A rough night for stock markets on both sides of the Atlantic with tech stocks leading the charge down with Wall Street falling more than 2% across the board on earnings scares, not Halloween or other clowns riding around in garbage trucks. Tonight’s US non-farm payrolls employment print will now prove quite volatile as other risk markets also move around on Fed rate cut speculation and the trajectory of the US economy after next week’s election. The USD remains somewhat strong against most of the majors although Euro continued its bounceback while the Australian dollar remains firmly under the 66 cent level.

US bond markets were relatively calm with slightly higher yields as the 10 year Treasury remained at the 4.3% level while Brent crude lifted higher on Iranian tensions to get back above the $74USD per barrel level. Gold however fell back to its start of week position at the $2740USD per ounce level.

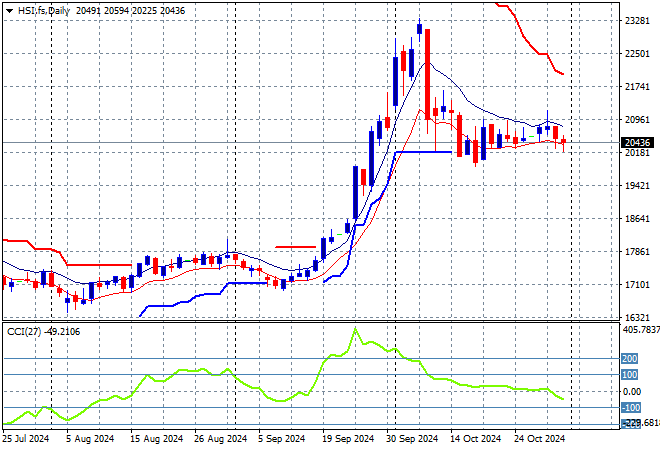

Looking at markets from yesterday’s session in Asia, where mainland Chinese share markets were up modestly going into the close with the Shanghai Composite gaining more than 0.2% but still unable to get back above the 3300 point level while the Hang Seng Index was dead flat before closing 0.3% lower at 20317 points.

The Hang Seng Index daily chart shows how short term resistance was finally being pushed away with a huge breakout above the 19000 point level that then set up for a run at the 20000 level in the response to PBOC stimulus. Price action is again bunching up at the 20000 point level setting up for another potential breakdown if short term support breaks:

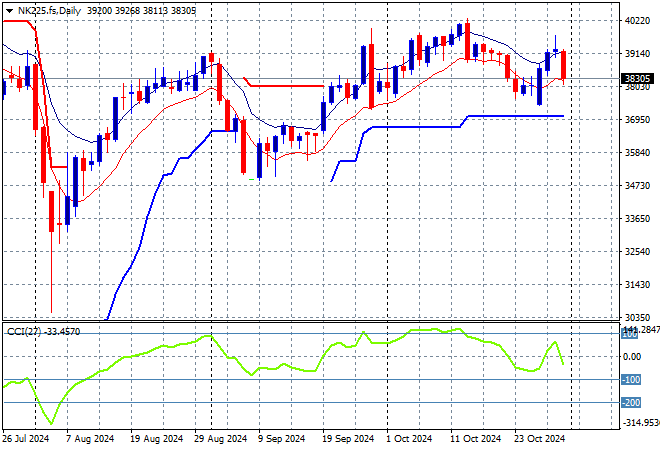

Meanwhile Japanese stock markets are back tracking in the wake of the BOJ meeting with the Nikkei 225 down 0.7% to 39000 points.

