Data from the Australian Bureau of Statistics showed that retail spending increased by just 0.1% nationwide in September, well below market expectations of 0.3% growth.

AMP economist My Bui notes that while population growth is a crucial driver of retail sales growth, spending per capita remains negative.

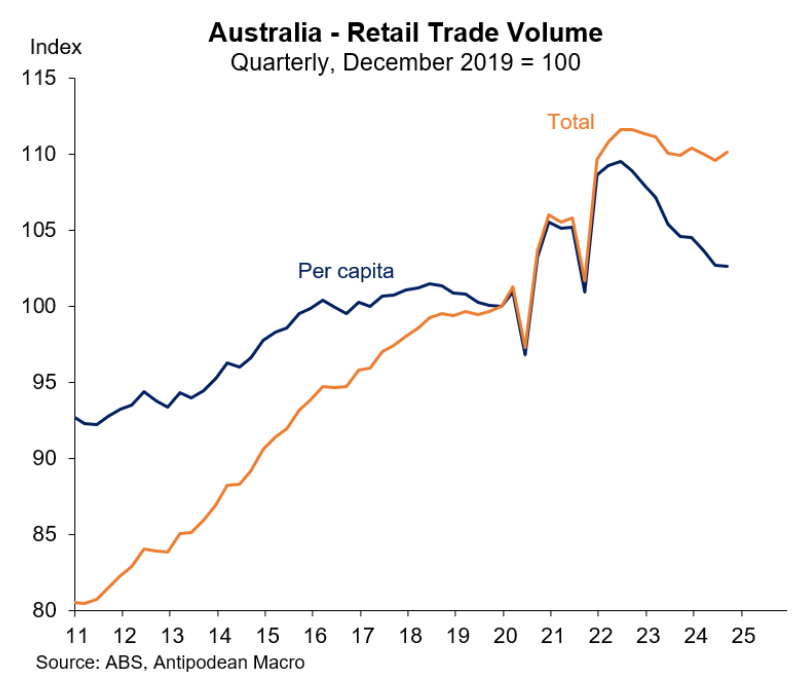

“This is the longest and deepest retail per-capita recession in the history of the series”, she said.

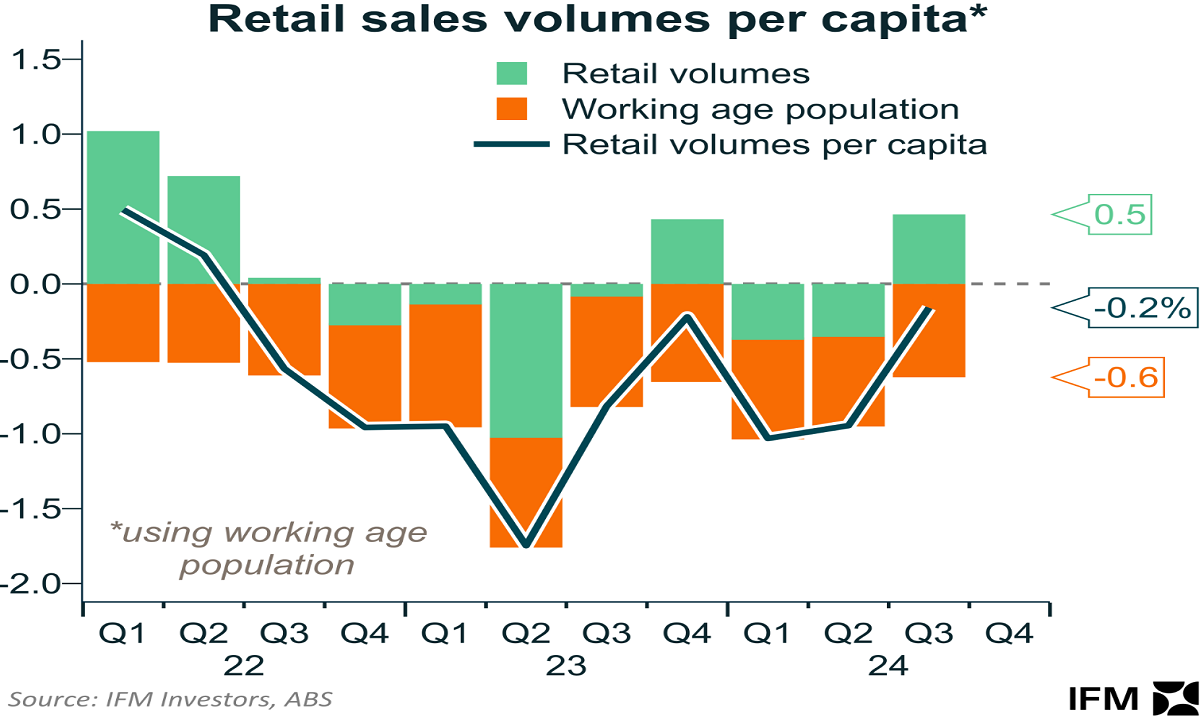

Indeed, Alex Joiner, chief economist at IFM Investors, published the following chart showing that retail sales have declined for nine consecutive quarters:

The following chart from Justin Fabo at Antipodean Macro shows the depth of the decline in real per capita retail sales.

