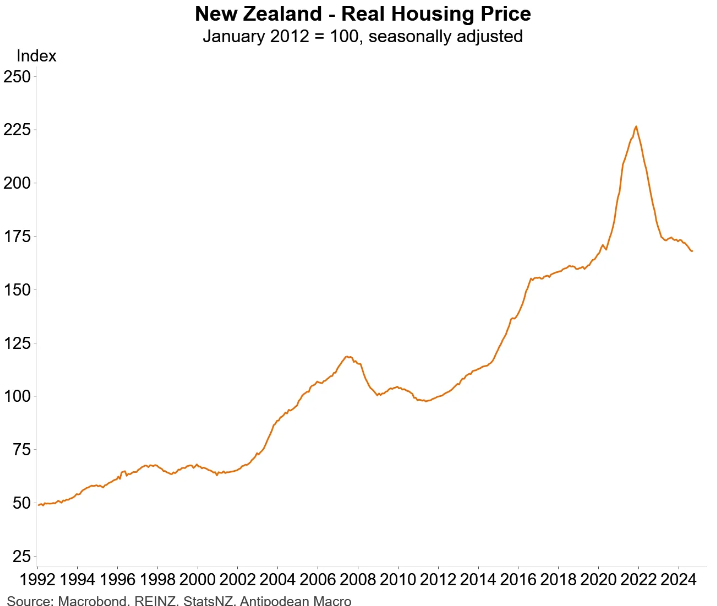

The Reserve Bank of New Zealand’s aggressive monetary policy, which lifted the official cash rate to a peak of 5.50%, successfully unwound the nation’s pandemic house price gains.

New Zealand experienced one of the world’s largest house price booms over the pandemic. However, in real inflation-adjusted terms, values have returned to their pre-pandemic level.

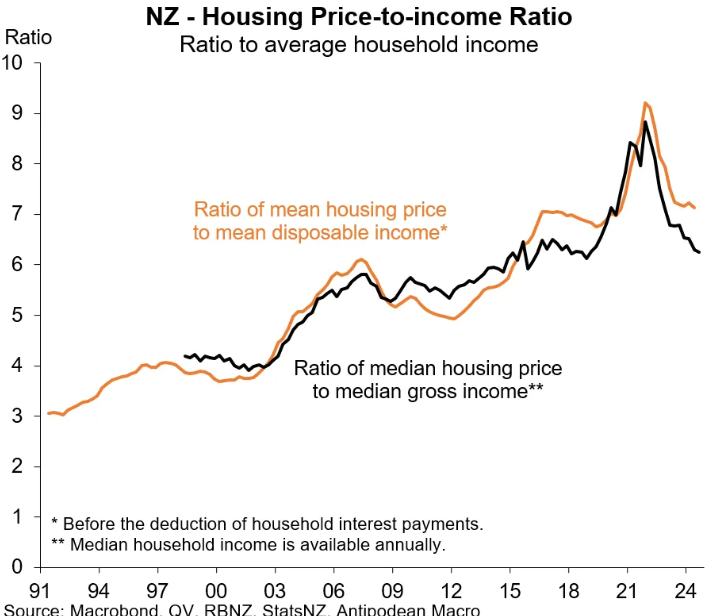

As illustrated by Justin Fabo at Antipodean Macro, New Zealand’s median house price-to-income ratio has fallen back to around 2018 levels.

