Exclusively from Gerard Minack beautifully analysing everything MB has argued for over ten years. Amazingly.

The Australian economy has been on public sector life support for a year as a policy squeeze caused a recession-like slump in real incomes. Real income growth is probably past the worst, so there may be a tepid cycle recovery. But Australia faces structural headwinds caused by a combination of fast population growth and low investment which has crushed productivity growth. That points to structurally weak income and spending growth.

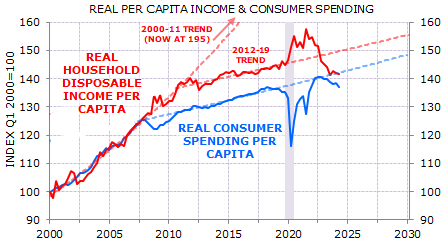

Rate hikes, tax hikes and price hikes led to a recession-like decline in real incomes over the past two years. Part of the decline was payback for the pandemic-era fiscal largesse. However, real incomes are now well below the anaemic trend that’s been in place since 2012 (Exhibit 1).