The latest iteration of the bullhawk has fallen:

Warren Hogan abandoned his call for an increase in the Reserve Bank cash rate because inflation fell by more than he expected last quarter, leading the economist to conclude that Australia’s benchmark rate should stay on hold for another year.

…“I think February is crazy,” Mr Hogan said.

…Mr Hogan is not expecting a rate cut before November 2025 and warned there is a “very good chance” that the cash rate could stay on hold until 2026.

It looks like my December call is caput, which only means inflation is going to undershoot next year as the energy rebates are extended and collapse administered prices.

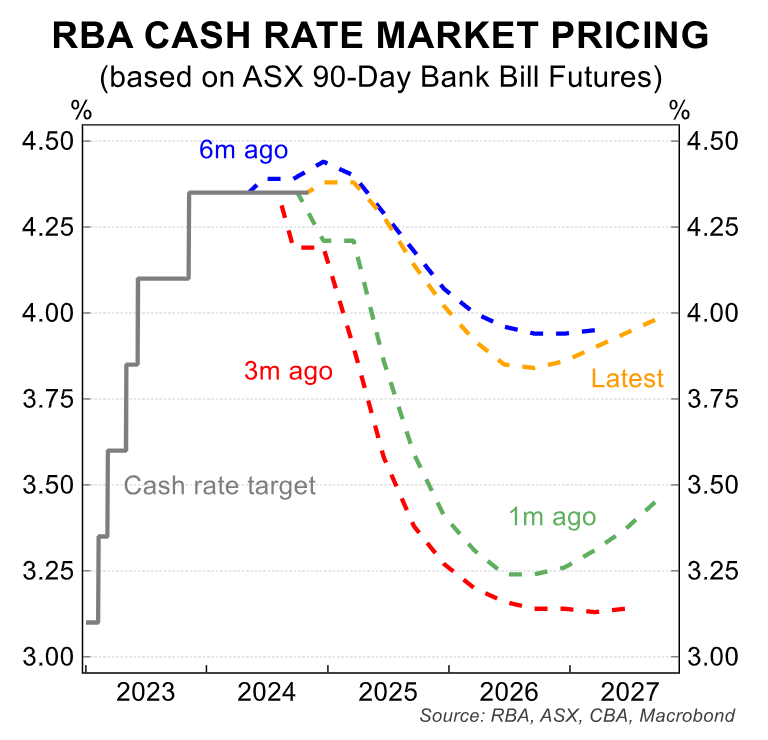

I am most amused by cash rate futures, which show about as much commitment to a known neutral interest rate as Albo does to good government:

Is the neutral interest rate 3% or 4%? It’s quite a difference.

Given the following:

- Iron ore ice age.

- Mass immigration to forever crush wages.

- Rental affordability ceiling reached.

- Energy rebates forever.

- Demise of the Albanese government.

I side with the 3% or lower over 2025/26.

As for tomorrow, a softening of rhetoric is in order to continue the great pivot as the energy rebate argument implodes ahead.