The Australian dream of home ownership is fading for younger Australians.

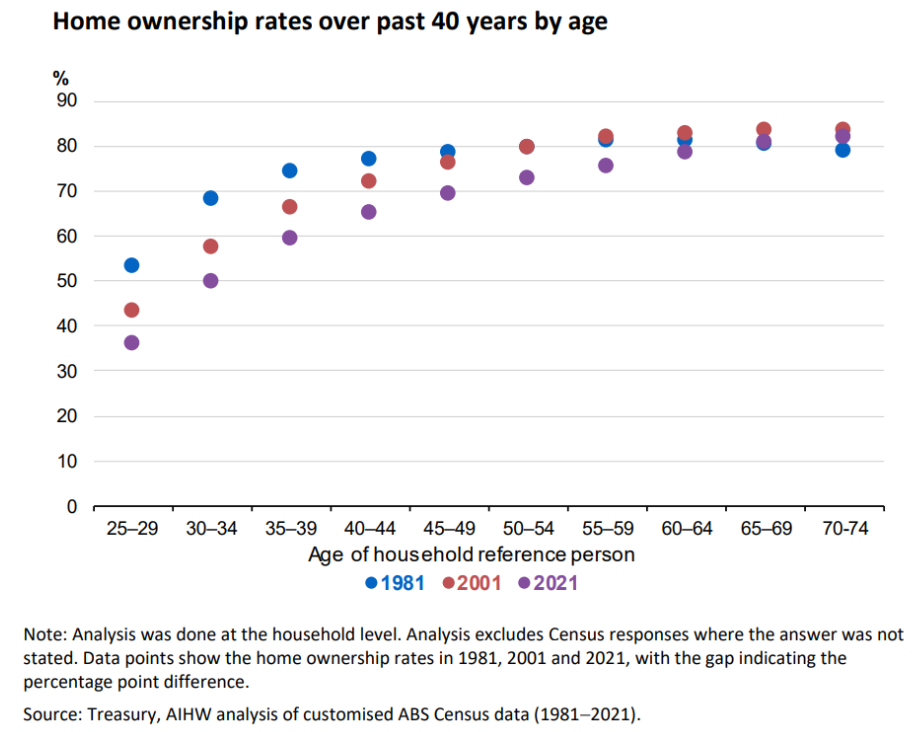

The 2023 Intergenerational Report illustrated the sharp structural decline in home ownership rates among younger Australians, following decades of strong price growth and stagnating incomes.

The above chart is based on 2021 Census data, and the housing affordability picture facing younger Australians has deteriorated markedly since.

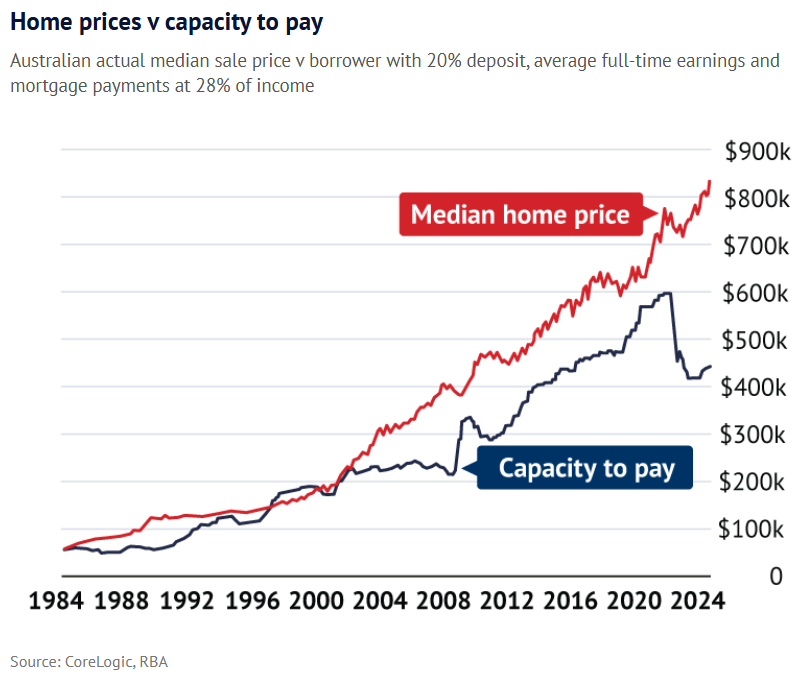

Home prices have risen strongly despite the sharp rise in mortgage rates, which has reduced borrowing capacity.

