Australian energy is a disaster. We are trying to transition from coal to renewables with both hands tied behind our backs.

The issue is neither. It is gas.

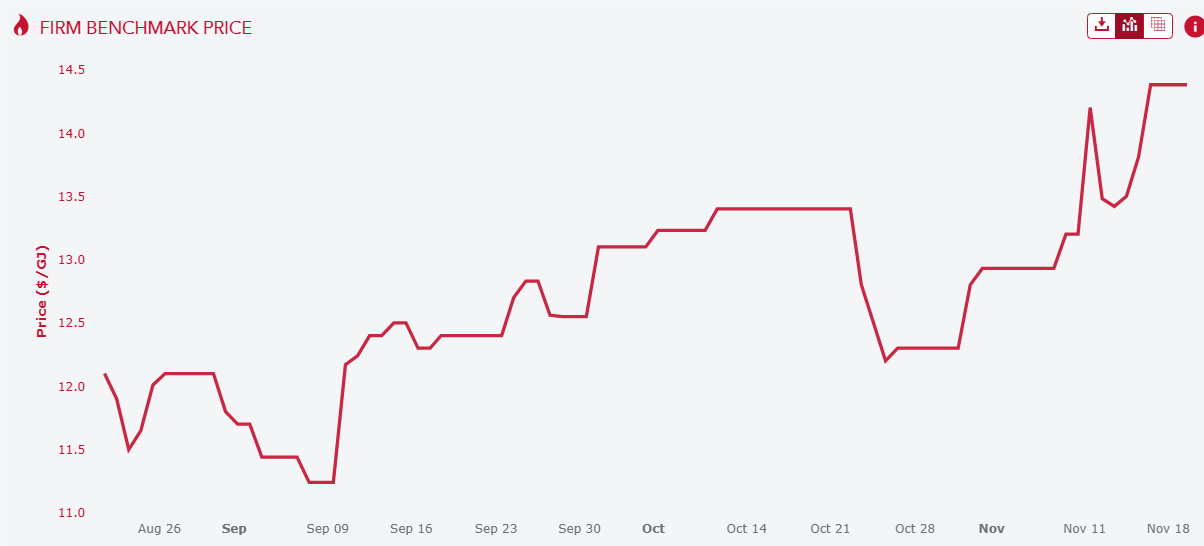

The East Coast gas export cartel is driving the price unseasonably higher as we speak.

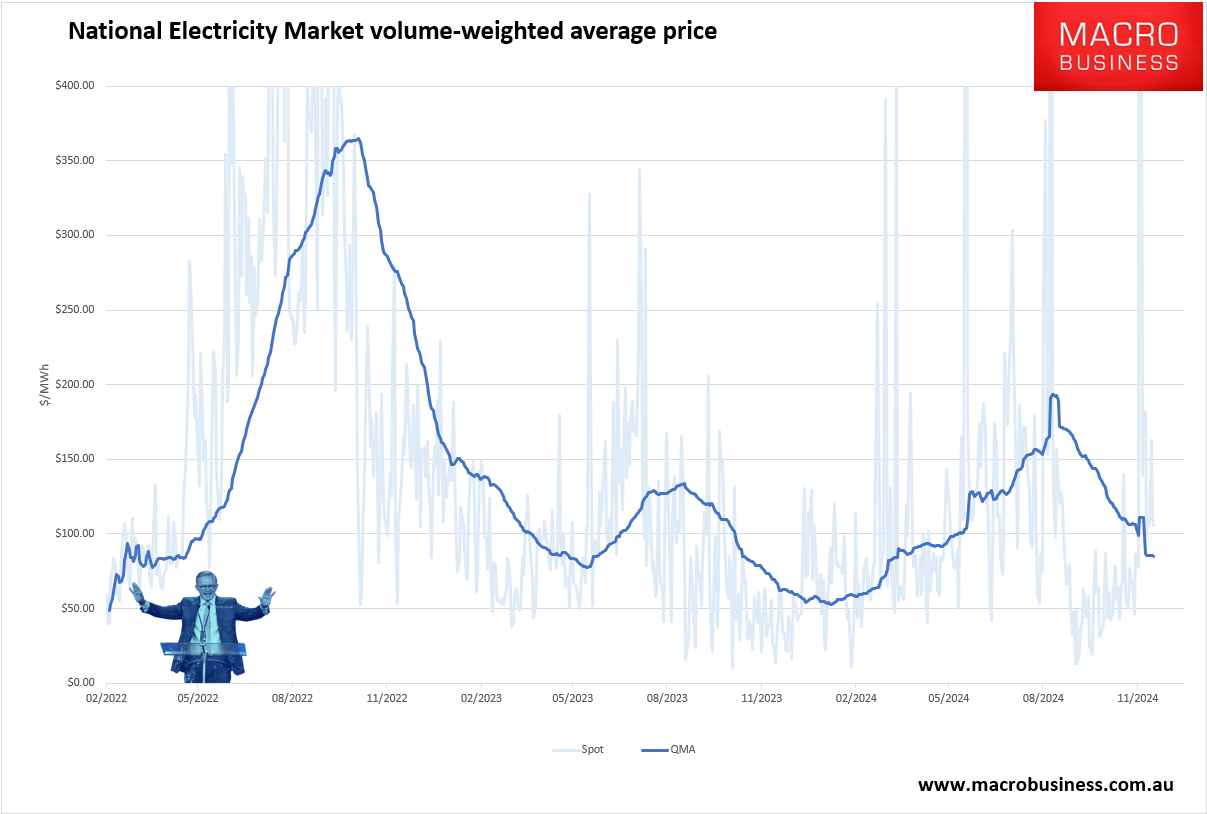

If it continues much longer, off-season electricity pricing will bottom out far above the 2024 low.