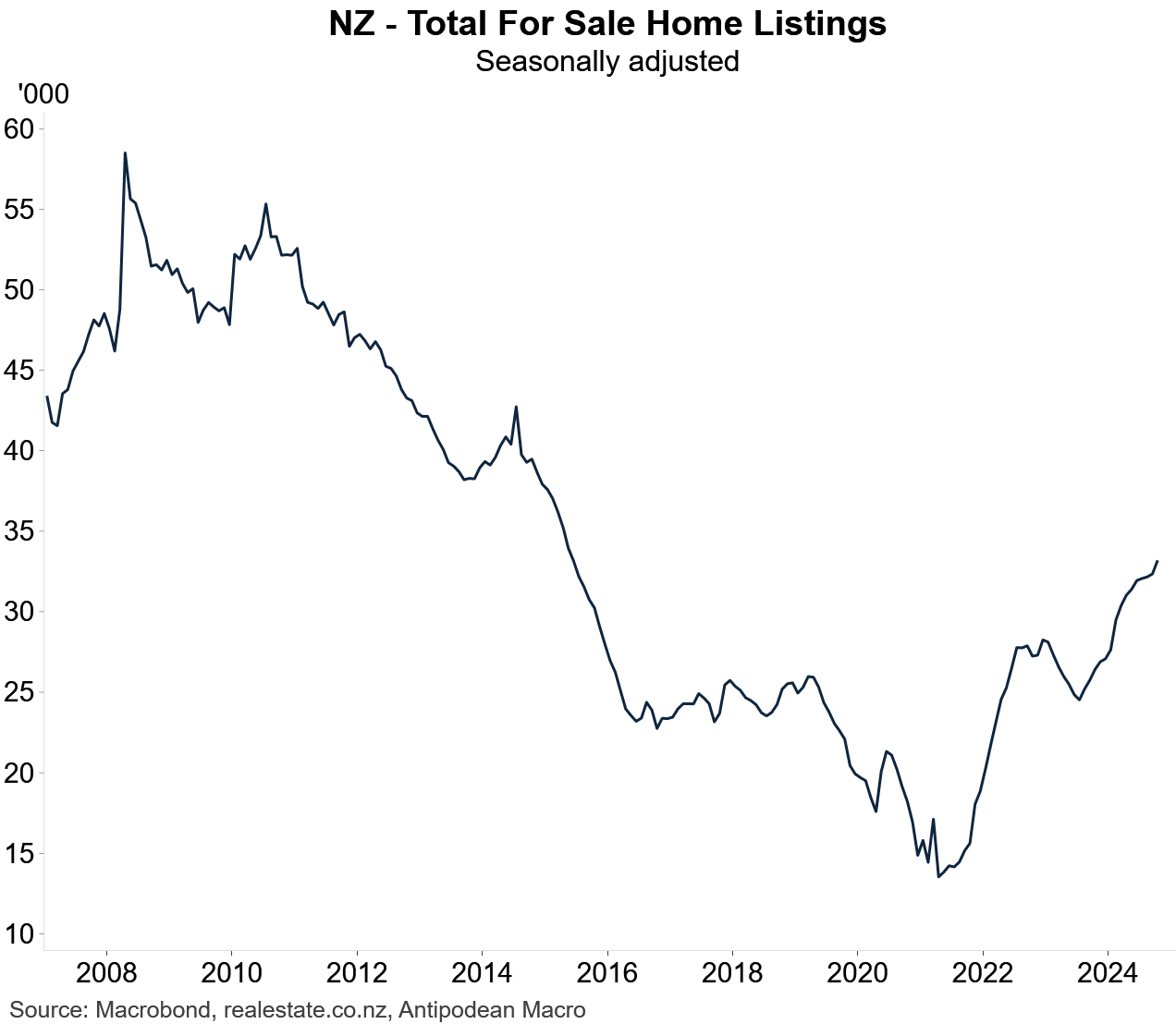

The immediate outlook for home prices remains bearish given the sharp rise in for-sale listings across New Zealand.

As illustrated below by Fabo, total for-sale listings are tracking at their highest level since 2015.

According to Interest.co.nz, “property sales website Realestate.co.nz received 11,572 new listings in October, up 21.4% compared to October last year”.

“That pushed the total stock of properties for sale on the website up to 32,339 at the end of October, the highest level it has been at that time of year since October 2014”.

“While higher stock levels are typical as the spring selling season ramps up, these levels reflect trends we haven’t seen since 2014 and 2015”, Realestate.co.nz’s latest monthly report said.