Price action had been indicating a rounding top on the daily chart with daily momentum retracing away from overbought readings with the breakout last month above the 40000 point level almost in full remission. Yen volatility remains a problem here, with a sustained return above the 38000 point level from May/June possibly on the cards as positive momentum is building. Futures are looking a bit worse for wear here for the final session of the week:

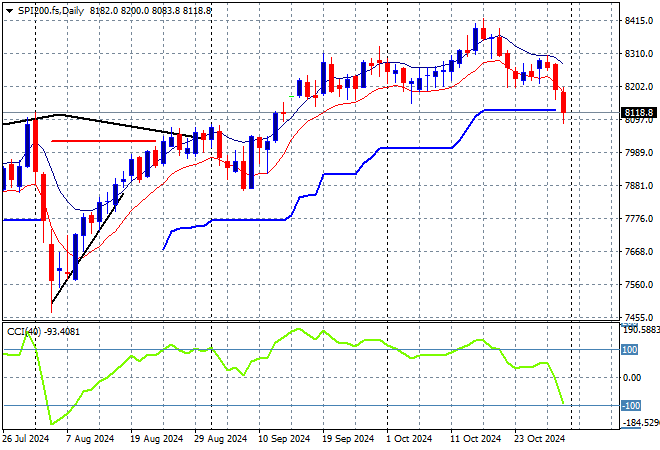

Australian stocks were basically unchanged despite a big list of releases as the ASX200 closed 0.2% lower at 8160 points.

SPI futures are down at least 0.6% due to the sharp falls on Wall Street overnight. The daily chart pattern was potentially signalling a top as short term price action suggests a pause at least with momentum retracing from overbought status, however the medium term picture still looks firm but this rollover could extend further so watch the 8100 point zone closely:

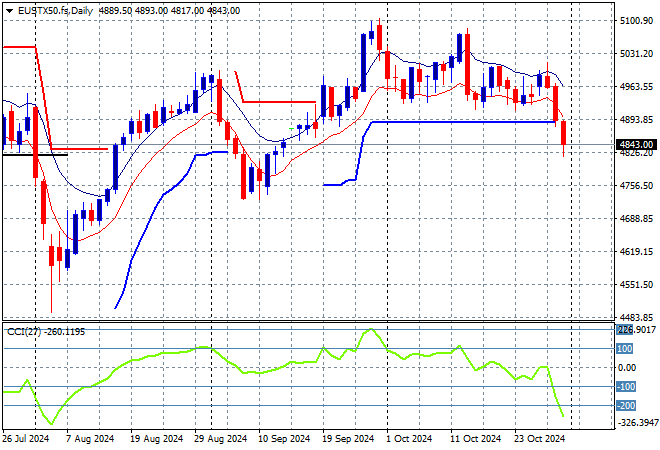

European markets faltered again with the German DAX falling the most with further losses across the continent as the Eurostoxx 50 Index closed nearly 1.2% lower to finish at the 4827 point level.

This was looking to turn into a larger breakout with support at the 4900 point level quite firm with resistance just unable to breach the 5000 point barrier. Price had previously cleared the 4700 local resistance level as it seeks to return to the previous highs as momentum was picking up here but the higher Euro is not helping as support comes under attack here:

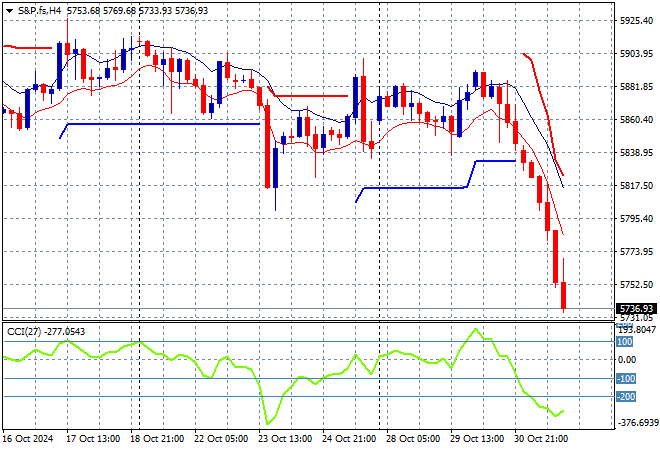

Wall Street was unable to recover from its previous session with tech earnings and election fears dragging everything down as the NASDAQ lost nearly 3% while the S&P500 finished nearly 2% lower to close at 5705 points.

