The general consensus of economists is that the Reserve Bank of Australia (RBA) will begin to reduce the official cash rate in the first quarter of 2025.

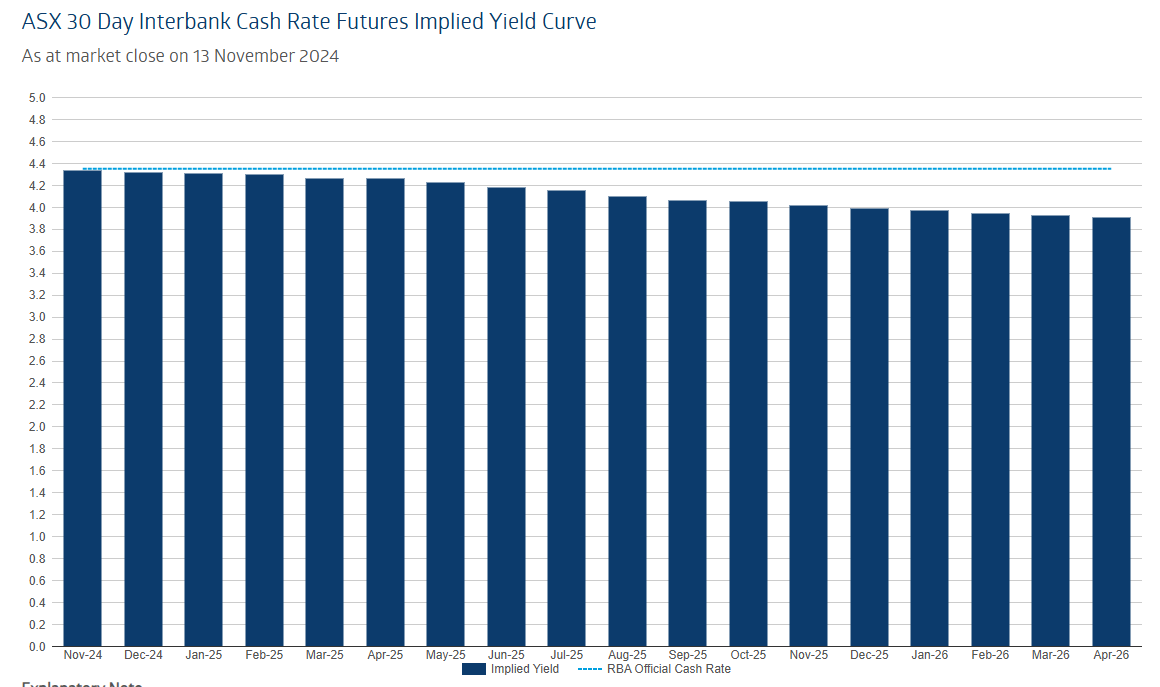

However, financial markets have now fully priced in September for the first interest rate cut, having previously anticipated a rate cut in May before Donald Trump won the US presidential election.

In fact, the one-year bond has started to price interest rate hikes with yields above the cash rate.

Meanwhile, Christian Baylis from Fortlake Asset Management warns that the potential inflationary impact of Trump’s policies could prompt the RBA to leave the cash rate on hold until 2026.

“I don’t think that’s inconceivable”, he said.

Paul Bloxham of HSBC believes there is a 25% chance of rates staying on hold for 2025.

“We see an increasing risk that it takes longer for cuts to be delivered or that the RBA misses the easing phase altogether”, he said.

While Bloxham still expects the first rate cut to arrive in the June quarter of 2025, he cautioned that the global economy could reinflate under President Donald Trump.

I am not concerned about a Trump presidency stoking local inflation.

Trump’s tariffs on China are likely to see surplus, cheap Chinese, European and emerging market goods dumped into other markets, including Australia. This would lower imported (goods) inflation and should ultimately be disinflationary for Australia.

Sure, there is a risk that a weaker Australian dollar raises oil prices, leading to higher fuel prices in Australia. But this risk is offset by Trump’s intention to lift US energy exports to the world, which would be deflationary for global energy prices.

Trump is also intent on peace in Ukraine and has the leverage to pull it off. Which would return Russian barrels to markets.

There is also the distinct risk that steel consumption falls worldwide as tariffs hit the world’s largest exporters the hardest. Whether they will stimulate enough to offset this is an open question.

One thing that Trump’s election win has done is raise uncertainty. This factor could go either way for the RBA.

Undoubtedly, the most nervous observers in the nation are Prime Minister Anthony Albanese and Treasurer Jim Chalmers. They desperately need the RBA to cut rates before the May federal election.

A least based on market bets, this is looking increasingly uncertain.