RBA assistant governor Christopher Kent spoke about how rising interest rates have hit Australian households particularly hard.

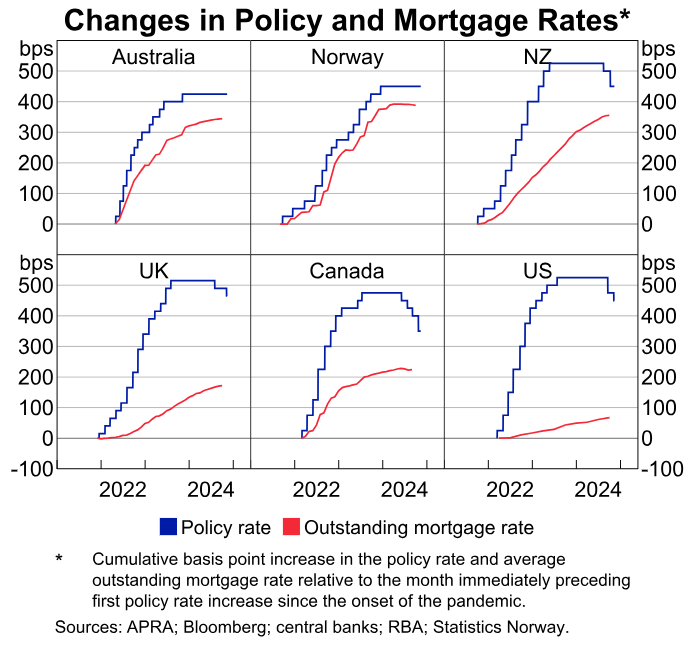

Although the official interest rate in Australia rose by less than the average, the average interest rate on outstanding mortgages in Australia is among the highest in the developed world.

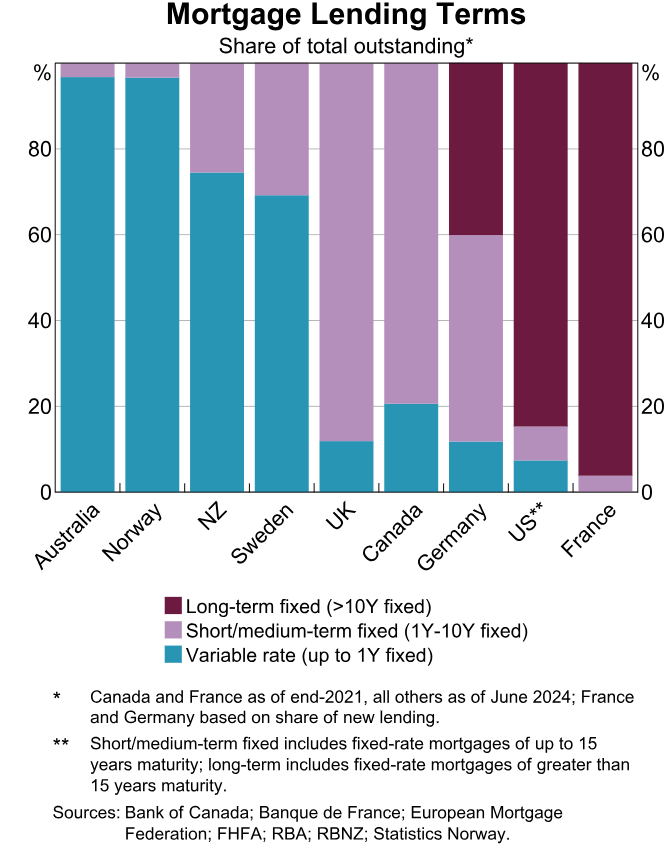

The more significant rise in mortgage rates in Australia is because it has one of the world’s highest shares of variable-rate mortgages.

“In Australia, most private sector debt is subject to variable interest rates. Even fixed-rate debt tends to be fixed for short periods compared with other economies”, Christopher Kent noted.

“At the other extreme, most mortgage debt in the United States is fixed for 30-year terms and large corporations issue a lot of fixed-rate bonds”.

“Over recent years, some of the most rapid increases in average outstanding mortgage rates occurred in Australia and Norway, which also has a high share of variable rate mortgage debt”.

“This is despite policy rates rising by less in these economies compared with many other advanced economies”, Kent said.

