David Harrison, CEO of the $80 billion property behemoth Charter Hall, warned that Australia’s housing crisis would deteriorate as population growth (immigration) outpaces supply.

“If they call it a crisis now, God knows what they’re going to call it in five or 10 years”, Harrison said to The AFR.

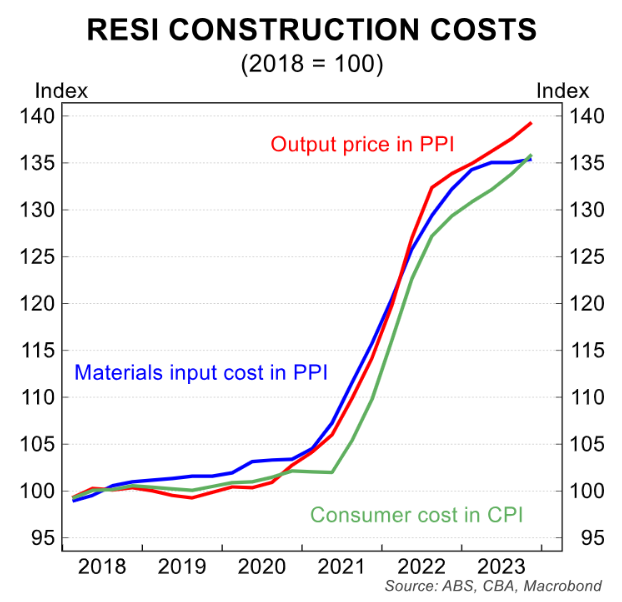

Harrison argued that while population demand would continue to grow, supply would remain bottlenecked by high construction costs and interest rates, which have crushed developers’ confidence.

Harrison said that supply won’t come through “because no one can see the merit in doing construction and development”.

“If you bought land more recently over the last couple of years at full price, it’s going to be very hard to develop those sites”, adding that the slow rollout of infrastructure such as roads, water, and power is also working against supply.

“This all creates a pressure cooker on rents and eventually existing asset values go up. There’s not new supply, but the net population growth drives a multiplier for demand in all sectors”, he said.

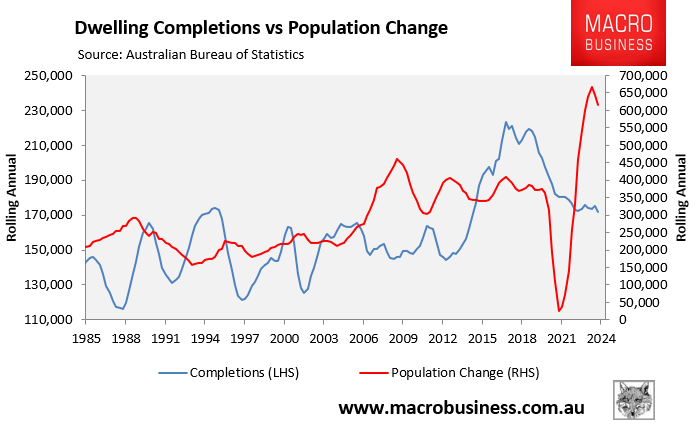

The reality is that Australia’s immigration program is driving Australia’s housing crisis in two ways.

First, immigration volumes for two decades have been too high and have overwhelmed housing and infrastructure provision.

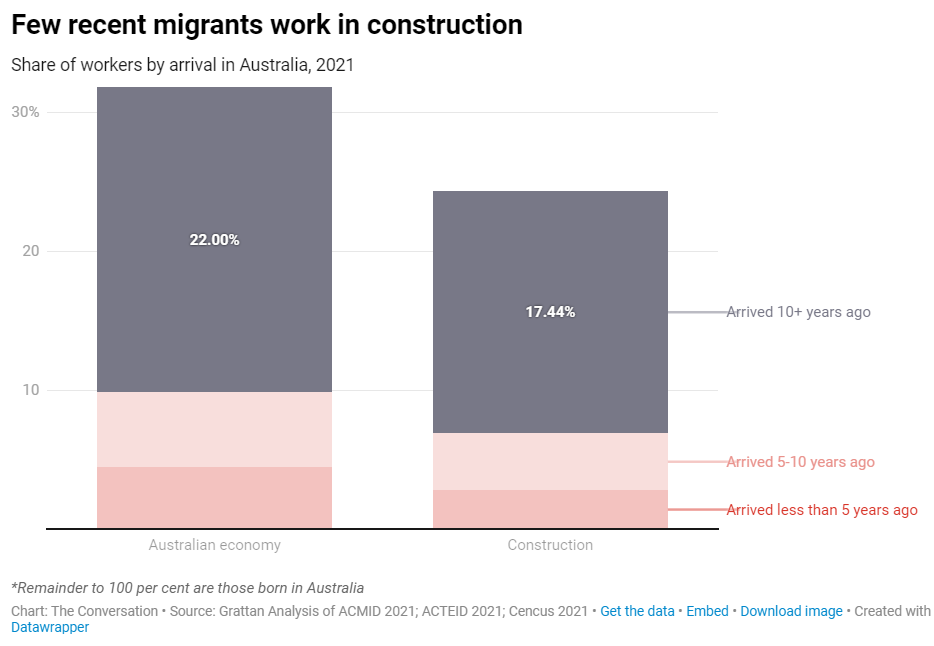

Second, very few of these migrants work in construction.

As noted by Alan Kohler in August, “in Australia the percentage of permanent and temporary migrants who are building workers is 0.6%”.

Separate analysis from the Grattan Institute also showed that migrants are woefully underrepresented in the construction industry.

Therefore, Australia’s mass immigration policy is massively adding to the demand for housing without providing any material boost to the supply side.

The obvious solution to this mess is to run a much smaller migration program that is also biased toward the skills the Australian economy actually needs.

Then we might actually make inroads into Australia’s housing shortage.