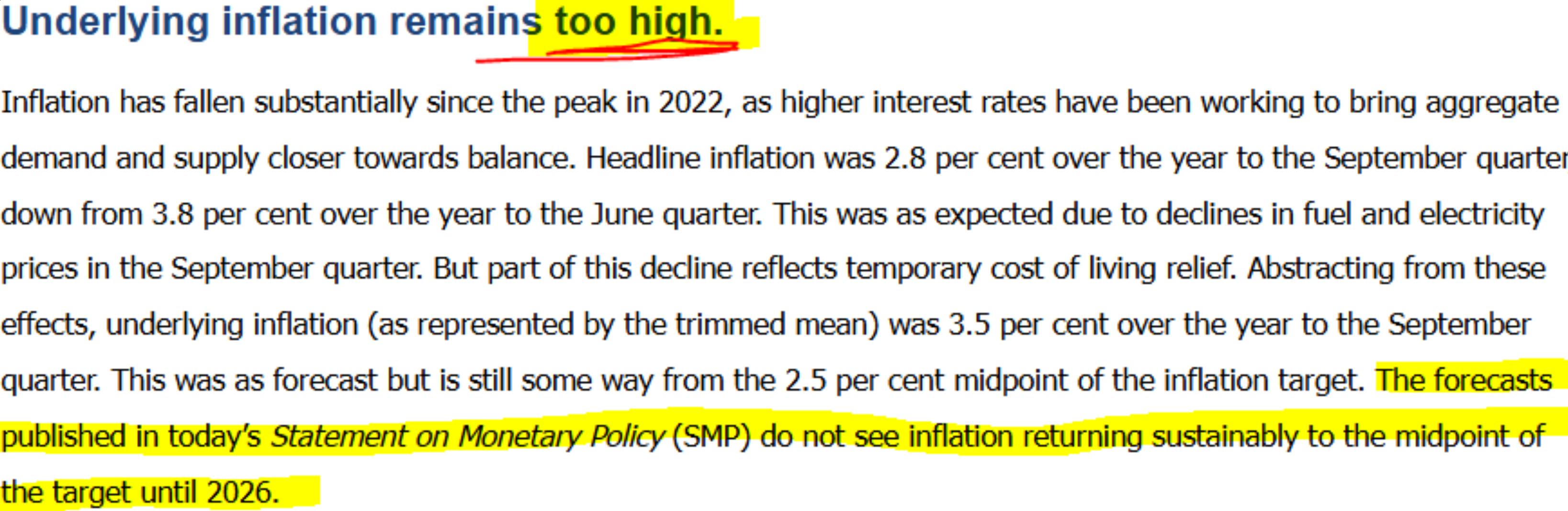

The Reserve Bank of Australia (RBA) has categorically ruled-out rate cuts in the short-term, noting in Tuesday’s monetary policy statement that “underlying inflation is too high” and that “labour market conditions remain tight”.

Alex Joiner, chief economist at IFM Investors, has highlighted the key bits from its Monetary Policy Statement:

Joiner notes that “the clear risk is that consensus for a cut is pushed out beyond February 2025”, which could sound the death knell for the Albanese government as it seeks re-election by May 2025.

Indeed, the RBA’s statement suggests that we could be waiting a long time for rate cuts:

“The November SMP forecasts suggest that it will be some time yet before inflation is sustainably in the target range and approaching the midpoint”…

“Policy will need to be sufficiently restrictive until the Board is confident that inflation is moving sustainably towards the target range”.