Price action had a small breakout on the previous NFP print but the sequential hurricanes and Middle East tensions took a toll before CPI/PPI volatility is swinging it lower again. We can expect more volatility as we barrel into the end of the US election cycle with momentum now extremely oversold mode:

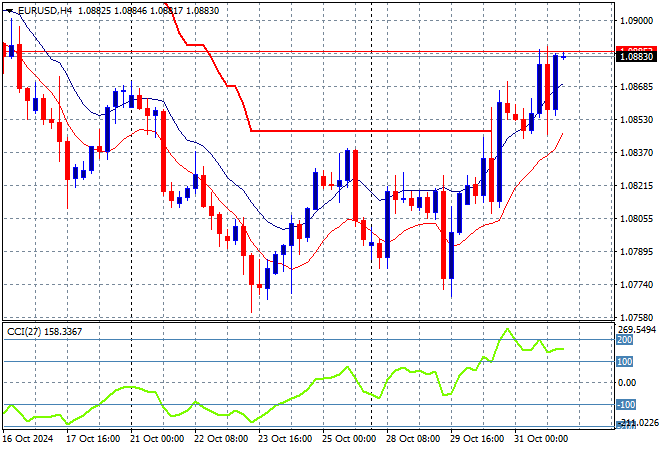

Currency markets have been dominated by USD strength for sometime but this is starting to turn as traders get ready for the next NFP print tonight. Euro kept lifting higher overnight to get back above the 1.08 handle.

The union currency had been structurally supportive before the Fed meeting and US jobs report but a double plunge indicated more weakness in the short term as momentum collapsed into the oversold zone with a breakdown of short term ATR support as well. Overhead resistance has been breached at the mid 1.08 level with momentum overdone already so this could be a short term move as it fails to beat the previous breakout high:

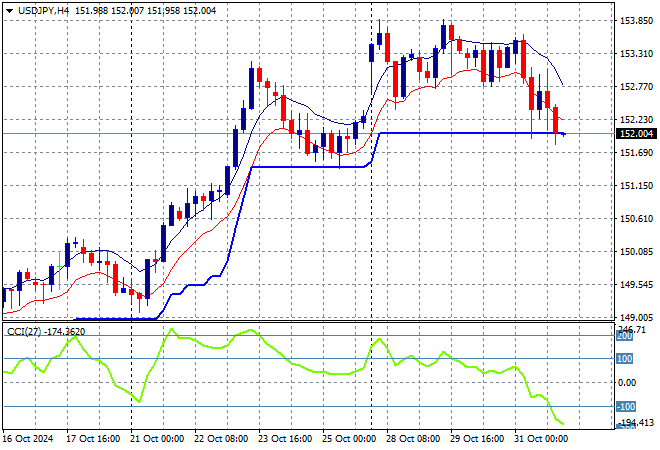

The USDJPY pair is also moving lower after a series of steps up higher as it settled right on the 153 handle overnight, just off short term support.

Momentum is cooling down but remains quite positive as Yen weakness seems baked in for now, but this could all pivot on tomorrow night’s NFP print so watch for trailing ATR support at the 152 handle to hold here:

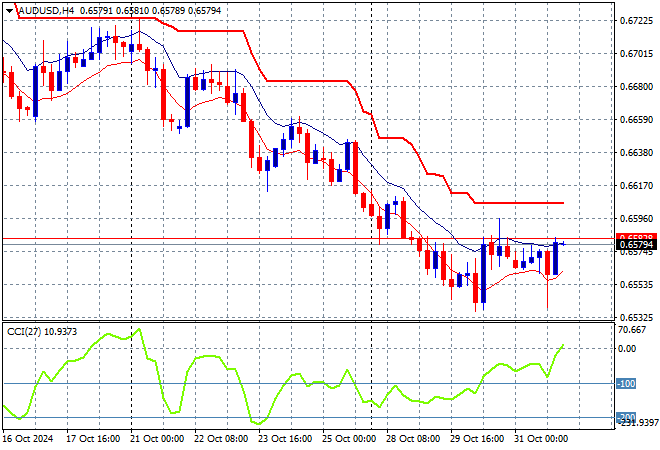

The Australian dollar is barely holding on at medium term support around the 65 cent level with a break below that level not yet evident as traders await tonight’s US NFP print.

