This week’s interview on Professor David Flint’s Save The Nation Program.

Edited Transcript:

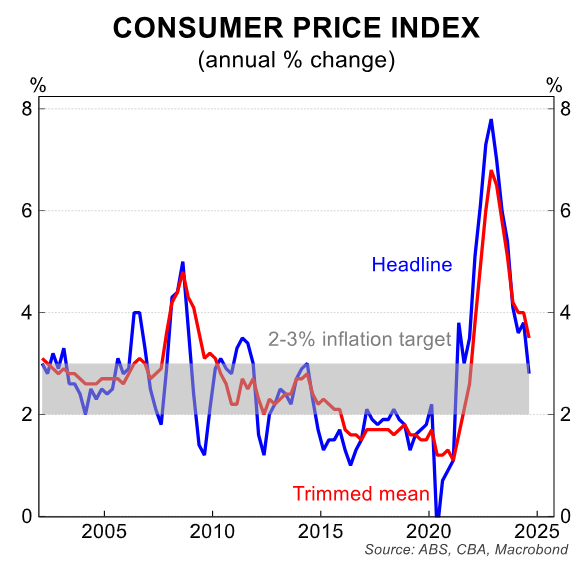

There are two inflation measures that matter. The first one is the headline inflation. That is the standard Consumer Price Index you hear about on television and radio.

Headline came in below the Reserve Bank’s target in Q3. We got a quarterly inflation print of just 0.2%, which was below economists’ expectations. It was actually the lowest print Australia has had since mid-2020 during the pandemic.

Annually, the inflation rate fell to 2.8%, which is within the Reserve Bank of Australia’s Target of between 2% and 3%.

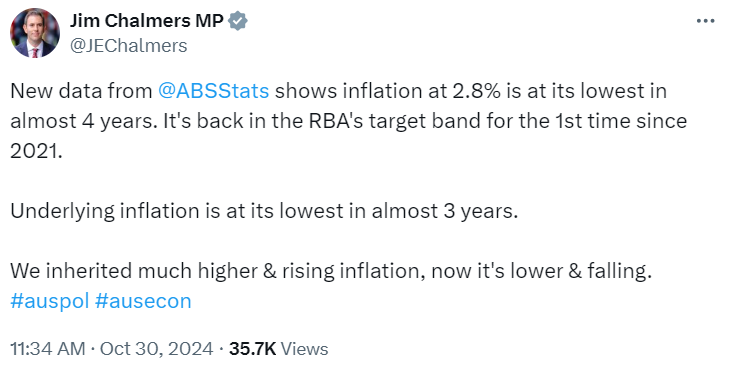

That is obviously good news and our esteemed Treasurer Jim Chalmers was out there crowing about it saying that it is the lowest inflation in nearly four years, inflation is within target, etc.

Chalmers was effectively trying to pressure the Reserve Bank to lower interest rates.

However, the headline inflation figure has been statistically manipulated. The primary reason why the inflation rate fell was because the federal government has dished out a whole bunch of energy rebates.

These subsidies have lowered electricity bills by 16% and suppressed the quarterly headline inflation rate 0.4%.

We also saw quite a sharp fall in petrol prices, which also pulled down the headline inflation rate.

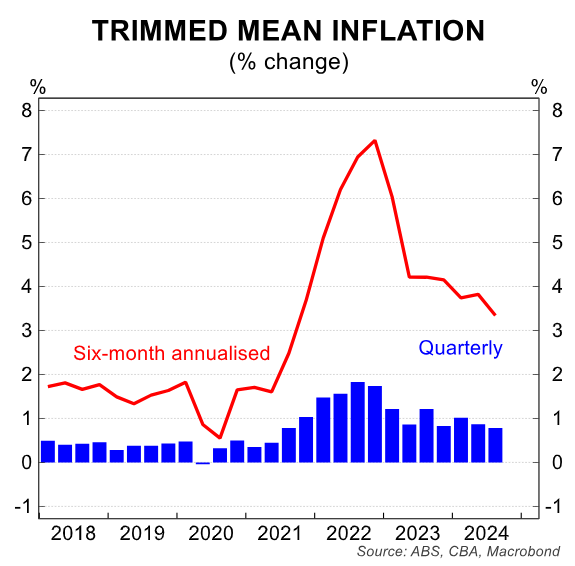

This brings me to the second reading from the inflation print, which is the core inflation or trimmed mean inflation. And this reading is what the Reserve Bank of Australia has said that they will focus on because they want to exclude the impact of subsidies and volatile items.

The trimmed mean inflation chops out the most volatile items. What this measure showed is that quarterly inflation rose by 0.8% and was 3.5% higher year-on-year.

