US stock markets continued higher in the post election haze, helped along by a somewhat dovish Fed which cut rates at the latest FOMC meeting overnight by 25 basis points. This arrested the post election surge in USD somewhat as Euro bounced back alongside other undollars with the Australian dollar heading up to a two week high at just below the 67 cent level.

US bond markets came back slightly after the FOMC decision with 10 year Treasury yields dropping back to just above the 4.3% level while oil markets reduced in volatility as Brent crude remained slightly above the $75USD per barrel level. Gold rebounded on the rate cut after slumping post election, heading back above the $2700USD per ounce level.

Looking at markets from yesterday’s session in Asia, where mainland Chinese share markets were up strongly going into the close with the Shanghai Composite lifting more than 2.5% to extend beyond the 3400 point level while the Hang Seng Index has also lifted, currently up more than 1.3% to 20819 points.

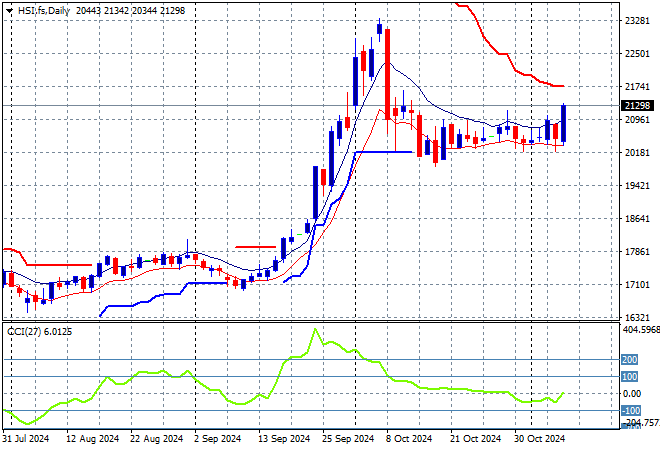

The Hang Seng Index daily chart shows how short term resistance was finally being pushed away with a huge breakout above the 19000 point level that then set up for a run at the 20000 level in the response to PBOC stimulus. Price action is again bunching up at the 20000 point level setting up for another potential breakdown if short term support breaks, but this looks more promising:

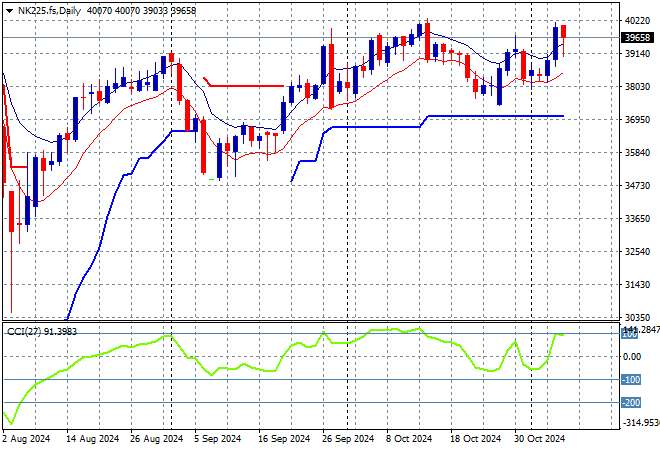

Japanese stock markets were being pushed around by BOJ machinations again with the Nikkei 225 down 0.3% to close at 39346 points.

Price action had been indicating a rounding top on the daily chart with daily momentum retracing away from overbought readings with the breakout last month above the 40000 point level almost in full remission. Yen volatility remains a problem here, with a sustained return above the 38000 point level from May/June possibly on the cards as positive momentum is building.