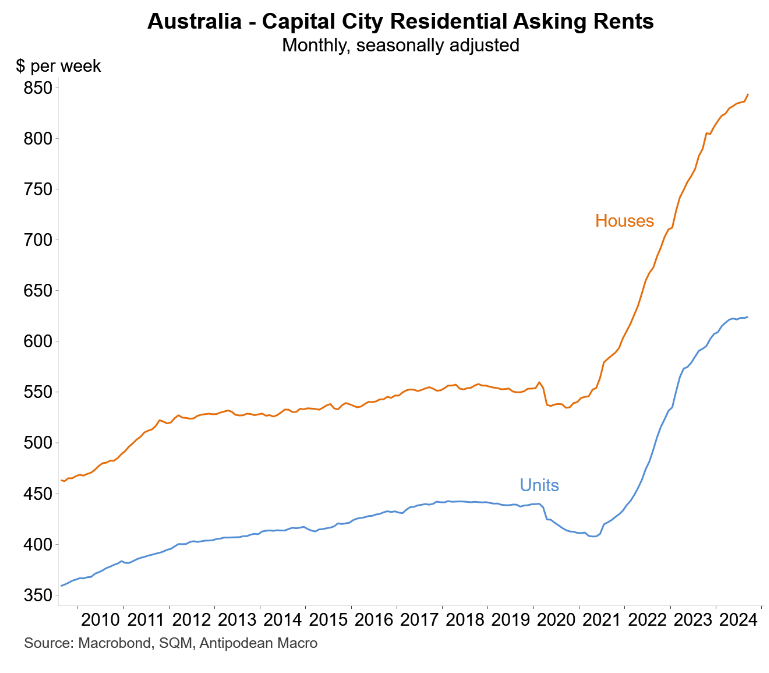

Rents have also soared, making it harder for younger Australians to save a deposit.

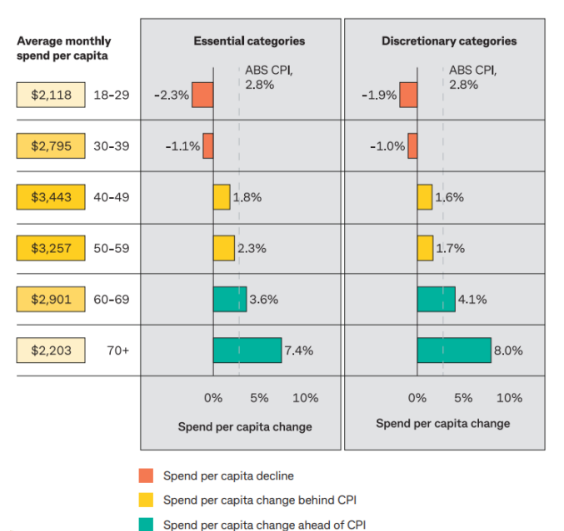

Older Australians, on the other hand, are sitting pretty. Since the pandemic, they have dramatically increased their savings, and most are spending freely while younger Australians cut back.

Source: CBA

Older Australians’ good financial fortune stems from the fact that most own their homes outright. Therefore, they have little mortgage debt and do not need to rent.

They are also earning higher interest on savings, and have been largely unaffected by rising income tax payments.

New data from electronic conveyancing firm PEXA Group shows that an increasing share of home sales across Australia’s three largest states are cash purchases, primarily to older Australians.

The firm’s analysis of settled residential property transactions during 2023-24 shows that $138 billion worth of sales were made using cash across New South Wales, Victoria, and Queensland. This represented a year-on-year increase of 14%.

Some 114,000 properties were settled with cash, an increase of 3.9%.

PEXA’s chief economist Julie Toth says cash buyers could help to sustain house prices, noting that interest rates have less impact on them.

“This segment is less affected by interest rates, and they comprise a large portion of the market, which I expect will continue to rise in line with the ageing population”, she said.

“The amount they spend on property, 28% of all transactions, is substantial, which is one of the reasons why the housing market stayed resilient in the past year”.

Independent demographer Mark McCrindle agreed, noting that falling prices would likely see more cash buyers, “who largely are in the older generations”.

“Australia’s property market is not likely to see a significant fall or crash because there is a lot of money available, sitting on the sidelines, and able to step in when there are buying opportunities”, he said.

The baby boomer demographic already accounts for most of Australia’s home ownership and wealth.

According to the above facts, they are increasing their grip on the nation’s housing and wealth.

It is a dismal picture if you are a younger Australian without wealthy parents to call upon for financial support.