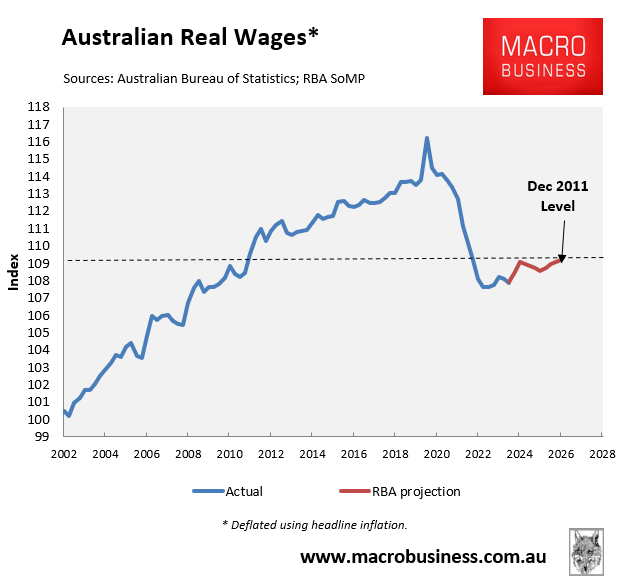

On Tuesday, the Reserve Bank of Australia (RBA) released its Statement of Monetary Policy (SoMP), which provided forecasts on Australian wage growth and CPI inflation to December 2026.

Australians have endured the sharpest decline in real inflation-adjusted wages on record, tracking 7.2% below their June 2020 peak as of Q2 2024.

According to the RBA SoMP, Australian real wages will only recover 1.2% by December 2026, leaving wages still 6.1% below their June 2020 peak.

Indeed, Australian real wages in December 2026 will be tracking at around the same level as December 2011, according to the RBA’s forecasts.

This means that Australians will have given up 15 years of wage growth.

Based on the trajectory of wage growth presented above, it also suggests that it could take more than a decade for Australian real wages to recover to their pre-pandemic level.

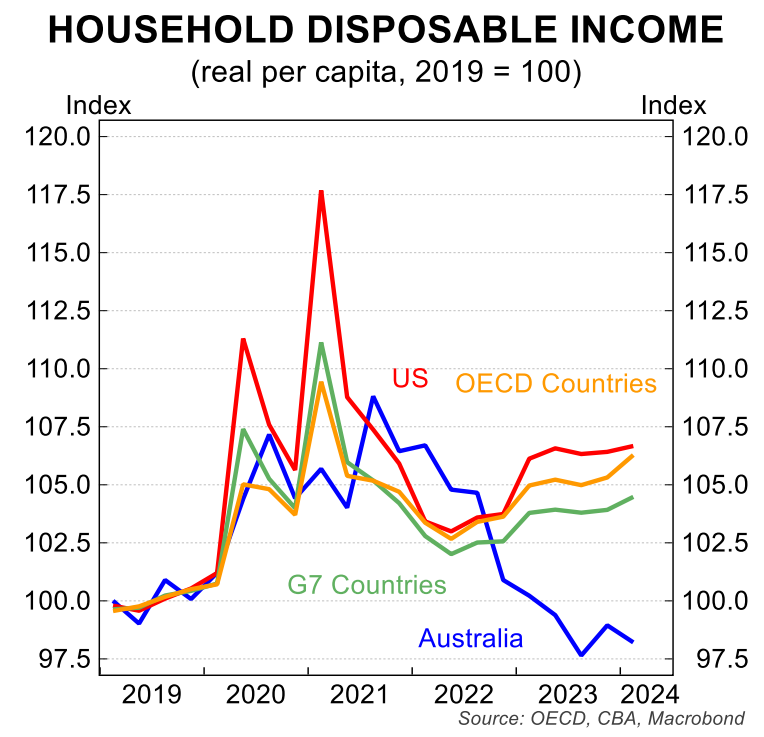

It could also take years for Australian real per capita household incomes to recover to their former peak following their recent world-record decline.

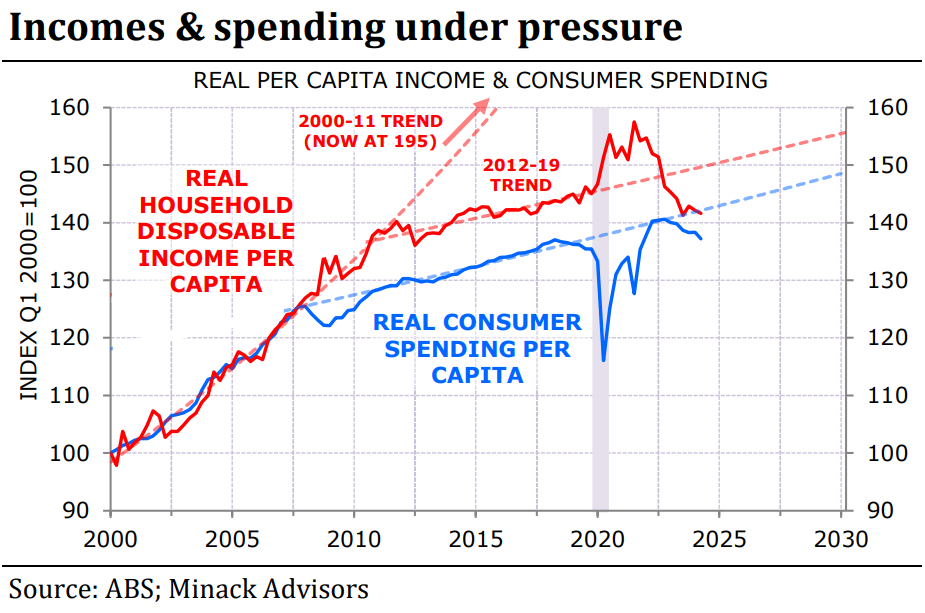

The 2020s decade is shaping up to be a lost decade for Australians.

Unless productivity growth miraculously picks up, Australia also faces low economic and income growth in the 2030s.

As noted by Gerard Minack in this week’s seminal report on the Australian economy, “Low investment and fast population growth is crushing productivity growth, leading to structurally weak income growth”.

“Poor productivity growth in Australia is a structural headwind for GDP growth”.