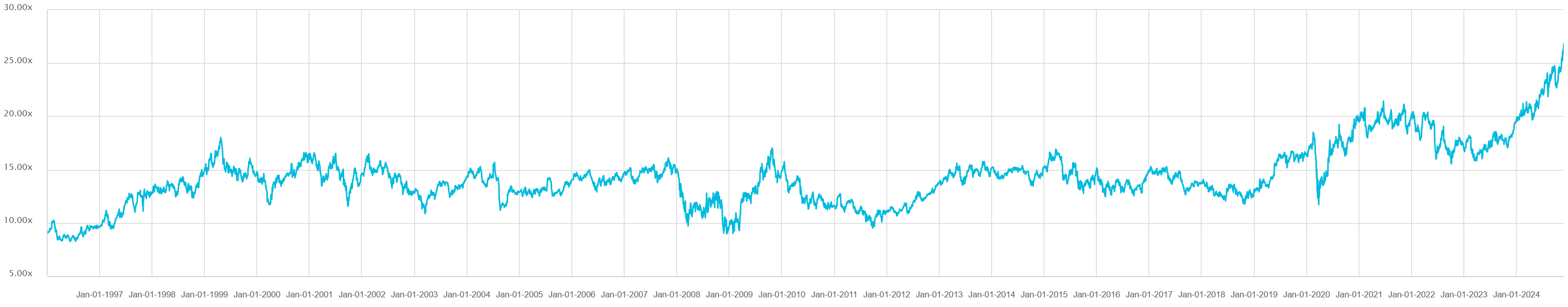

Behold the bubble of a lifetime.

CBA is now at 27x NTM, 40% more valuable than Google. No change in the business. No change in the terrible macro environment. No profit growth.

However, there is a change coming to interest rates, and that looms as the pin for this bubble.

It is all well and good inflating the value of a late-cycle stock when a central bank is in denial about falling inflation.

But when the worm turns and rates are cut more than everyone expects, net interest margins come under sustained pressure, and price will have to rise versus a falling profit outlook.

- The tariff shock is massively deflationary for goods.

- Wages are cooked killing services inflation.

- Rents have outstripped affordability.

- Rebates take care of energy.

- Oil is falling.

- China is stuffed and bulks are in an ice age.

- The budget is coming under intensifying pressure.

The last time we saw anything like this was from 2015 to 2019, when CBA fell by one-third through the lowflation period.

The CBA Death Star is now the ultimate power in the universe.

Or is it?

Sell hubiris.