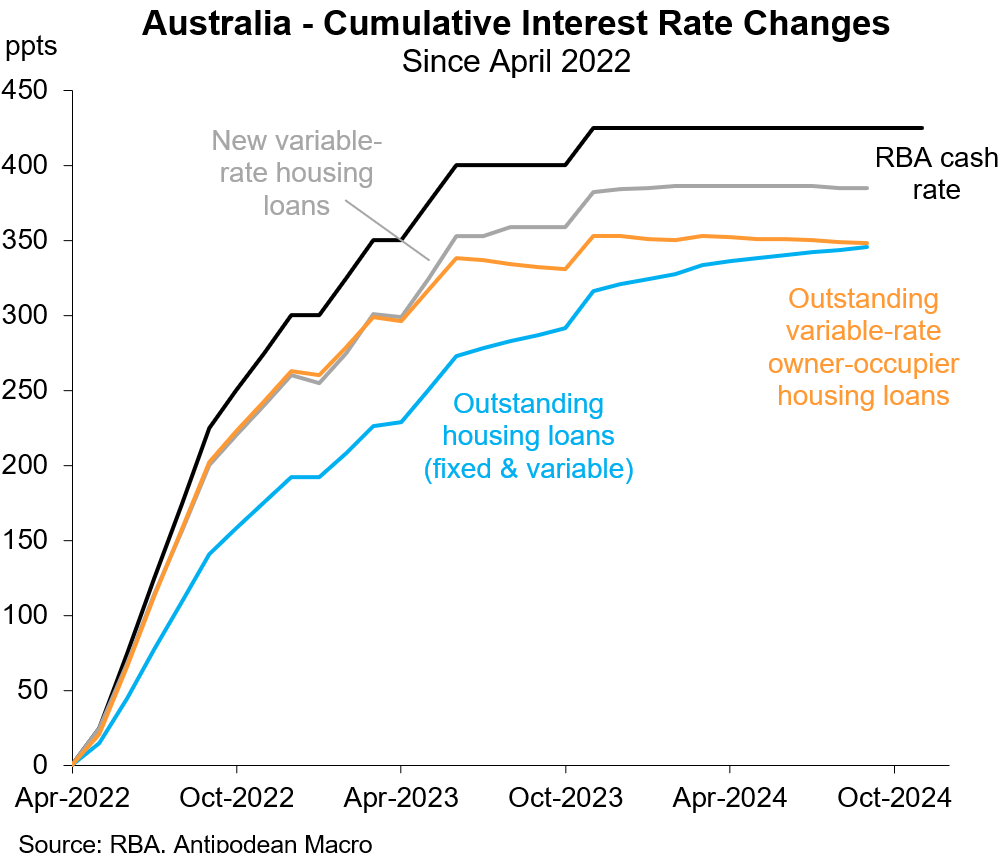

The Reserve Bank of Australia’s (RBA) latest Statement of Monetary Policy (SoMP) noted that the increase in Australian housing credit and prices to record highs is “unusual” given the tightest monetary conditions since the Global Financial Crisis in 2008.

“Unusually for a rate tightening period, housing credit growth has picked up over the past year”, the SoMP noted.

“Nominal housing credit growth has been gradually increasing since August 2023, over which time the RBA has assessed financial conditions as being restrictive”.

“In previous tightening phases, housing credit growth generally decreased after a period of tighter monetary policy (and then continued to decline even as policy was eased)”.

“Although housing credit growth did initially decline materially during the current tightening phase, the recent pick-up is unusual compared with previous periods of restrictive monetary policy”, the SoMP said.

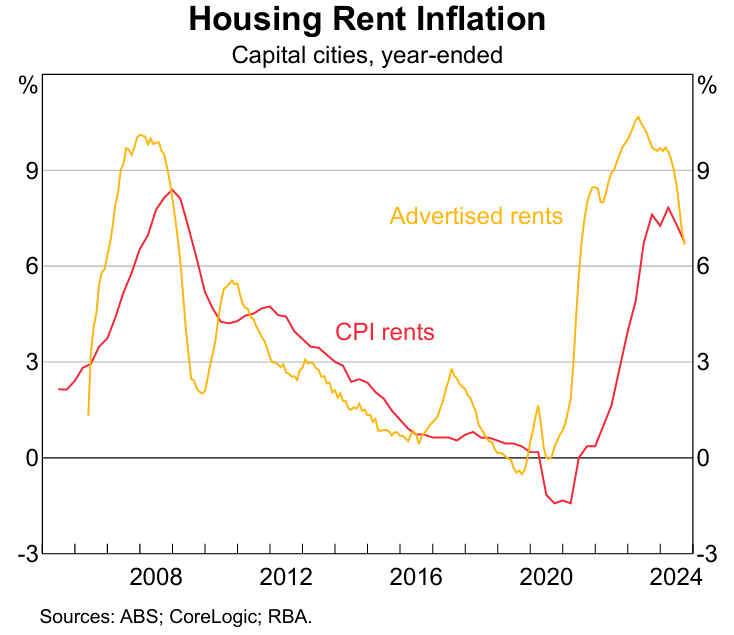

The RBA SoMP noted that housing credit growth and prices have risen because of historically strong population growth amid tightening supply.

