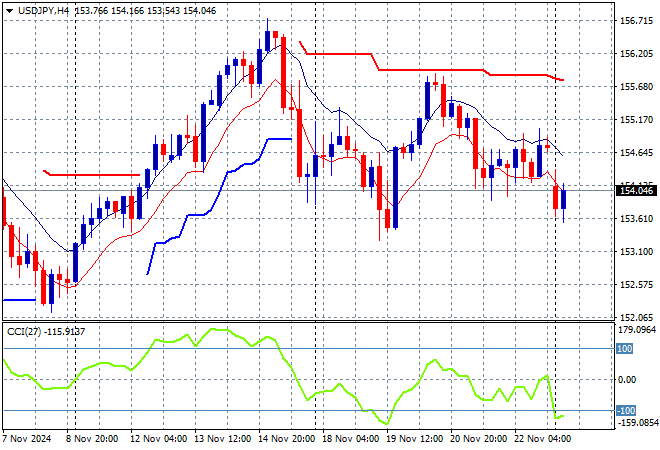

Mainland Chinese share markets are falling again going into the close with the Shanghai Composite down nearly 0.4% to remain below the 3300 point level while the Hang Seng Index is down around 0.5% to almost cross the 19000 level. Japanese stock markets were the best performers however with the Nikkei 225 closing 1.4% higher to 38829 points while trading in the USDPY pair has seen a big weekend gap down on USD weakness as it almost breaks into a new weekly low against Yen at the 154 level:

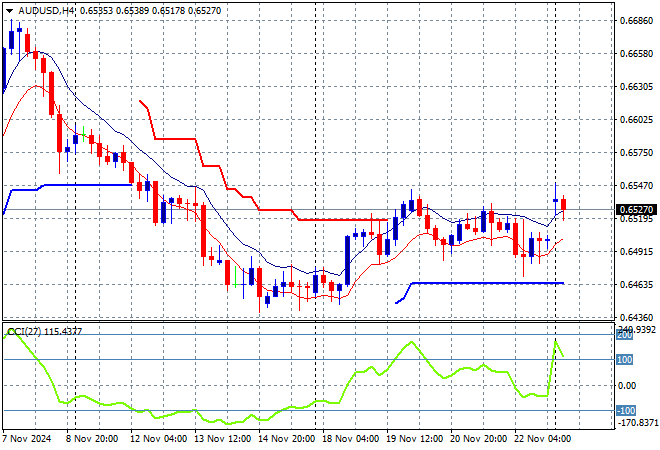

Outside of China, Australian stocks were the worst performers in the region as the ASX200 looks set to close just 0.4% higher at 8434 points while the Australian dollar was able to gap above the 65 cent handle as it tries to get a breakout pattern for a new weekly high:

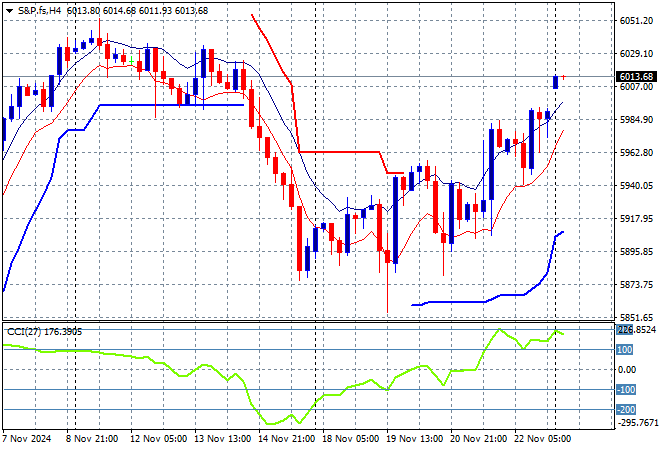

S&P and Eurostoxx futures are leaping higher making a nice weekend gap up as we head into the London session with the S&P500 four hourly chart showing momentum still in overbought mode as price looks to push through the 6000 point area and go to the moon:

The economic calendar starts the new trading week realitvely quietly with the latest German IFO survey.