As the world awakes to the new United Fascist States of America, US stock markets have soared alongside the USD on the Trump/GOP clean sweep while European shares retreated. The election outcome is fraught with opportunity in all risk markets with volatility likely to continue in the coming days as traders reweight the new world order for 2025 and beyond. Euro was slammed back to the 1.07 level while the Australian dollar almost broke through the 65 handle before recovering later in the session.

US bond markets sold off with a three month high in yields across the curve as 10 year Treasuries shot through to the 4.5% level while oil markets were volatile but started where they finished as Brent crude remained at the $75USD per barrel level. Gold however slumped on the stronger USD, falling back to the $2660USD per ounce level in a strong downside selloff.

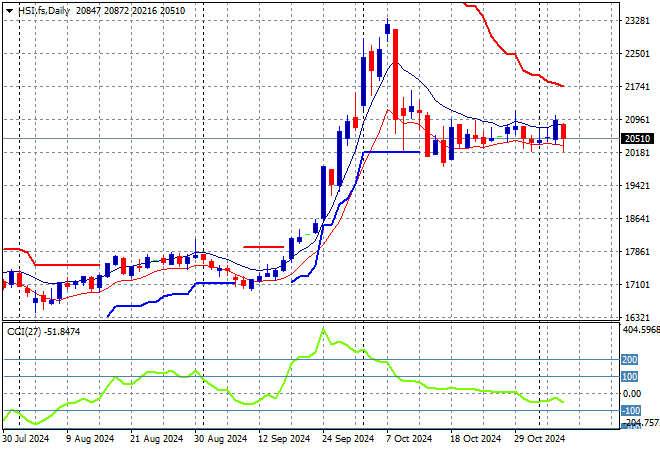

Looking at markets from yesterday’s session in Asia, where mainland Chinese share markets were up slightly going into the close with the Shanghai Composite but finished flat at just below the 3400 point level while the Hang Seng Index flopped more than 2% lower to 20538 points.

The Hang Seng Index daily chart shows how short term resistance was finally being pushed away with a huge breakout above the 19000 point level that then set up for a run at the 20000 level in the response to PBOC stimulus. Price action is again bunching up at the 20000 point level setting up for another potential breakdown if short term support breaks, but this looks more promising:

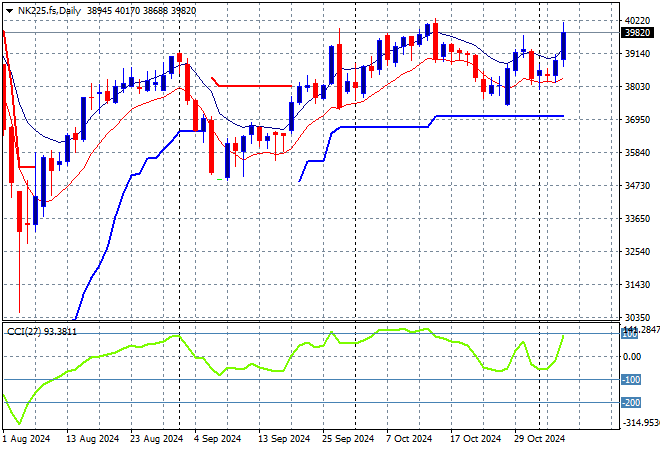

Japanese stock markets are far more boisterous with the Nikkei 225 lifting more than 2% higher to close at 39480 points.

Price action had been indicating a rounding top on the daily chart with daily momentum retracing away from overbought readings with the breakout last month above the 40000 point level almost in full remission. Yen volatility remains a problem here, with a sustained return above the 38000 point level from May/June possibly on the cards as positive momentum is building.

