Goldman with the note.

USD: Elections have consequences.

Our US economists expect tariffs to feature prominently in the new Trump Administration, coupled with modest additional tax cuts, more federal spending, and a light touch on regulation.

Our European economists downgraded their GDP forecasts across the region in anticipation of higher uncertainty and other spillovers.

The policy proposals on offer would raise the cost of US imports, lower the cost of doing business domestically, and weigh on foreign activity levels.

We believe this will have direct and powerful implications for the Dollar on a broad basis.

We are not persuaded by the arguments that President Trump might be able to engineer a weaker Dollar or that the full effect is already priced in; we attribute the retracement this week to lingering uncertainty about the policy path ahead (against our economists’ more robust tariff expectations) and short-term trading around the event, with some clear signs of increased profit-taking in carry-negative currency pairs.

However, even with tariffs on the agenda, Dollar strength is far from guaranteed.

While a ‘currency pact’ is not feasible, in our view, a strong policy response abroad could mitigate or even dominate the effect of tariff threats.

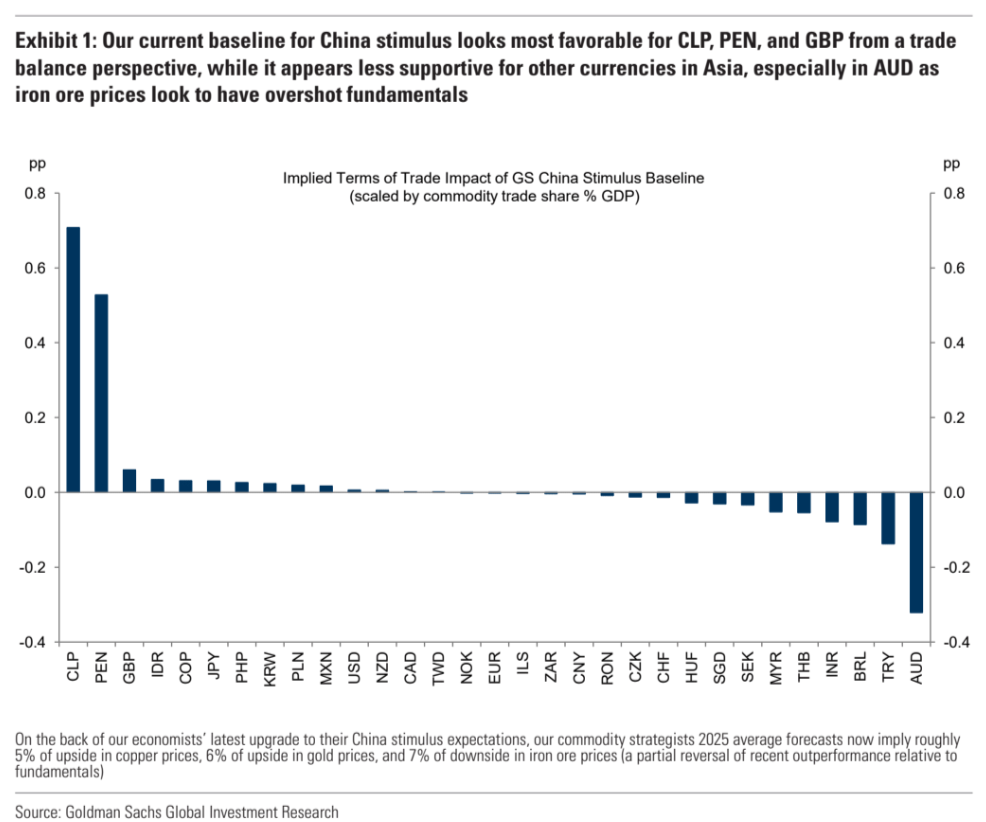

Already China’s ongoing fiscal stimulus package has helped offset some of the potential impact, and Germany’s evolving fiscal debate bears watching.

We will incorporate our estimate of the foreign exchange market impact of the expected policy changes into our forecasts in our 2025 Outlook next week.

China’s fiscal stimulus has done very little to boost growth so far but may yet. Rate cuts must deepen.

Europe will have to boost fiscal, as well as accelerate rate cuts.

None of it will be enough to overtake the US inflationary boom and save the AUD in 2025, in my view.