Australian Retailers Association CEO Paul Zahra said 2024 has been one of the most challenging years for retailers, citing factors such as a continued slowdown in discretionary spending, high business costs, and supply chain disruptions.

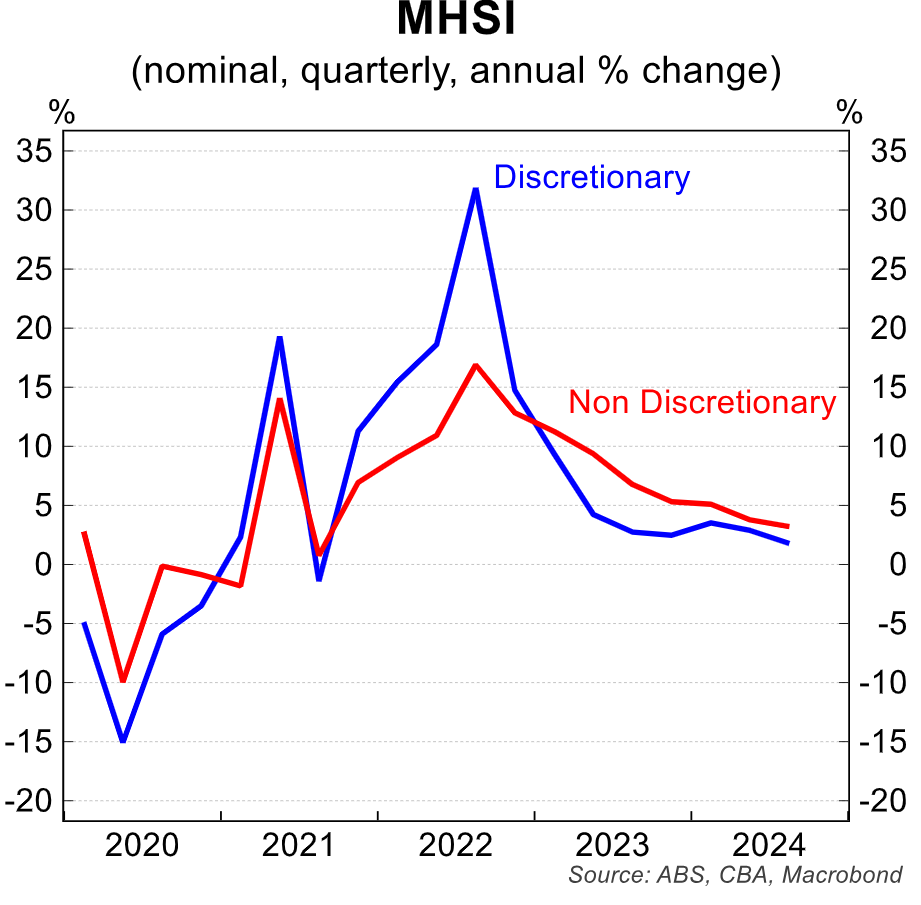

Indeed, the latest monthly household spending indicator (MHSI) revealed that discretionary spending continues to ease more quickly than non-discretionary spending.

Spending on discretionary items was just 1.8% higher in nominal terms through the year in Q3 24, well below both population growth (~2.3%) and CPI inflation (2.8%).

Zahra has, therefore, called on the Reserve Bank board to cut the official cash rate when it meets on Tuesday, arguing that this would give confidence to the retail sector in the lead-up to the peak Christmas season.

“We are calling on the Reserve Bank of Australia to provide a cash-rate cut when it meets next week. This decision would give confidence to the retail sector in the lead-up to the all-important peak Christmas season where many discretionary retailers make up to two-thirds of their profits”, Zahra said.

“Interest rates and cost-of-living pressures continue to impact Australians, which is resulting in slowed consumer spending in most categories”.

While the RBA is certain to ignore Zahra’s plea and keep the cash rate on hold, the weak retail sales and household spending data will alleviate the board’s concern that the stage-three personal income tax cuts would boost consumer spending and put upward pressure on inflation.

I discussed the stiff headwinds facing the Australian retail sector on Saturday’s Treasury of Common Sense with Luke Grant on Radio 2GB.