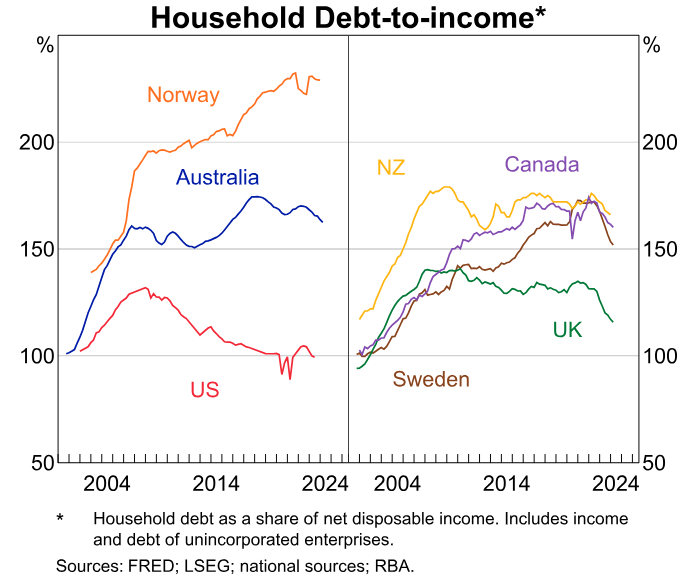

Compounding the situation for Australians is the fact that our households carry one of the highest debt loads in the world.

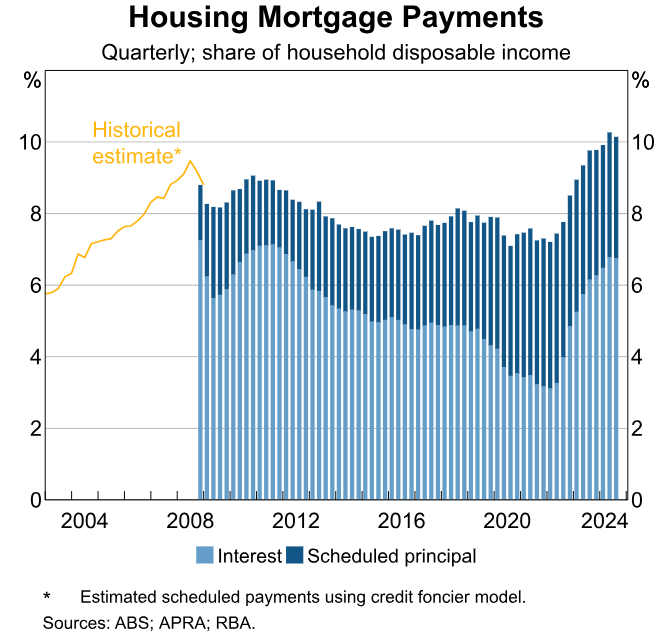

“Combined with the significant rise in outstanding mortgage rates, this has led required mortgage payments – interest plus principal – to increase by 2.5 percentage points of total household disposable income since May 2022; the increase as a share of mortgage holders’ incomes is much larger still”, Kent noted.

“These mortgage payments have reached record highs in Australia”.

The charts above show why the RBA did not need to hike official interest rates as much as other countries to lower demand and inflation.

The RBA’s monetary tightening has been particularly detrimental to Australian households.

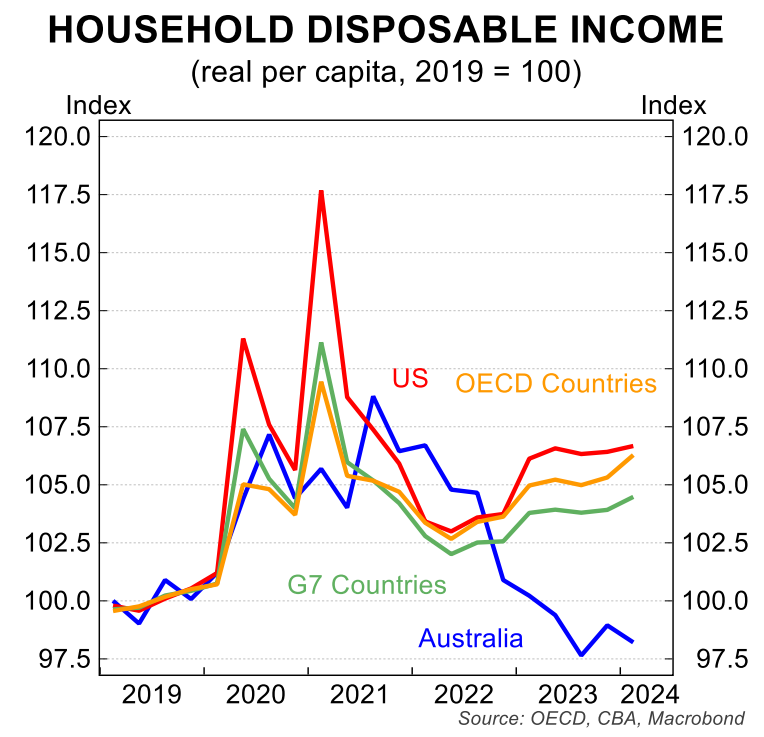

Australia’s real per capita household disposable income suffered one of the world’s largest declines due to falling real wages, rising mortgage rates, and increased income taxes.