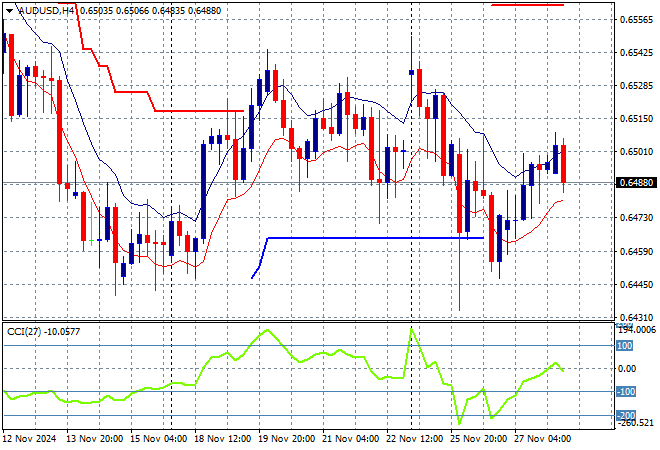

Asian stock markets are being generally positive today given all the macro concerns over tariffs and the lack of a lead from Wall Street as they have their awkward in more ways than one Thanksgiving mid week holiday. Chinese stocks are failing to continue their rebound while the USD continues to weaken although Yen finally reversed course today after a serious decline in the USDJPY pair while the Australian dollar however remains depressed around the 65 cent level.

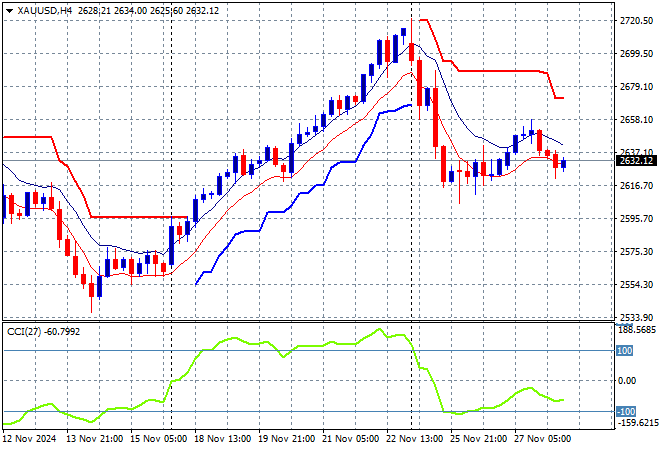

Oil futures are barely moving despite the weaker USD with Brent crude hovering around the $72USD per barrel level while gold is failing to lift out of its recent slump to remain well under the $2750USD per ounce level:

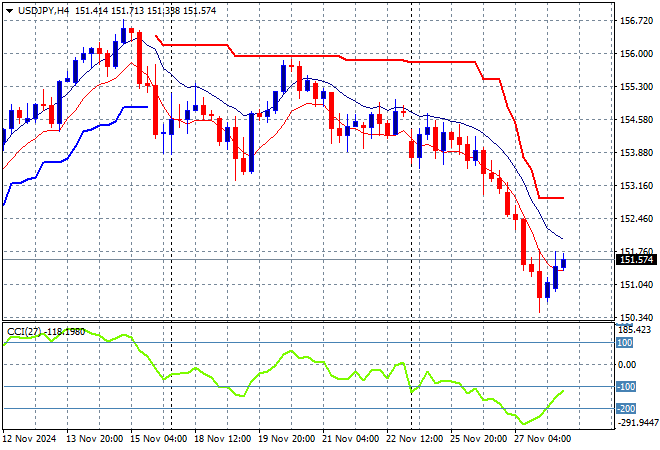

Mainland Chinese share markets are faltering after their recent strong rebound with the Shanghai Composite down 0.3% and again below the 3300 point level while the Hang Seng Index is off by more than 1%, currently at 19387 points. Japanese stock markets are seeing a better return after a weakening Yen throughout the session with the Nikkei 225 closing 0.7% higher to 38427 points while the USDPY pair has bounced off its recent extreme low at the 150 handle to be at the mid 151 level but looking extremely weak:

Australian stocks had a better session as the ASX200 closed 0.4% higher at 8444 points while the Australian dollar saw a slight blip higher before falling back in afternoon trade to currently be below the 65 cent handle and still barely off its new weekly low:

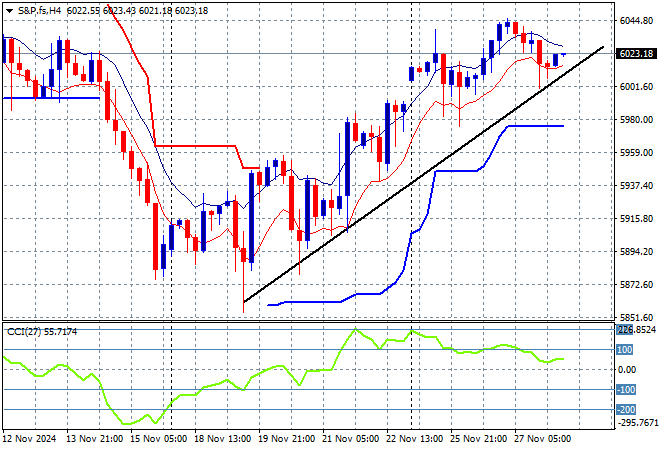

S&P and Eurostoxx futures are down slightly as we head into the London session with the S&P500 four hourly chart showing momentum now fully retracing from overbought mode as price slips below the 6000 point area:

The economic calendar is light again tonight due to the US Thanksgiving holiday. Should be plenty of uncomfortable dinner tables this year around to discuss the latest election!