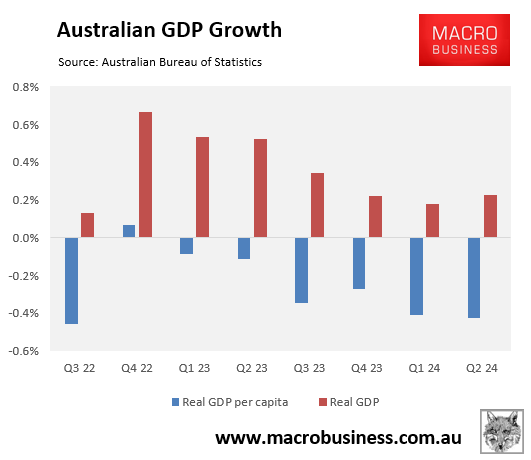

Australians are experiencing the longest per capita recession on record, with six consecutive quarterly falls in per capita GDP and seven declines in the previous eight quarters.

The International Monetary Fund’s (IMF) most recent World Economic Outlook report, released last month, predicted that the Australian economy would grow by only 1.2% in 2024, down from its April prediction of 1.5%.

The IMF predicts that real GDP growth will recover marginally to 2.1% by 2025.

The IMF’s prognosis is marginally more positive than the OECD’s most recent economic outlook, which downgraded Australia’s GDP growth projection for 2024 to 1.1%, down from 1.5% in the previous edition published in May.

The OECD estimated that Australia’s GDP would increase by only 1.8% in 2025.

Deloitte is even more pessimistic, expecting growth of only 1.1% this calendar year and 1.6% in 2025.

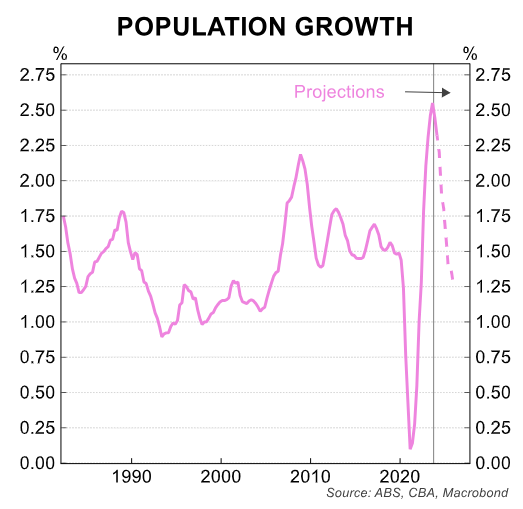

CBA predicts that Australia’s population growth would decline from its current rate of around 2.3% to just under 2% by the end of 2024 and to around 1.5% in mid-2025.

This means that Australia’s per capita recession, which is already the longest in recorded history, will continue into Q1 or Q2 2025.

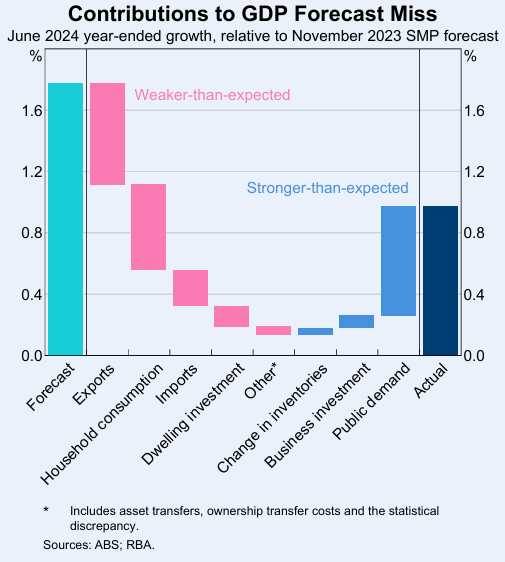

On Tuesday, the Reserve Bank of Australia (RBA) released its November Statement of Monetary Policy (SoMP), which noted how the Australian economy has grown far slower than expected.

“GDP grew by 1.0% over the year, compared with expectations of 1.8% at the November [2023] Statement. The outcome was also weaker than Treasury forecasts and more in line with market economists’ expectations”.

“In per capita terms, the forecast miss was even larger, given population growth was stronger than had been assumed”.

“The momentum in GDP growth has also been materially different to expectations; GDP growth is yet to show signs of a recovery and has remained around 0.2% in quarterly terms since December 2023”.

“At the expenditure component level of GDP, weaker growth in household consumption and exports, which was only partially offset by stronger-than-anticipated growth in public spending, contributed to the forecast miss”.

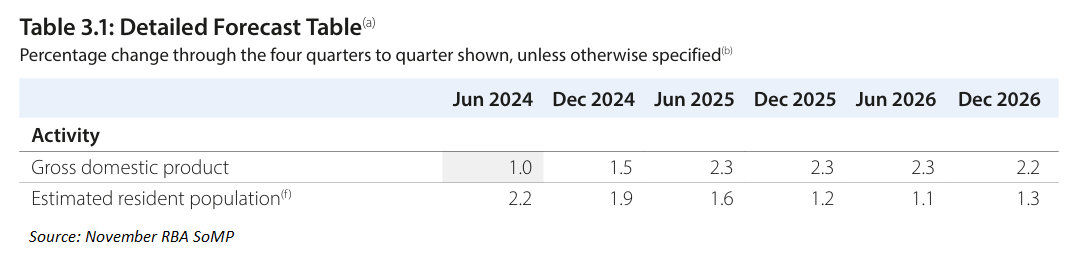

The RBA SoMP downgraded Australia’s GDP forecasts to 1.5% for the year ended 2024 and 2.3% for 2024-25. This compares to projected population growth of 1.9% for the year ended 2024 and 1.9% for 2024-25:

Like the IMF, OECD, and Deloitte, the RBA forecasts that Australia’s per capita recession will likely run until Q1 2025.

If true, this would mean that Australia’s already record per capita recession would run for an unprecedented nine consecutive quarters.

The RBA’s projections also suggest that the growth trajectory out of the recession will also be lacklustre.