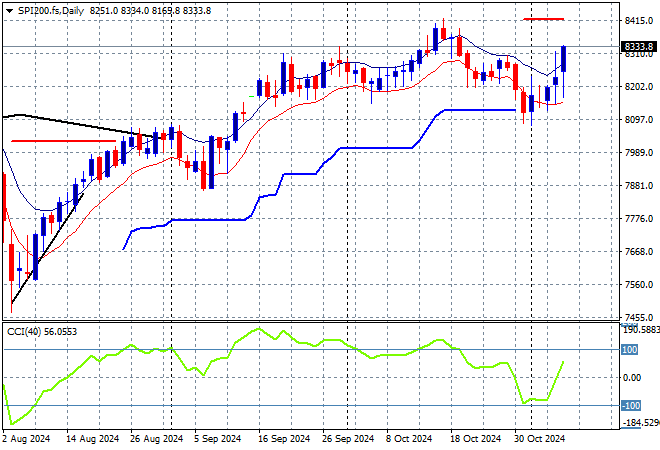

Australian stocks were the relative worst performers in the region again as the ASX200 closed just 0.3% higher at 8226 points.

SPI futures are up more than 1% on the continued rally on Wall Street overnight but the higher Australian dollar may mute these gains on the open. The daily chart pattern was potentially signalling a top as short term price action suggests a return to the pre election uptrend:

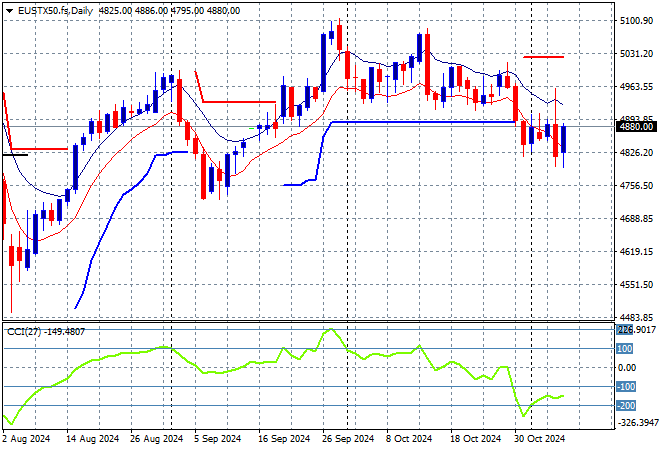

European markets were at first cautious around the US election outcome but began to lift in unison across the continent as the Eurostoxx 50 Index closed more than 1% higher to finish at the 4851 point level.

This was looking to turn into a larger breakout with support at the 4900 point level quite firm with resistance just unable to breach the 5000 point barrier. Price had previously cleared the 4700 local resistance level as it seeks to return to the previous highs but momentum is still oversold despite the solid Friday finish with price action still below previous support:

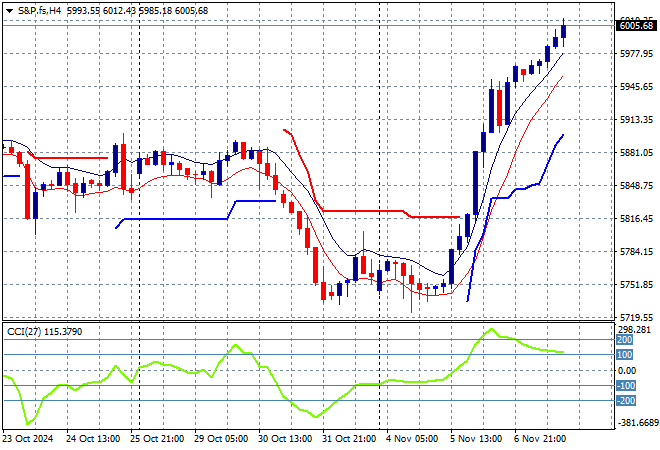

Everything is awesome for Wall Street which was able to launch higher across the board as the NASDAQ put in a new record high while the S&P500 put on more than 0.7% to finish at 5973 points on its way to another record high.

