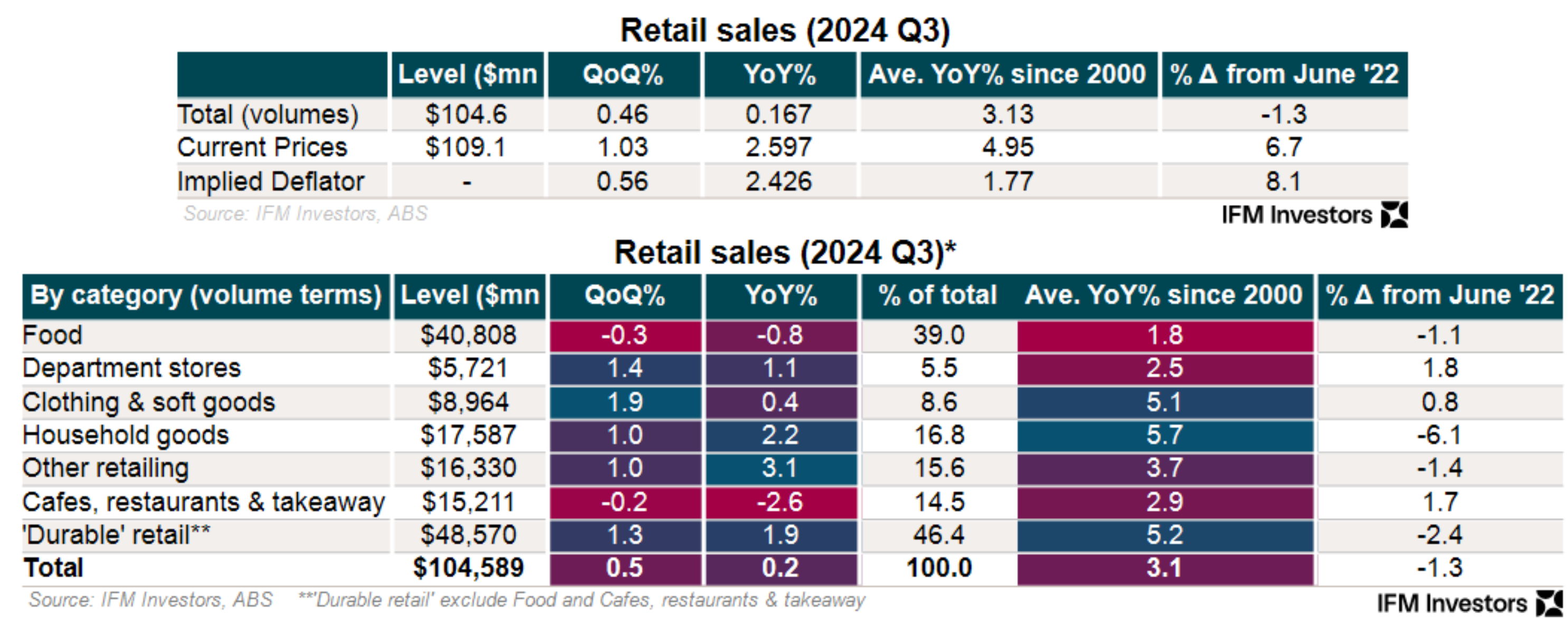

On Thursday, the Australian Bureau of Statistics (ABS) released retail sales data for Q3, which recorded a 0.46% rise in sales volumes over the quarter and a 1.7% increase year-on-year.

The following table from Alex Joiner at IFM Investors breaks down the key figures:

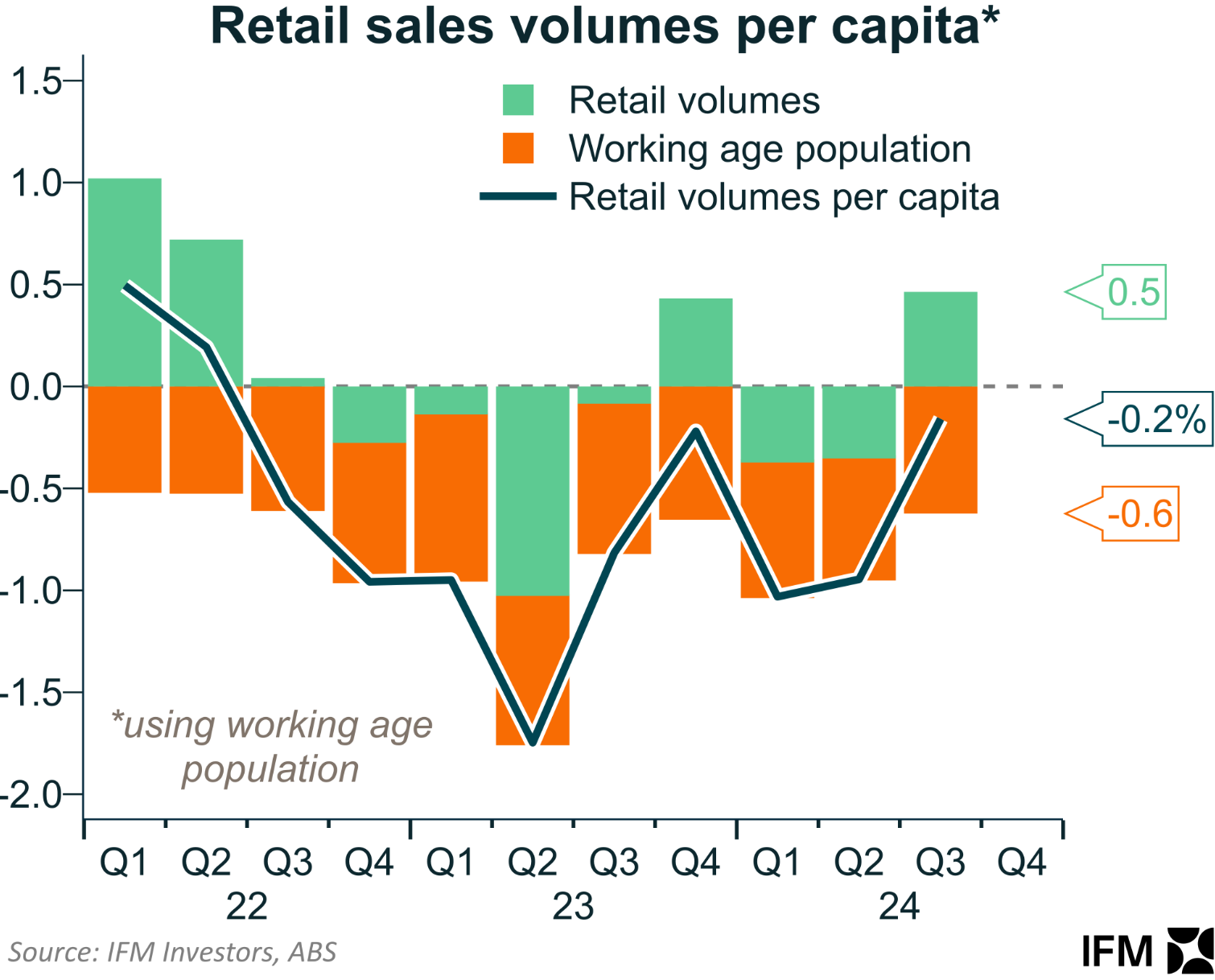

Joiner also pointed out that retail sales volumes per capita have declined for 11 consecutive quarters based on the growth in the working-age population:

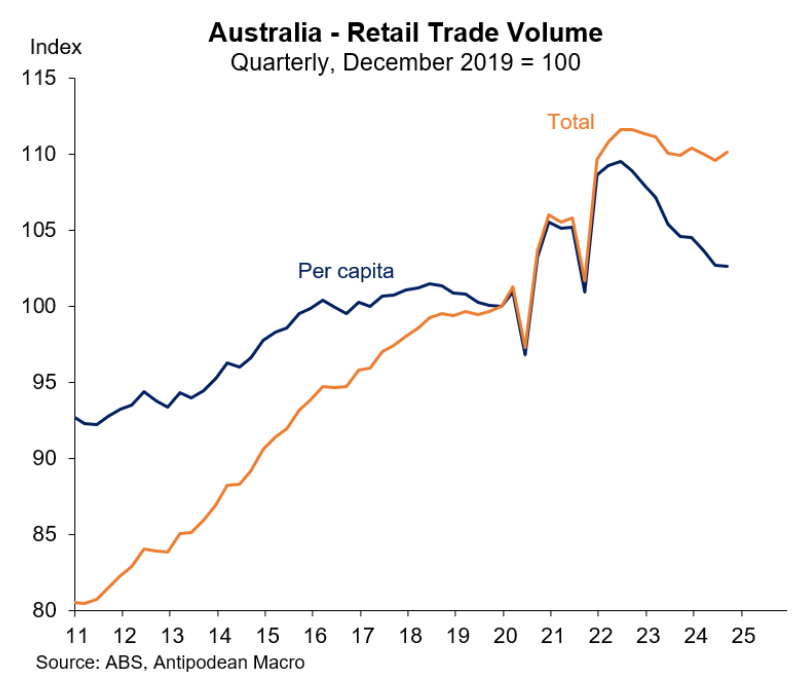

The following chart from Justin Fabo at Antipodean Macro plots retail trade volumes as a time series, which shows that per capita sales have fallen sharply.

