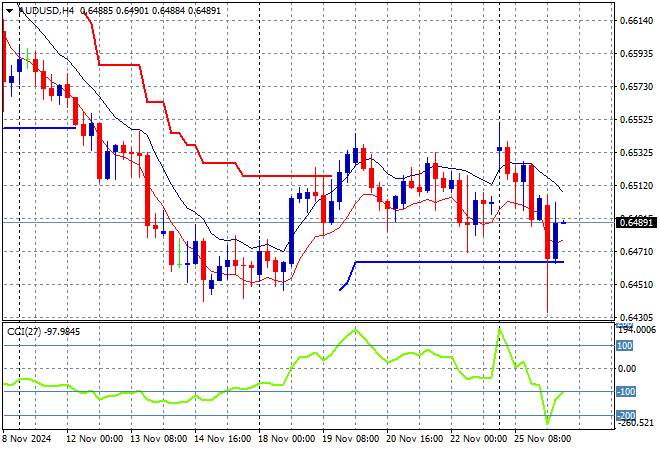

Asian stock markets are having a mixed session today in reaction to the “Everyone gets a Tariff” economic policies from the incoming Trump administration although Chinese stocks seemed to have already absorbed the news. The USD is making new highs against the Loonie however on the Canadian tariff punch while the Australian dollar was pushed around violently before recovering back to just below the 65 cent level.

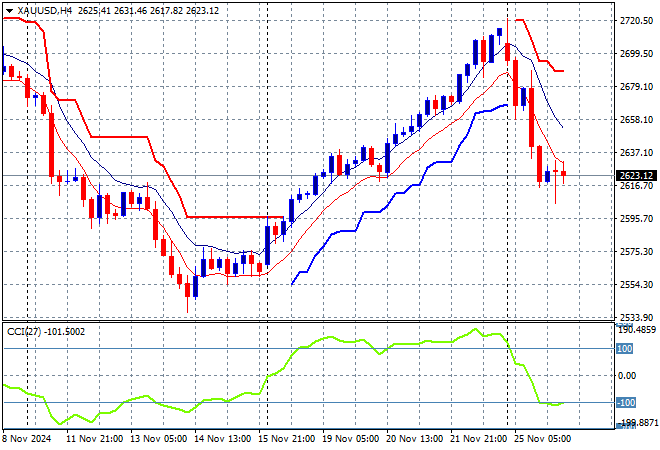

Oil futures are holding steady despite the weaker USD with Brent crude hovering around the $73USD per barrel level while gold is also holding on to its overnight losses as it remains well below the $2700USD per ounce level:

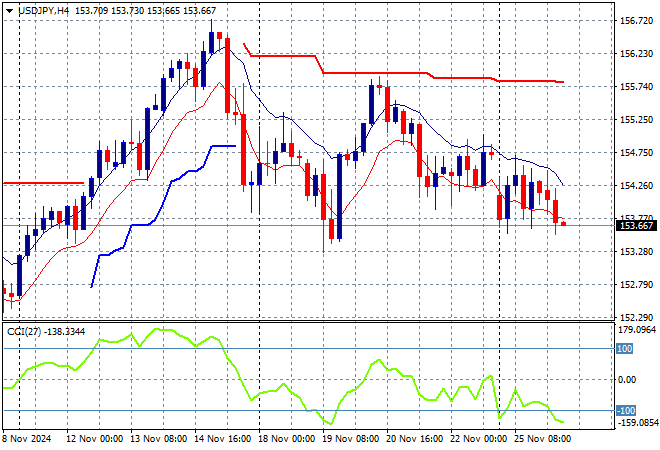

Mainland Chinese share markets are falling again going into the close but are being resilient with the Shanghai Composite down just 0.2% to remain below the 3300 point level at 3257 points while the Hang Seng Index is actually up 0.2% to cross the 19000 level. Japanese stock markets were the worst performers however with the Nikkei 225 closing 1.4% lower to 38246 points while trading in the USDPY pair has seen the big weekend gap down on USD weakness extend slightly further as it almost breaks into a new weekly low against Yen below the 154 level:

Australian stocks had somewhat of a bad day as the ASX200 closed 0.7% lower at 8359 points while the Australian dollar suffered through a large range to end up where it started this morning at just below the 65 cent handle to almost make a new weekly low:

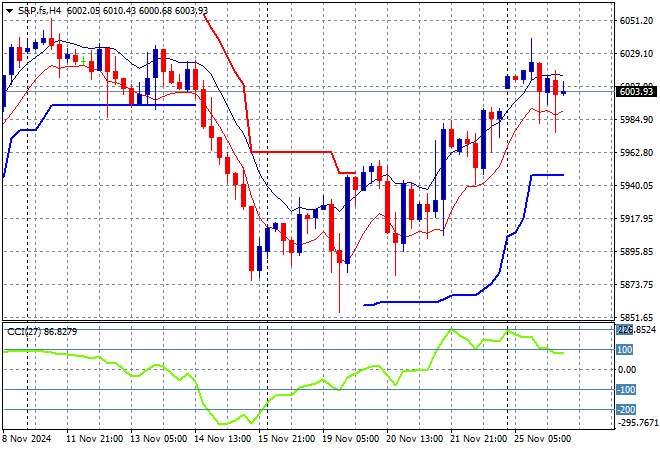

S&P and Eurostoxx futures are steady which is surprising given the volatility in Asia as we head into the London session with the S&P500 four hourly chart showing momentum retracing from overbought mode as price looks to push through the 6000 point area and go to the moon:

The economic calendar includes the latest US house price data, plus consumer confidence figures and new home sales. Early in the morning we will also get the latest RBNZ meeting.