“Housing prices and housing credit growth have been supported by strong population growth and constrained housing supply”.

“Population growth over the tightening phase has contributed to increased demand for housing, which (combined with a lack of new supply) has led to strong growth in housing prices”, the SoMP noted.

A new Domain report noted that prospective Australian home buyers have been hit with a double whammy of rising prices and crashing borrowing capacity, which has driven affordability to record lows.

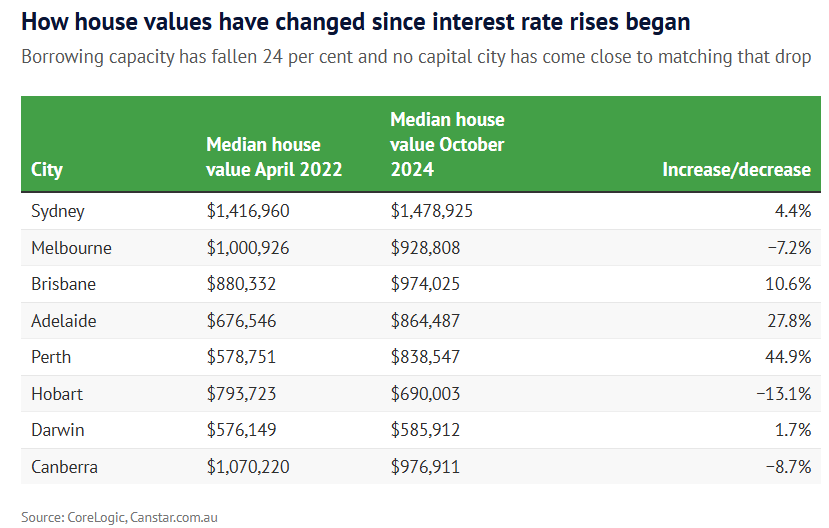

Data compiled by Canstar and CoreLogic shows that median house prices have risen across most markets since the RBA commenced its tightening cycle in May 2022.

However, borrowing capacities have been “shredded” by the aggressive hikes in mortgage rates, according to Canstar data insights director Sally Tindall.

“For property hotspots, largely Sydney, prices have broadly stayed the same when you compare pre-hike prices to today”, she said. “Yet someone’s borrowing capacity has gone through the shredder”.

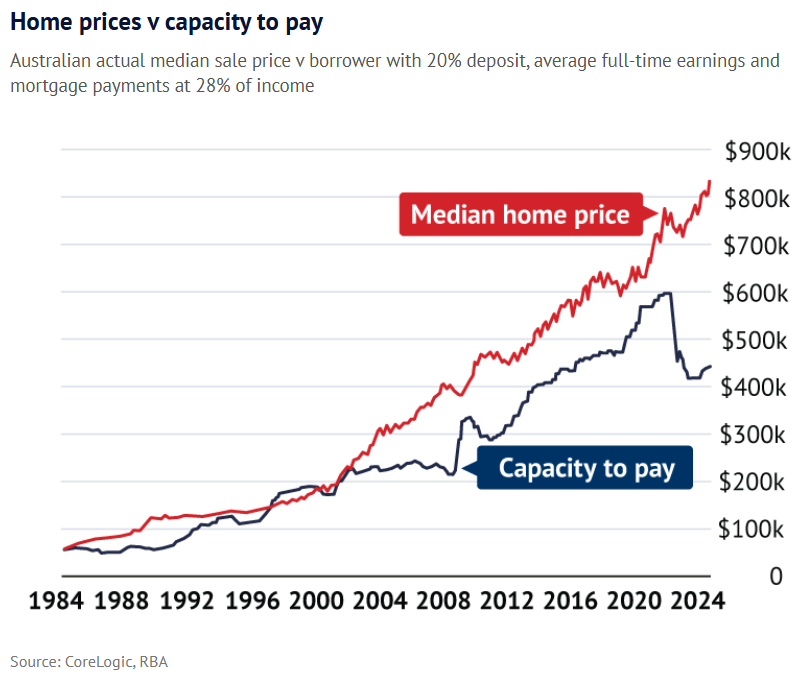

AMP chief economist Shane Oliver estimated that Australian home values were around 26% higher than they should be, based on the assumption that values were tied to borrowing capacity.