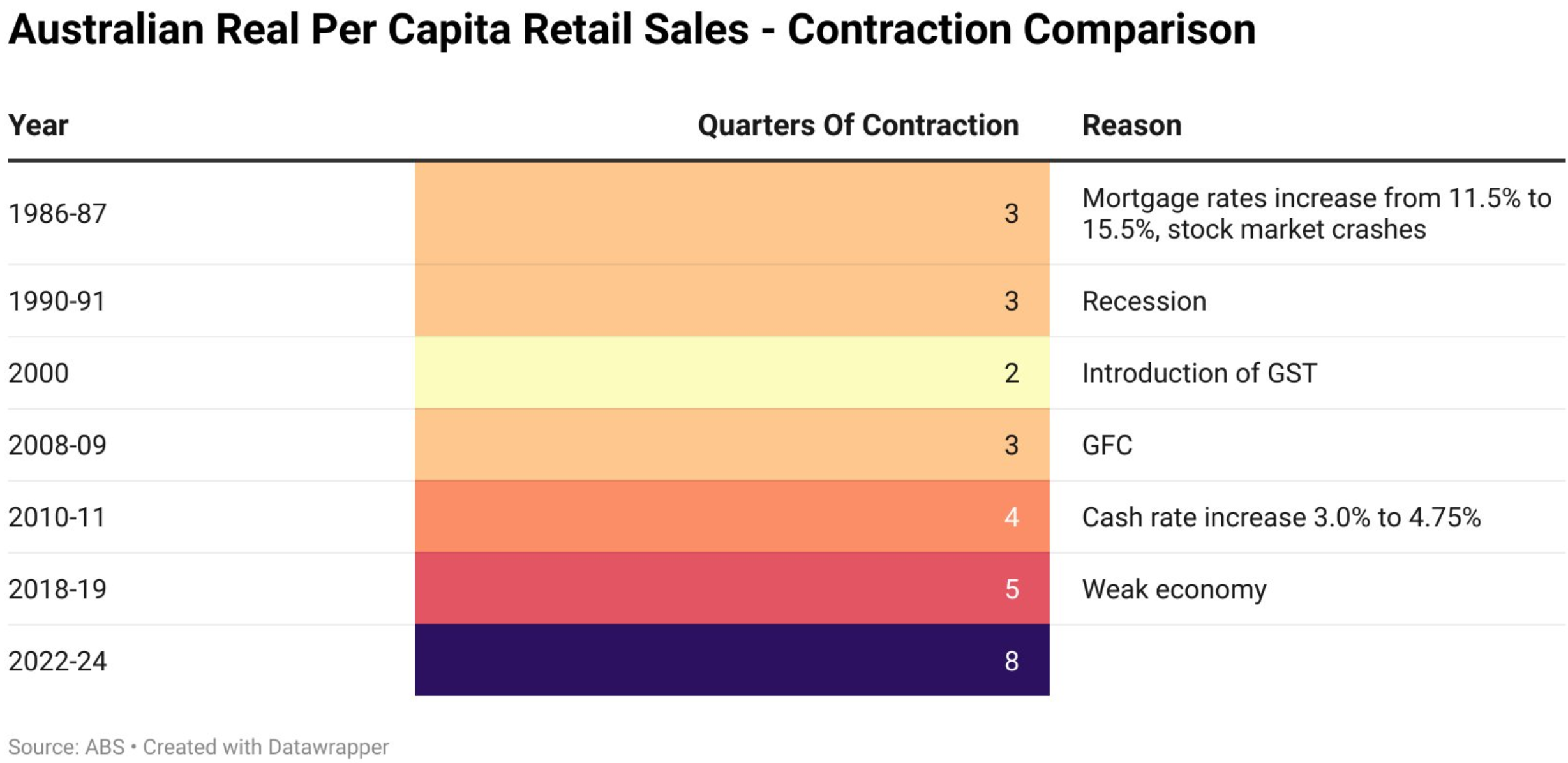

Independent economist Tarric Brooker noted on Twitter (X) that year-on-year per capita retail sales volumes have contracted for a record eight consecutive quarters.

“Prior to the GFC the record was three, which occurred amidst recessions, 15.5% rates and a stock market crash”, Brooker wrote. “On a per person basis, Aussies sacrificed enough to kill inflation”.

The impact is even worse for discretionary ‘brick-and-mortar’ retailers who have lost market share to online sellers like Amazon, Temu, and Shein.

Amazon entered the Australian market in December 2017 and has rapidly grown its footprint.

Amazon Prime provides competitive pricing and unparalleled convenience, with most orders delivered free to your door within 48 hours.

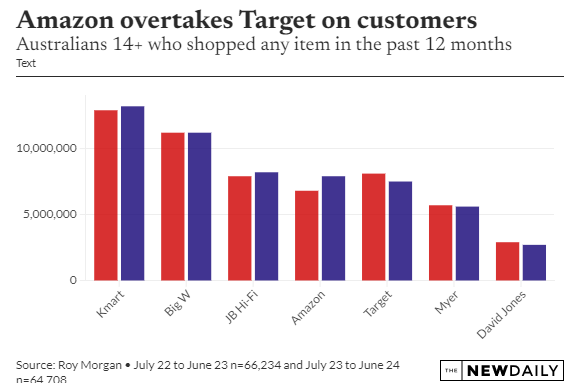

Roy Morgan estimates that Amazon’s client base increased by 16% last financial year, with 1.1 million more customers than in 2022–23.

Amazon stated that it intends to expand its operations and delivery network in Australia, which will increase competition for established Australian merchants.

Temu and Shein, two Chinese behemoths, are also rapidly increasing their market share in Australia, with an emphasis on the lower-end of the retail sector.

Roy Morgan estimated that 5.8 million Australians used either platform last year, with nearly 80% of them being repeat shoppers.

Online competition will only grow, increasing pressure on traditional retailers.

Roy Morgan consumer trends expert Laura Demasi predicts that Shein and Temu will increase their market shares over the Christmas period as more Australians seek bargains amid the cost-of-living crisis.

Roy Morgan expects Australians to spend close to $70 billion in the six-week lead-up to Christmas, and “a lot of that is going to be transacted through Shein and Temu”, Demasi said.

“The consensus was they’re going to take share away from Kmart and discount [stores]. That hasn’t happened”, she said. “They’re taking share away from everybody else”.

“Temu is disrupting because they’re going straight to factory, and so they’re cutting out some margin along the value chain. That’s where it’s becoming very cheap”, Craig Woolford, consumer and retail analyst at MST Marquee, added.

Thus, traditional brick-and-mortar stores will continue to lose market share.

Smaller specialist retailers are the most severely impacted. However, it is only a matter of time before larger retailers, such as department stores, are forced to streamline their operations in order to adapt to the changing economic climate.