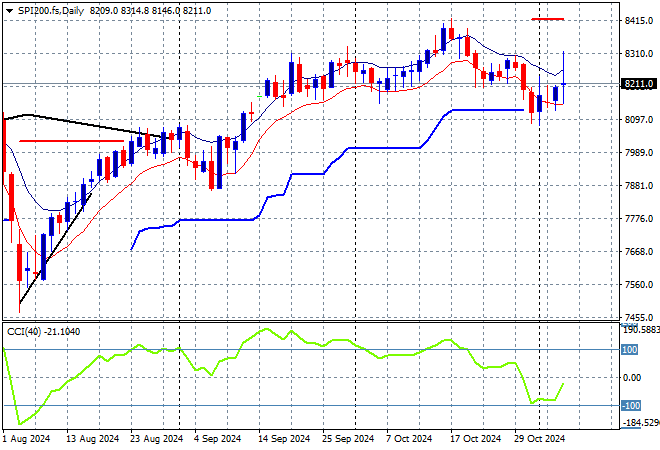

Australian stocks were the relative worst performers in the region but it wasn’t all bad news as the ASX200 closed more than 0.8% higher at 8199 points.

SPI futures are up slightly but not as much as expected given the big rally on Wall Street overnight and its likely volatility will be the order of the day without much direction. The daily chart pattern was potentially signalling a top as short term price action suggests a pause at least with momentum retracing from overbought status, however the medium term picture still looks firm but this rollover could extend further so watch the 8100 point zone closely:

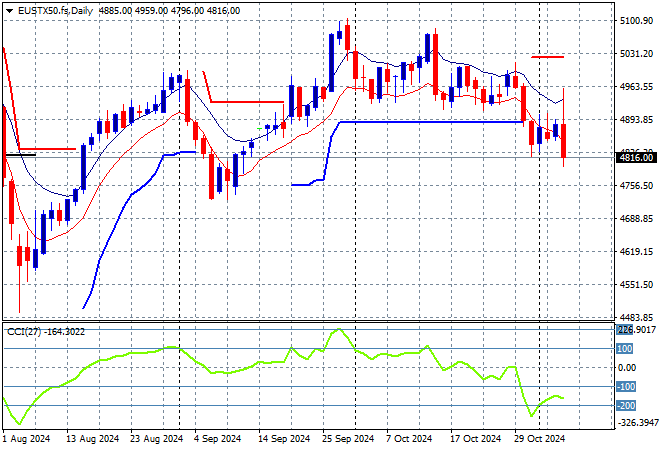

European markets were obviously cautious around the US election as they began to realise the horror most markets sold off across the continent as the Eurostoxx 50 Index closed 1.4% lower to right on the 4800 point level.

This was looking to turn into a larger breakout with support at the 4900 point level quite firm with resistance just unable to breach the 5000 point barrier. Price had previously cleared the 4700 local resistance level as it seeks to return to the previous highs but momentum is still oversold despite the solid Friday finish with price action still below previous support:

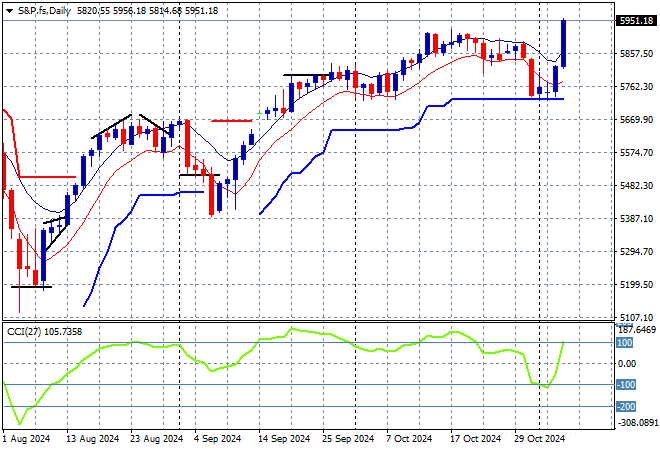

Everything is awesome for Wall Street which was able to launch higher across the board as the NASDAQ was boosted by nearly 3% while the S&P500 put on more than 2% to finish at 5931 points on its way to another record high.