“There has been some improvement in households’ capacity to pay because interest rates have been on hold over the last year now and incomes have gone up a little bit, but we’re still in a situation where the gap is wide and that hasn’t changed”, he said.

Gareth Aird, the head of Australian economics at CBA, believes that buyers turning to their families for financial support has bridged the gap between home prices and capacity to pay.

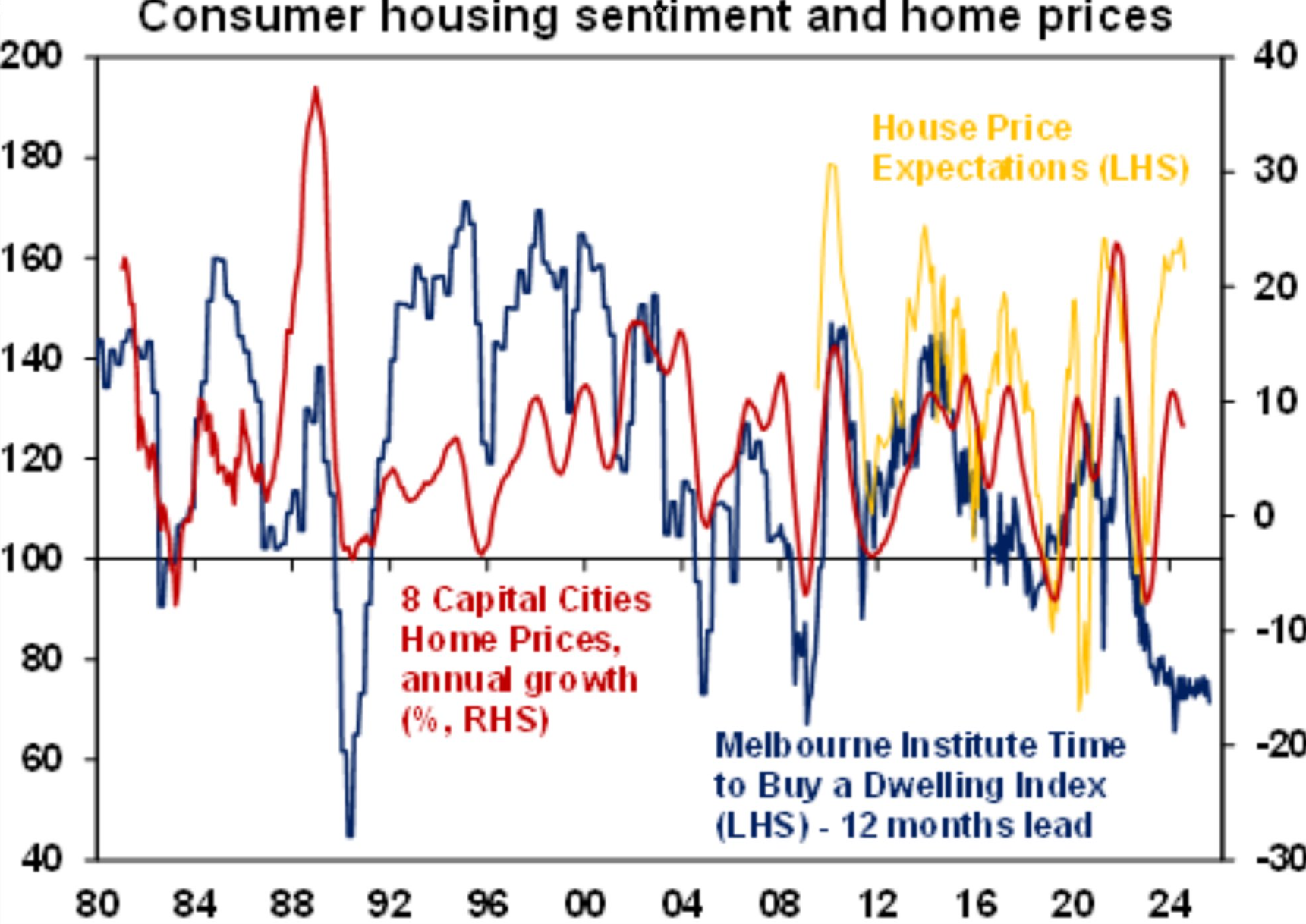

The Westpac-Melbourne Institute consumer sentiment index also shows that there is an enormous disconnect between Australians’ sentiment about property prices and their purchasing appetite.