Price action is looking extremely positive as all the stops will literally be taken out of business regulation, taxation, competition etc in a new dominating GOP Congress with the sky the limit here for big business – and with the Fed cutting rates, add more to the punchbowl:

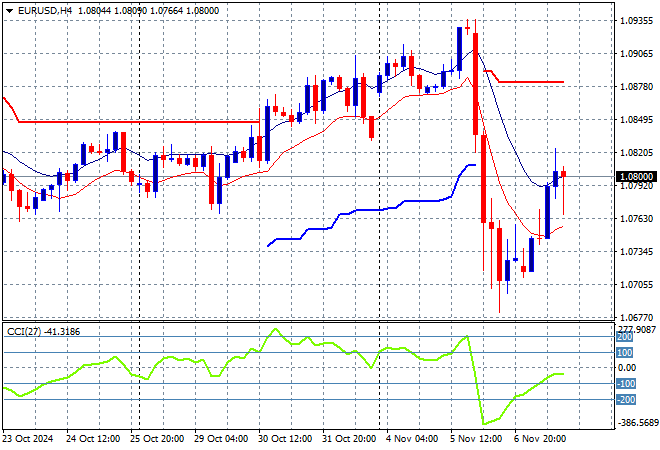

Currency markets are still reacting to the US election with the USD gaining temporary dominance across all the undollars before last night’s Fed and BOE meeting as Euro was able to bounce back to the 1.08 handle this morning after previously been slammed more than 200 pips lower.

The union currency had been pushed higher after remaining oversold for weeks in a dominant downtrend, then cleared overhead resistance at the mid 1.08 level in the lead up to the election. However the retribution has been swift and we are likely on our way back to parity as traders start to price in the now very unclear future for the continent:

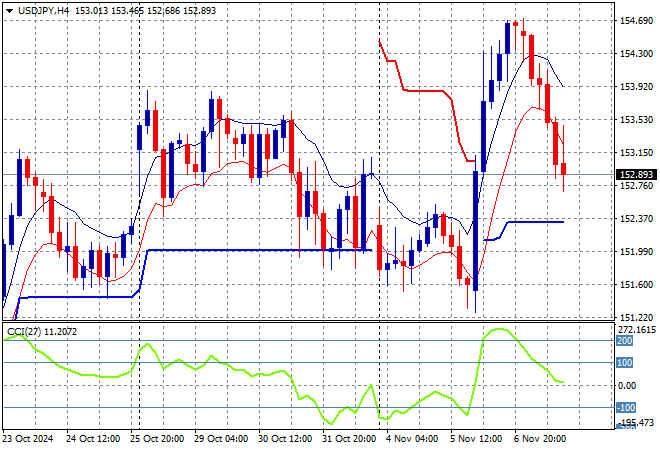

The USDJPY pair shot higher on USD strength, blasting through the 154 level to a new high but this was way overbought and saw a mild reversion in yesterday’s Asian session and then an accelerated selloff before the FOMC meeting to dive back below the 153 handle this morning.

Momentum has reverted back into extreme overbought mode with the previous weekly highs at the 152 level likely to turn into support here:

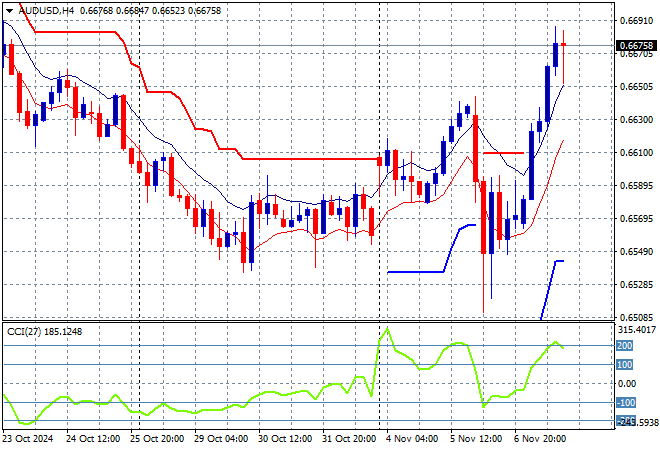

The Australian dollar had been one of the more robust undollars through the US election volatility although it did suffer a retreat back to the low 65 level before recovering, which gave a stage for it to advance strongly overnight through the mid 66 cent level on the Fed rate cut.

