Michele Bullhawk appears to be a worker-hating psycho.

All central banks care about inflation and the potential impact of their policies on the economy and the labour market. But there have been some important differences reflecting the different weights that central banks place on the two objectives. In Australia, interest rates did not reach the same levels of restrictiveness as many other countries (see the blue bars in Graph 4), and consistent with this, inflation has been somewhat higher relative to target here than in most of those economies, and the labour market is also tighter. This means that even with a similar approach to setting policy, the time to adjust domestic monetary policy settings can differ from peer central banks.

Indeed, Australia’s labour market conditions appear unusually tight, relative to those in other peer economies. Conditions in labour markets in those economies have eased significantly and unemployment has increased, such that labour markets are now assessed to be close to balance or have spare capacity. Given the tightness in Australia’s labour market, along with our assessment that the level of demand still exceeds supply in the broader economy, we expect it will take a little longer for inflation to settle at target in Australia.

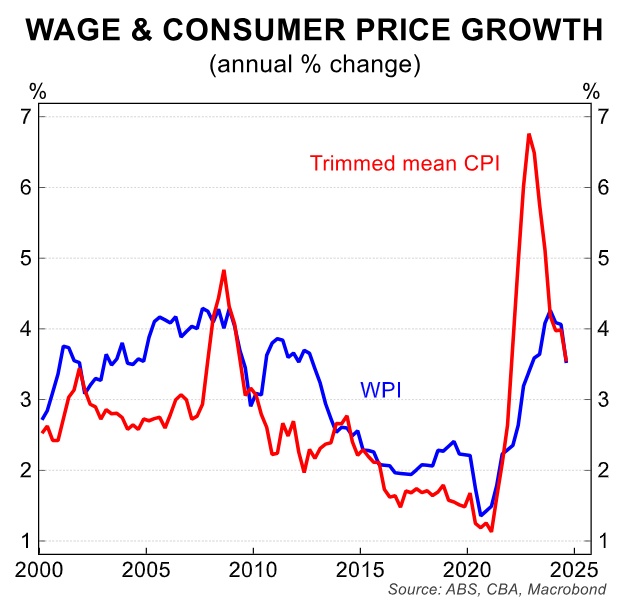

Errr…versus “peer economies” that are already slashing interest rates, Australian wage growth is much lower:

| Australia | 3.5 |

| NZ | 3.4 |

| US | 5.6 |

| Canada | 5.2 |

| EU | 5.1 |

| UK | 4.3 |

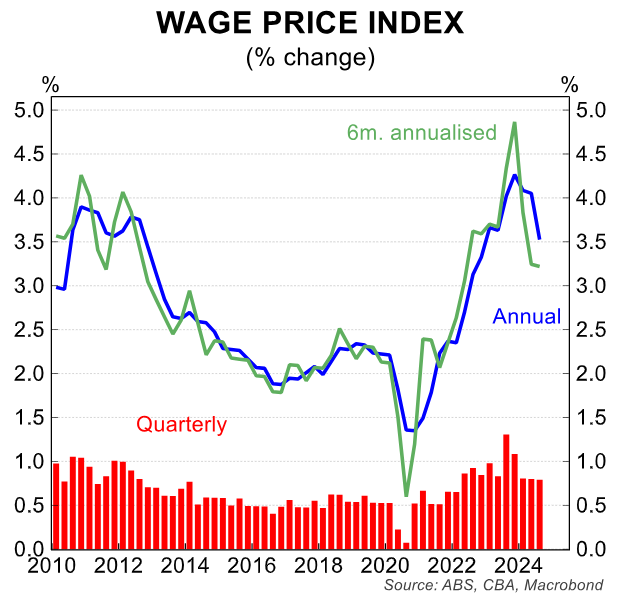

Wage growth is not firming; it is falling. Well below RBA forecasts. Why does the bank refuse to acknowledge this?

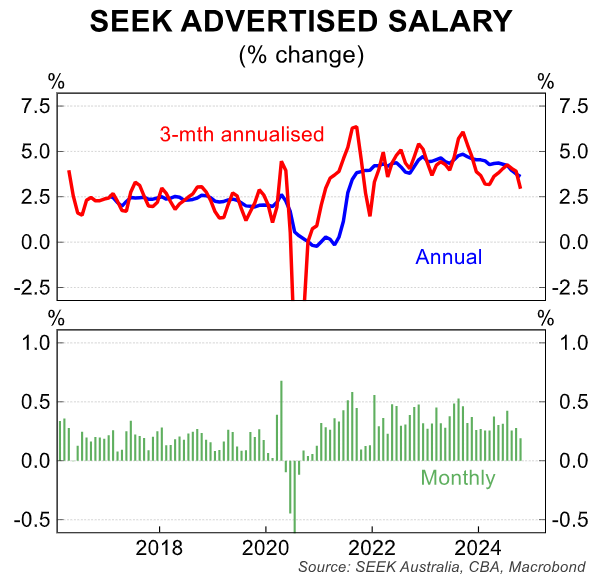

Leading indicators are softening further.

This will drag inflation down.

Why are wages softening if the Labor market is tight or even tightening?

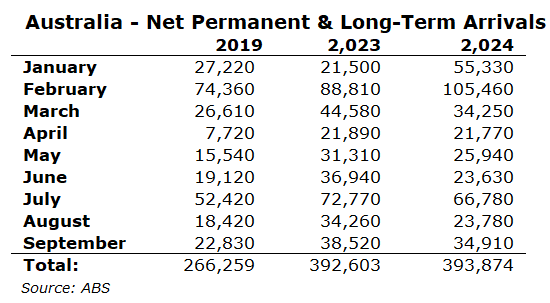

Because Australia has an immigration-led growth model that taps an endlessly expanding global labour market supply.

We finally got some weak wage growth when we shut our borders during COVID.

But since the borders reopened, the supply permashock is larger than ever.

Worrying about a wage push inflation breakout in this context is ludicrous. Or insane.

At least Bullock walked back one of her many blunders. Goldman.

In our view, underlying inflation in Australia is not materially higher than key G10 peers – relative to each central bank’s inflation target.

Given this, and comments by governor Bullock that the RBA would be forward-looking and not necessarily require two additional ‘good’ quarterly CPI reports, we continue to view an early 2025 rate cut as the most likely scenario.

We expect the RBA to commence a gradual easing cycle in February 2025 (GS: -25bp) but acknowledge ongoing institutional change at the RBA complicates our understanding of the RBA’s reaction function and that the risks are skewed to a slightly later start date.

The Bullock RBA communications are a mess. It lurches from one excuse to the next, from meeting to speech to publication.

Its evidence is feeble. Its understanding of the economy is weak. Its forecasting is no better.

And now it will be reformed by Jim “chicken” Chalmers.

What could possibly go wrong?