The insecurity of supply means nobody but ScoMo has built a gas peaker in Australia for many years.

Yet we need gas speakers to underpin renewables.

The answer? Subsidise the cartel at every step of the way.

South Australia has proposed using gas as part of a new model to ensure it has sufficient reserves of power to underpin the country’s largest state penetration of renewable energy.

Should the measure be adopted, the state would become the first state to use gas as part of a scheme to support renewable energy generation.

…The state said it will hold annual tenders where generators and battery operators can bid for a contract to underwrite a portion of their revenue – a scheme the state said will be called the Firm Energy Reliability Mechanism (FERM).

In exchange for the revenue certainty, those selected must ensure they can dispatch all year round.

We already subsidise gas extraction by the East Coast gas export cartel via various giveaways and foregone taxes.

We also subsidise end-users so that they can afford the extortionate prices charged by the cartel because it sends all the gas to China.

Now we will subsidise a buildout of gas peakers, often owned by the very same gas cartel, to pay for their own overpriced gas.

This incredibly destructive mess could be fixed in one second by reserving for domestic use 15% of East Coast gas exports.

Like Canada does.

In Canada, exports licenses are granted by the Canada Energy Regulator, formerly the National Energy Board. When granting the license, the CER will assess licence applications to determine if the volume of the applied for energy commodity proposed for export is surplus to Canadian requirements.

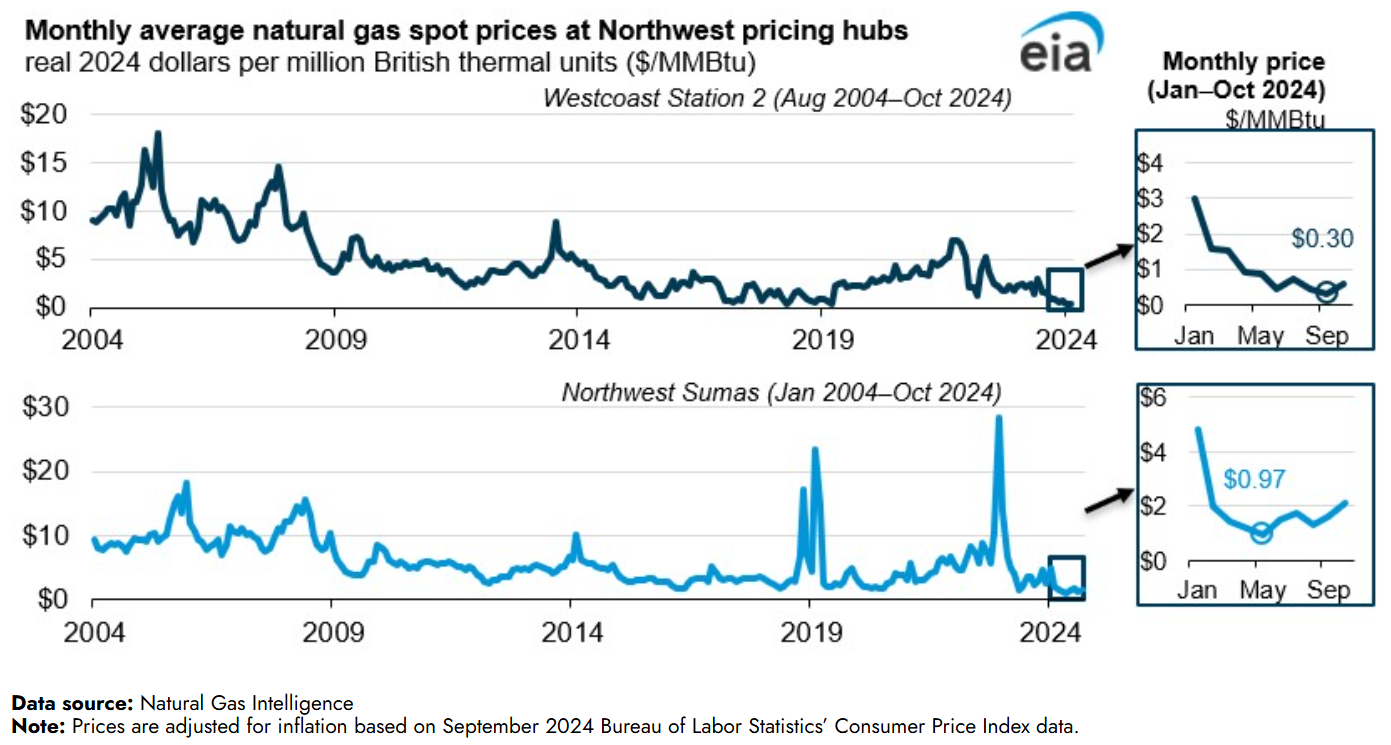

Where prices are now ridiculously low.

At Westcoast Station 2, the western Canada benchmark, the daily spot natural gas price has averaged $1.04 per million British thermal units (MMBtu) in 2024 through October, reaching its lowest monthly average of $0.31/MMBtu in September. Located near Fort St. John, British Columbia, close to natural gas production activities in the Western Canadian Sedimentary Basin (WCSB), Westcoast Station 2 is a key pricing hub for gauging production and available supply in the regional market.

The Department of Industry, Science, Energy and Resources secretive review of domestic reservation mechanisms looked at Canada before it was rolled by gas cartel propaganda in 2020.

Australia is buggered.