The ‘time to buy a dwelling index’ is tracking near record lows, whereas expectations for house price growth remain bullish.

Source: AMP

My view on the situation is that the ‘Hunger Games’ has gripped the housing market, with Australians feeling pressured to purchase amid strong rental inflation and the fear that prices will continue to rise, shutting them out permanently.

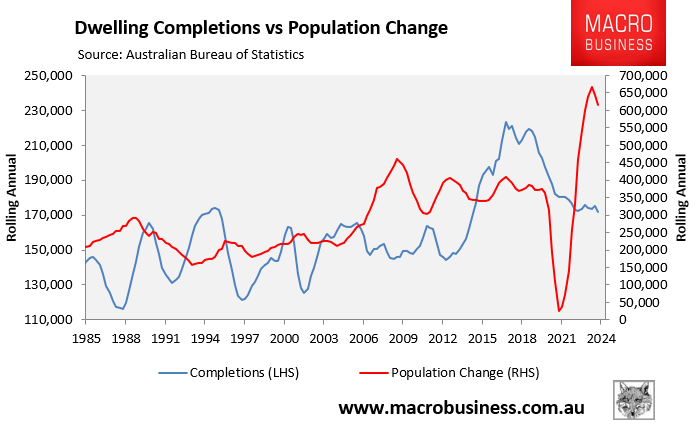

Underpinning this ‘fear of missing out’ [FOMO] is the record surge in immigration, whereby around one million net overseas migrants have arrived in Australia over the past two years at the same time as the rate of home building collapsed.

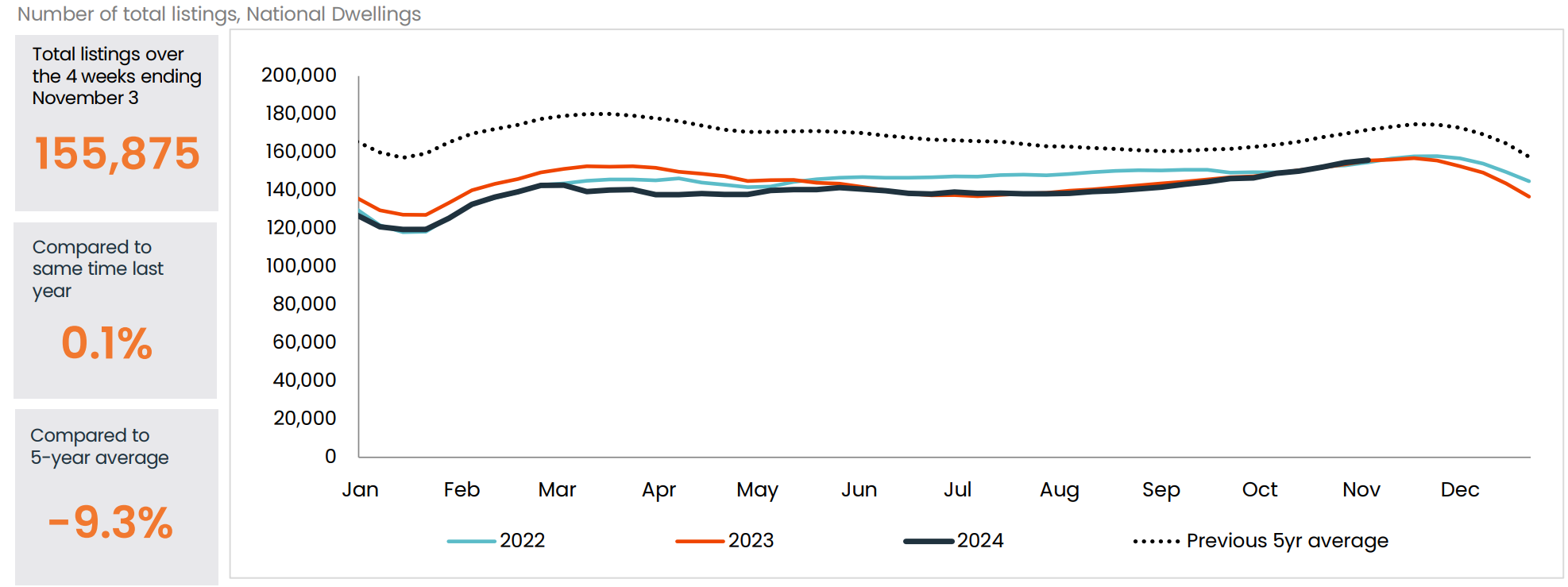

Meanwhile, the number of homes listed for sale is 9.3% lower than the five-year average.

Source: CoreLogic

In short, housing demand has swamped supply, creating unprecedented levels of FOMO and ‘panic buying’.