Earlier this week, Australian Prudential Regulation Authority (APRA) chairman John Lonsdale gave a speech to the European Australian Business Council.

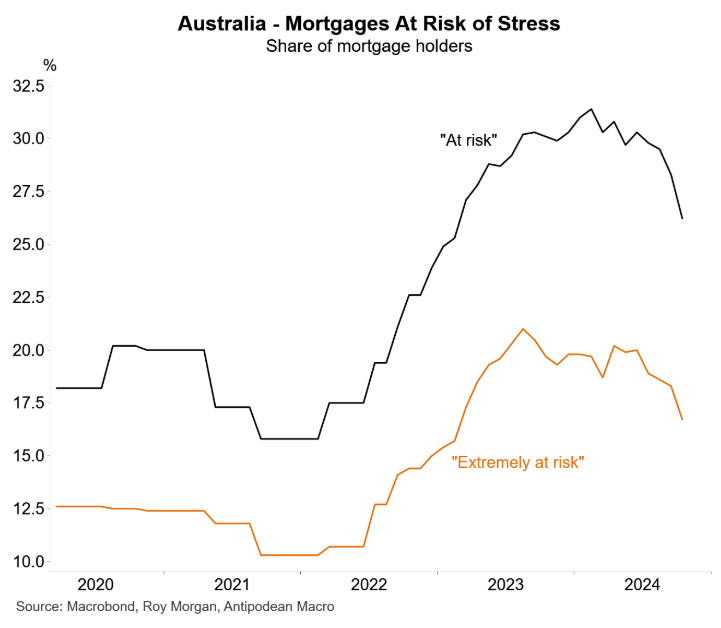

He noted that the number of Australians experiencing severe mortgage stress has nearly doubled from 2016 levels and is trending up amid the aggressive monetary tightening from the Reserve Bank of Australia (RBA).

“At the moment, about 1% of home loans are classified as non-performing to the value of $23 billion”, Lonsdale said.

“That’s around 35,000 households in deep financial difficulty and facing immense financial and emotional stress”.

“That level of mortgage stress is relatively normal in historical terms but it’s double the proportion we saw in 2016 and it’s trending up”, he said.

Lonsdale added that the rise in mortgage stress and the outlook for “low economic growth and higher unemployment in Australia over the coming year” justify maintaining APRA’s mortgage serviceability buffer at 3% above the loan rate.

“It’s a contingency for any type of deterioration in a borrower’s financial position, whether a loss of income, falling ill and being unable to work or an unexpected rise in expenditure”, Lonsdale said.

“At a system-level, it is a contingency against economy-wide risks factors, such as a rise in unemployment or the impact of an international trade war”.

“In short, it’s a buffer for uncertainty – something there is no shortage of in the current geopolitical environment”, he said.

Lonsdale added that Australians are overexposed to mortgage debt.

“Residential mortgages make up two-thirds of all bank loans in Australia, compared to 30% in Europe and only 10% in the United States”, Lonsdale said.

“Australians also have one of the highest levels of household debt relative to income in the world”.

“Our banking system is, therefore, particularly vulnerable to any scenario that results in large numbers of borrowers being unable to make their mortgage repayments”, he said.

The good news is that Roy Morgan’s mortgage stress index has improved over recent months, reflecting stable interest rates and rising nominal household incomes (assisted by the Stage 3 tax cuts).

Looking ahead, there are risks on both sides of the equation.

Expected interest rate cuts by the RBA will lower mortgage payments and ease mortgage stress. On the other hand, the forecast rise in the nation’s unemployment rate will increase mortgage stress.

APRA is wise in maintaining the 3% mortgage servicability buffer, at least for new mortgages.