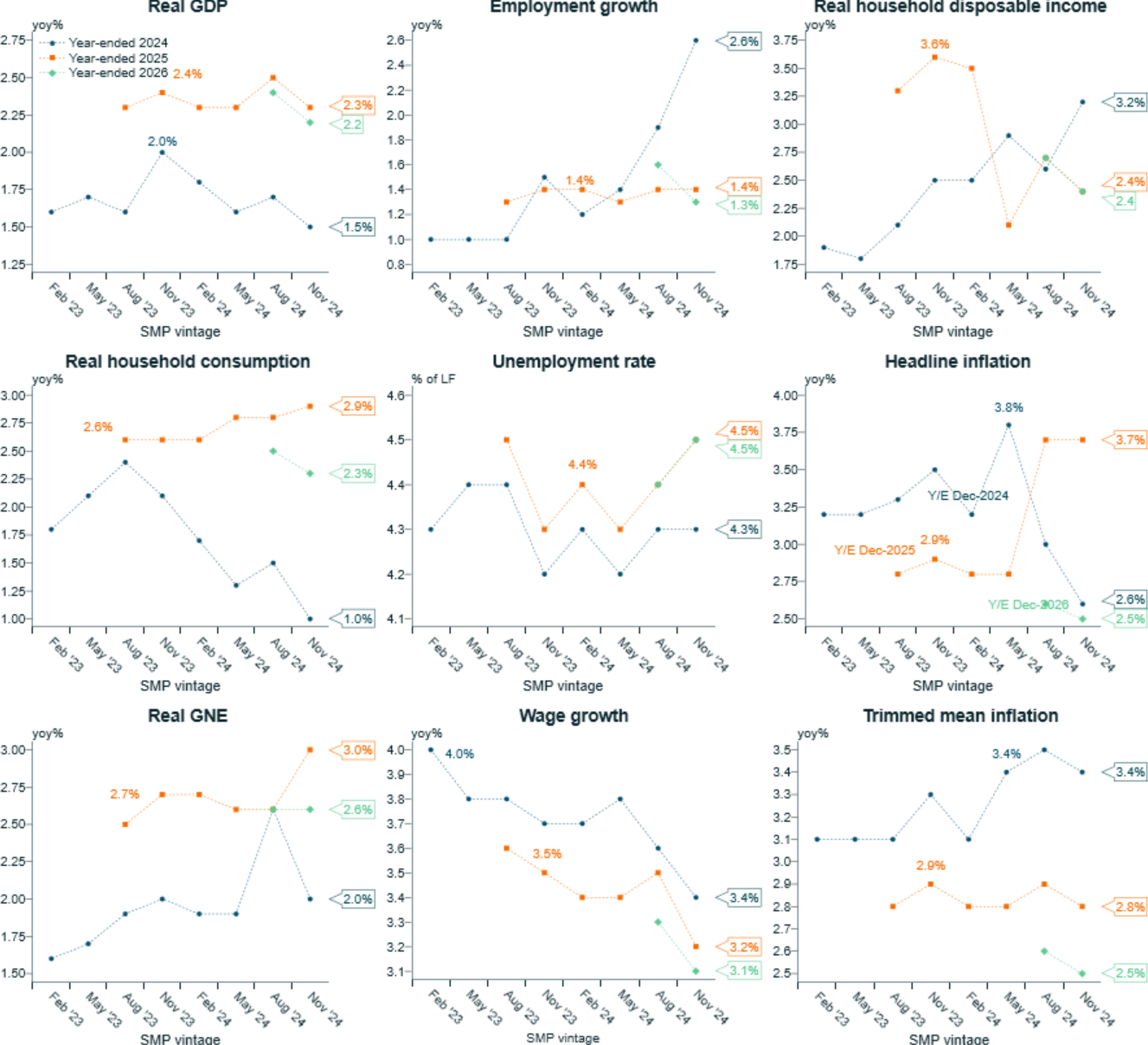

Joiner has also published the following charts on the RBA’s forecast evolution:

Source: Alex joiner (IFM Investors)

According to Joiner: “Unemployment rate a touch higher year end 2025, trimmed mean a touch lower. Headline inflation still sticks out as subsidies end (which they are unlikely to in my view)”.

Treasurer Jim Chalmers will no doubt be spitting chips at the RBA. His boast about lowering headline inflation via subsidies is sounding rather hollow.