Asian stock markets are having another mixed session today with more volatility looking through upcoming US trade policy but also getting ready for some key upcoming events on the economic calendar. Chinese stocks rebounded while the USD continues to weaken appreciably against Yen in the wake of the tariff news. The Australian dollar however remains depressed just above the 65 cent level.

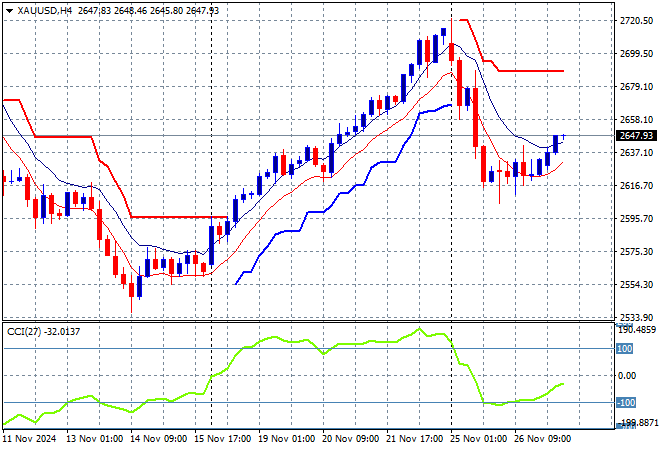

Oil futures are barely moving despite the weaker USD with Brent crude hovering around the $72USD per barrel level while gold is lifting slightly from its recent slump to be just under the $2750USD per ounce level:

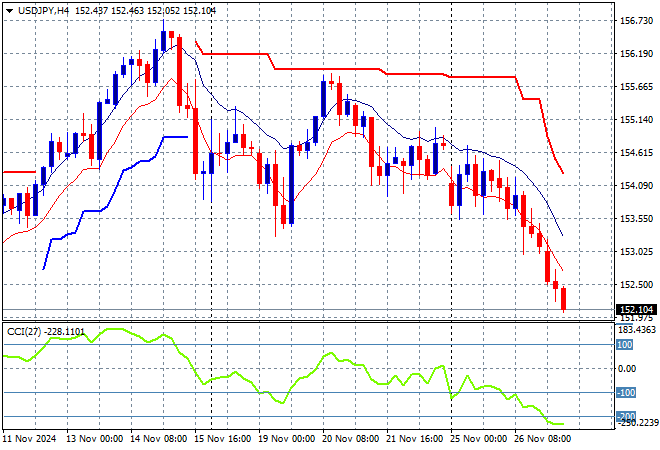

Mainland Chinese share markets are rebounding strongly into the close with the Shanghai Composite up more than 1.5% to punch through the 3300 point level while the Hang Seng Index is up more than 2% to cross well above the 19000 level. Japanese stock markets were the worst performers again with the Nikkei 225 closing 0.8% lower to 38146 points while trading in the USDPY pair has seen the big weekend gap down on USD weakness turn into a wider retracement with another new weekly low down to the 152 level:

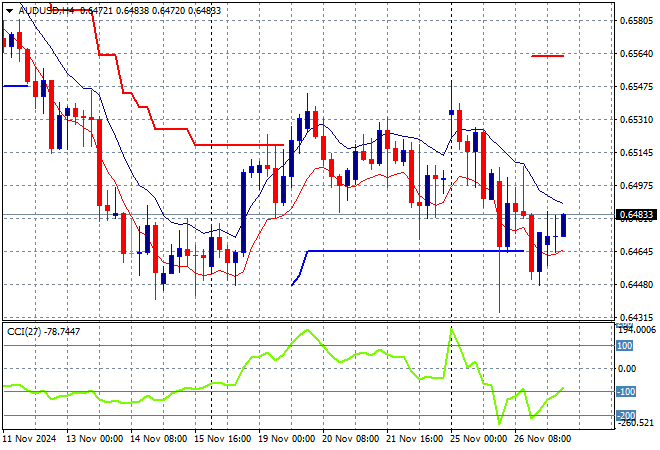

Australian stocks had a better session as the ASX200 closed 0.6% higher at 8406 points while the Australian dollar saw a slight return in reaction to the RBNZ cut to almost get back above the 65 cent handle but still barely off its new weekly low:

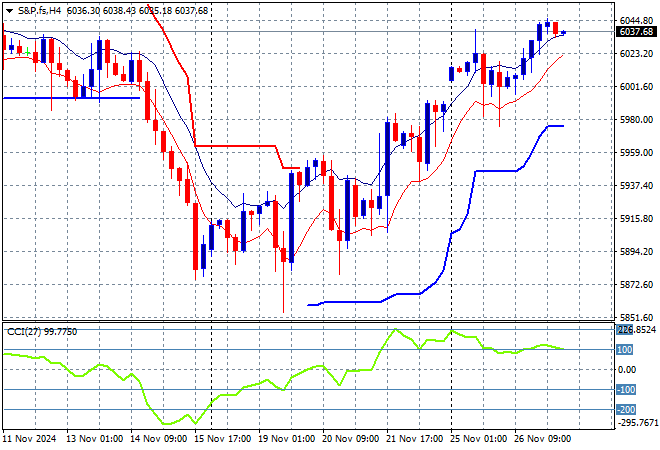

S&P and Eurostoxx futures are down 0.2% as we head into the London session with the S&P500 four hourly chart showing momentum retracing from overbought mode as price looks to push through the 6000 point area and go to the moon:

The economic calendar is very light tonight with no major releases.