Price action is looking extremely positive as all the stops will literally be taken out of business regulation, taxation, competition etc in a new dominating GOP Congress with the sky the limit here for big business:

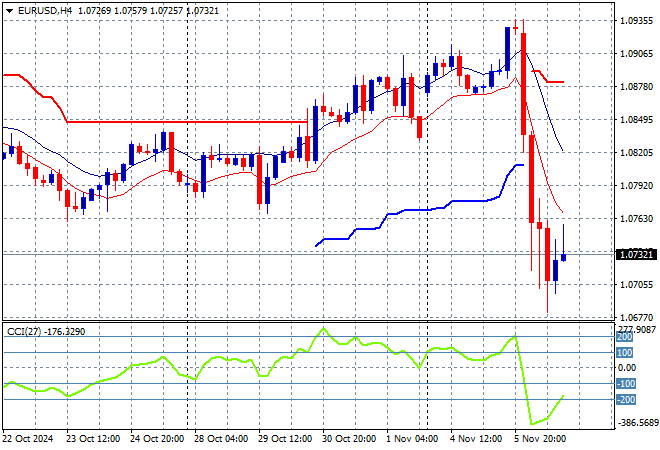

Currency markets reacted the sharpest to the US election with the USD gaining total dominance across all the undollars as Euro was slammed more than 200 pips lower where it briefly crossed into the high 1.06 level before finishing just above the 1.07 handle this morning.

The union currency had been pushed higher after remaining oversold for weeks in a dominant downtrend, then cleared overhead resistance at the mid 1.08 level in the lead up to the election. However the retribution has been swift and we are likely on our way back to parity as traders start to price in the now very unclear future for the continent:

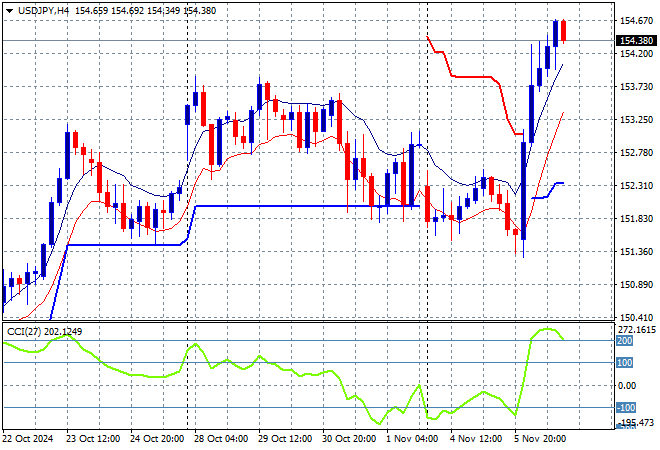

The USDJPY pair shot higher on USD strength, blasting through the 154 level to a new high where it remains in a very overbought state this morning ready for the Asian session reaction.

Momentum has reverted back into extreme overbought mode with the previous weekly highs at the 152 level likely to turn into support here:

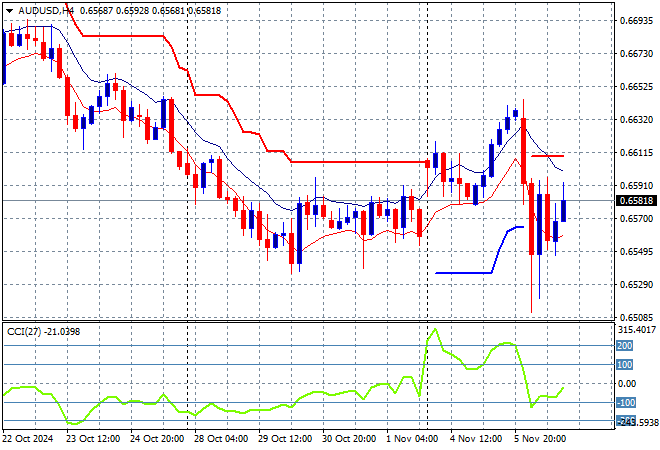

The Australian dollar was one of the more robust undollars overnight through the US election volatility with a slam back to the low 65 level before recovering to the start of week position just above the mid 65 level.