The Pacific Peso could come under more pressure here on reweighting risks and the lack of action from the RBA as it wants to hold through to Feb/March next year, and this move looks overbought already so I’m watching for a retracement back to the 66 handle proper soon:

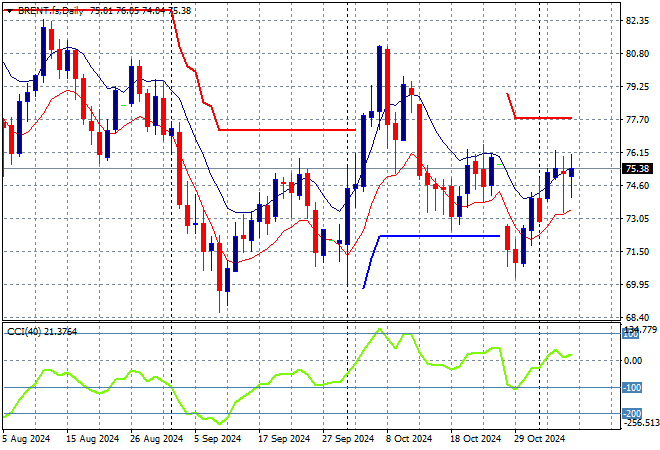

Oil markets are reducing somewhat in volatility in post US election tensions as Brent crude again range traded through the $75USD per barrel level without much else to go on apart from a small retreat in USD strength.

Short term momentum remains in negative territory as medium term price action still supports a downtrend with my contention of another sharp retracement forthcoming if the $70-72 zone is not defended:

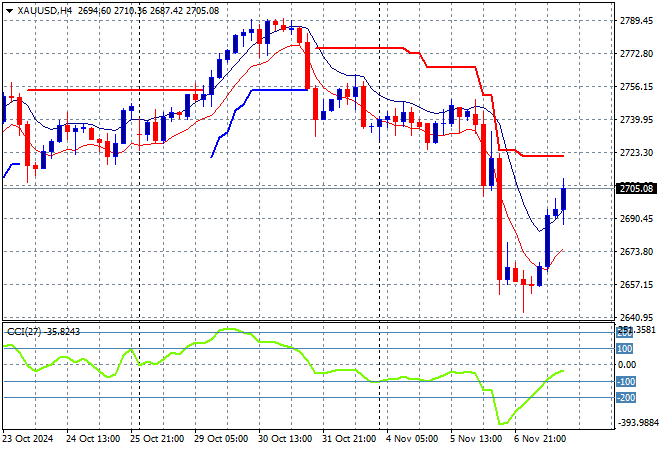

Gold had suffered the most out of the undollars on the possible new direction of whatever the hell comes out of the Clown Cabinet with a swift selloff down below the $2700USD per ounce level but this turned into a rebound overnight on the FOMC rate cut. Whether this will be sustainable is another matter.

Price action had been accelerating in confidence as new levels of support were being created for the shiny metal regardless of USD strength but this pullback and rebound both now remain under the $2700 zone so I’m skeptical of a new breakout here:

Glossary of Acronyms and Technical Analysis Terms:

ATR: Average True Range – measures the degree of price volatility averaged over a time period

ATR Support/Resistance: a ratcheting mechanism that follows price below/above a trend, that if breached shows above average volatility

CCI: Commodity Channel Index: a momentum reading that calculates current price away from the statistical mean or “typical” price to indicate overbought (far above the mean) or oversold (far below the mean)

Low/High Moving Average: rolling mean of prices in this case, the low and high for the day/hour which creates a band around the actual price movement

FOMC: Federal Open Market Committee, monthly meeting of Federal Reserve regarding monetary policy (setting interest rates)

DOE: US Department of Energy

Uncle Point: or stop loss point, a level at which you’ve clearly been wrong on your position, so cry uncle and get out/wrong on your position, so cry uncle and get out!