During June the Pacific Peso hadn’t been able to take advantage of any USD weakness with momentum barely in the positive zone but that has changed in recent weeks with price action finally getting out of the mid 66 cent level that acted as a point of control. This may start to look like a bottoming action with momentum returning back to neutral settings, but wait and see:

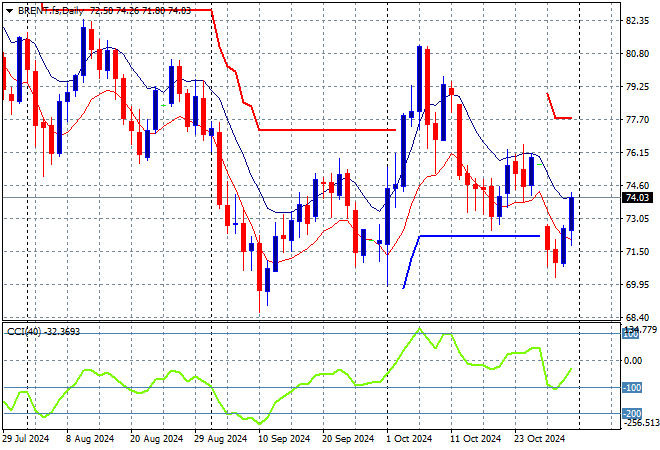

Oil markets remain somewhat high in volatility with some OPEC shenanigans and Iranian war tensions helping lift both markers overnight as Brent crude headed back above the $74USD per barrel level.

Short term momentum remains in negative territory as medium term price action still supports a downtrend with my contention of another sharp retracement forthcoming if the $70-72 zone is not defended:

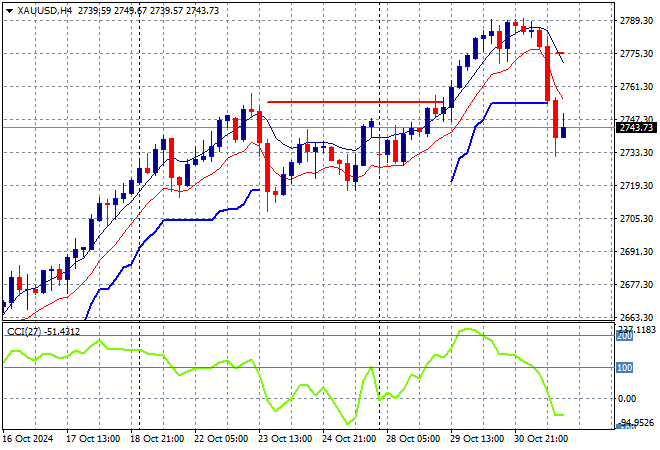

Gold was unable to hold on its recent new record highs or break through the $2800USD per ounce level overnight with a sharp turnaround back towards last week’s more sustainable high at the $2740 level instead.

Price action had been accelerating in confidence as new levels of support are being created for the shiny metal regardless of USD strength but as I’ve been saying, it will be interesting to see what happens in next week’s US election as momentum now returns to neutral settings:

Glossary of Acronyms and Technical Analysis Terms:

ATR: Average True Range – measures the degree of price volatility averaged over a time period

ATR Support/Resistance: a ratcheting mechanism that follows price below/above a trend, that if breached shows above average volatility

CCI: Commodity Channel Index: a momentum reading that calculates current price away from the statistical mean or “typical” price to indicate overbought (far above the mean) or oversold (far below the mean)

Low/High Moving Average: rolling mean of prices in this case, the low and high for the day/hour which creates a band around the actual price movement

FOMC: Federal Open Market Committee, monthly meeting of Federal Reserve regarding monetary policy (setting interest rates)

DOE: US Department of Energy

Uncle Point: or stop loss point, a level at which you’ve clearly been wrong on your position, so cry uncle and get out/wrong on your position, so cry uncle and get out!