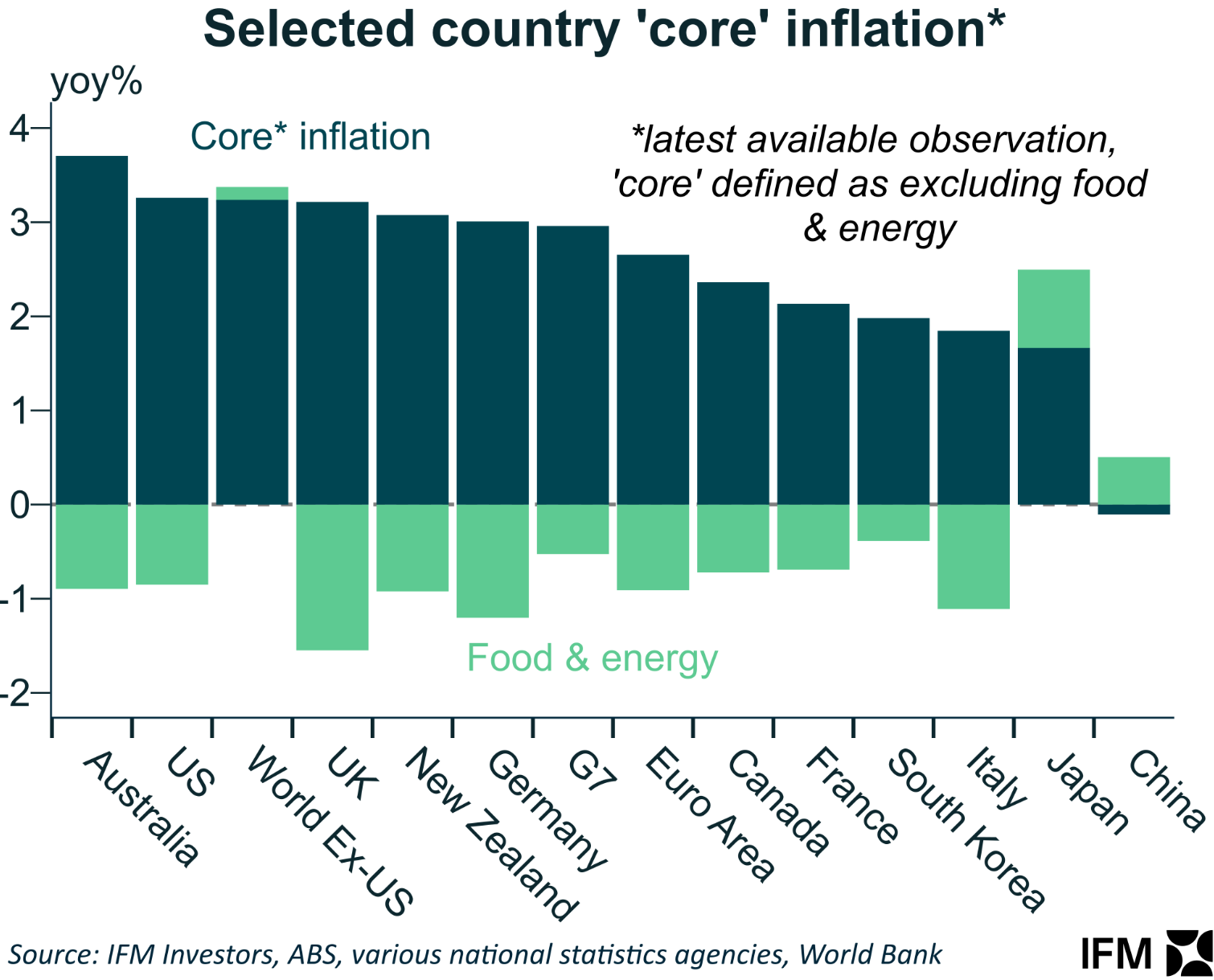

So, in a quarterly and an annual sense, trimmed mean inflation is above the Reserve Bank’s target. It remains among the highest in the advanced world. And what that means is that the Reserve Bank is almost certain to remain on hold until next year.

This leaves us in a pretty interesting situation because the federal government is desperate for the Reserve Bank to cut interest rates because it must hold the election by May next year.

Therefore, expect to see the federal government increase pressure on the Reserve Bank to cut rates, citing the fall in headline inflation.

At the same time, the Reserve Bank is not willing to look at the headline measure because it wants to focus on underlying or core inflation, and this remains above its target of 2% to 3%.

Treasurer Jim Charmers will no doubt point to the Reserve Bank charter, which does not mention trimmed mean inflation. It only says that headline inflation must be within target.

Treasurer Chalmers will probably try and use the charter as a way to pressure the Reserve Bank, whereas the Reserve Bank has been adamant and has said repeatedly that it will focus on underlying inflation.

Thus, the scene is set for a clash between the federal government, who is desperate for interest rate cuts, and the Reserve Bank who wants to remain on hold until underlying inflation is within its target range.

I will add that that headline inflation does matter in the sense that a lot of the government administered prices are indexed to headline inflation.

For example, the artificially supressed headline inflation rate will mean that fuel excise won’t rise by as much, nor will tobacco excise. Pension payments won’t rise by as much, nor will JobSeeker payments.

If headline inflation falls, even if those fall are artificially driven by subsidies, it means that inflation in other areas set via indexation will also eventually fall.

However, you won’t see these impacts for several quarters and certainly not in time for the next election.

The bottom line is that the government is desperate for the Reserve Bank to cut rates because it is staring at a hung parliament the way things stand at the moment. Labor desperately needs the rate cuts to save its political bacon.

That is why we are going to see a lot of pressure on the Reserve Bank to cut rates from Treasurer Chalmers and other Labor ministers.