The Pacific Peso could come under more pressure here on reweighting risks and the lack of action from the RBA as it wants to hold through to Feb/March next year, with short term machinations likely to hold below the 66 handle on USD strength:

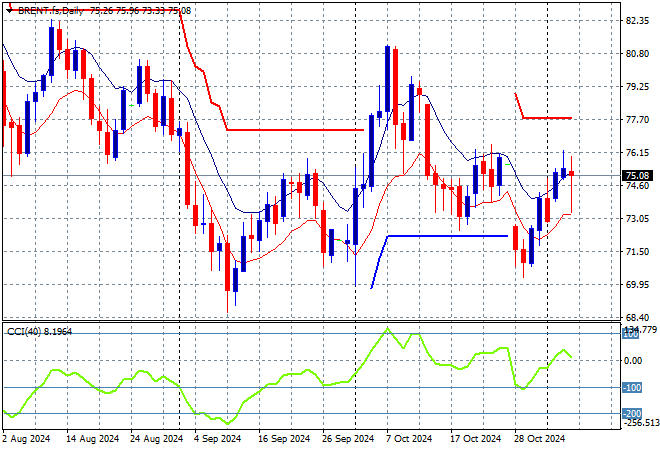

Oil markets remain somewhat high in volatility with some OPEC shenanigans and election tensions as Brent crude range traded through the $75USD per barrel level on USD strength.

Short term momentum remains in negative territory as medium term price action still supports a downtrend with my contention of another sharp retracement forthcoming if the $70-72 zone is not defended:

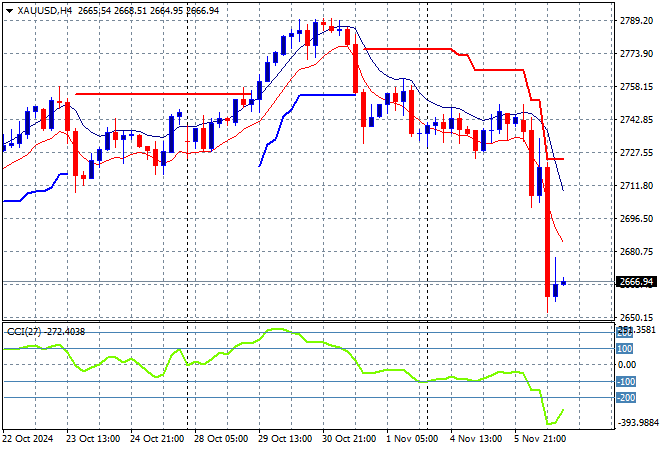

Gold suffered the most of the undollars overnight on the possible new direction of the Fed, or “Minister for Gold” or whatever the hell comes out of the Clown Cabinet with a swift selloff down below the $2700USD per ounce level.

Price action had been accelerating in confidence as new levels of support were being created for the shiny metal regardless of USD strength but as I’ve been saying, it will be interesting to see what happens in the US election and here we are – this will be a fun four years of volalitily!

Glossary of Acronyms and Technical Analysis Terms:

ATR: Average True Range – measures the degree of price volatility averaged over a time period

ATR Support/Resistance: a ratcheting mechanism that follows price below/above a trend, that if breached shows above average volatility

CCI: Commodity Channel Index: a momentum reading that calculates current price away from the statistical mean or “typical” price to indicate overbought (far above the mean) or oversold (far below the mean)

Low/High Moving Average: rolling mean of prices in this case, the low and high for the day/hour which creates a band around the actual price movement

FOMC: Federal Open Market Committee, monthly meeting of Federal Reserve regarding monetary policy (setting interest rates)

DOE: US Department of Energy

Uncle Point: or stop loss point, a level at which you’ve clearly been wrong on your position, so cry uncle and get out/wrong on your position, so cry uncle and get out!