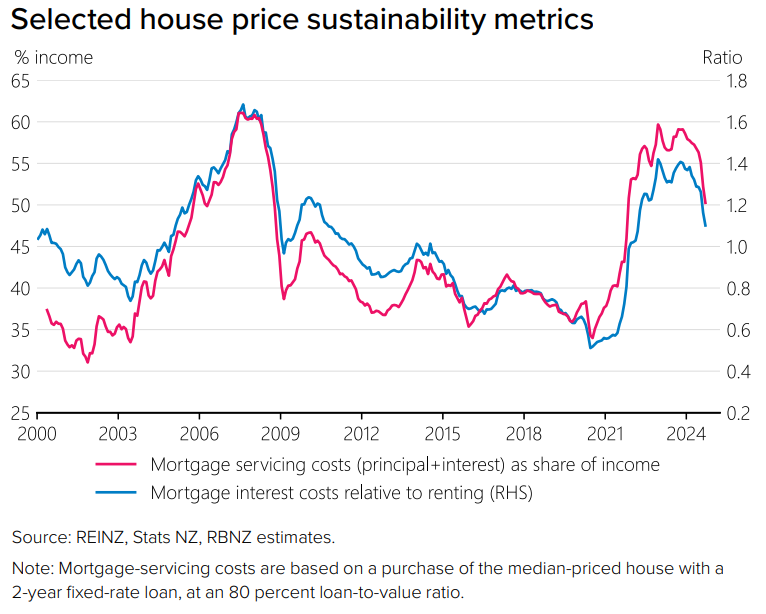

Despite the sharp decline in real house prices back to pre-pandemic levels, the Reserve Bank’s Update on the Housing Market noted that purchasing a new home “remains relatively unfavourable compared with long-term averages”.

“House prices remain stretched for prospective buyers, and are around the top of our estimate of sustainable levels”, the Reserve Bank notes.

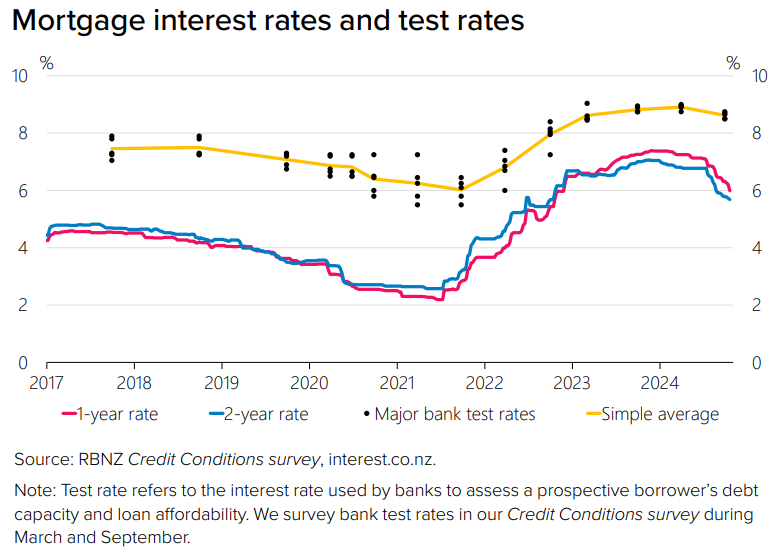

“Despite house prices easing, the elevated interest rates mean that purchasing a new house remains relatively unfavourable compared with long-term averages”.

“To assess the sustainability of house prices, we consider the mortgage servicing costs for a new buyer, both relative to average household incomes, and relative to the alternative option (renting)”.

“These two indicators rose rapidly as house prices were peaking in late 2021, and they have remained at historically high levels”.

“Overall, our metrics for house price sustainability suggest that current levels are around the top of the indicator range. This assessment is based on interest rates returning to neutral levels”, the Reserve Bank states.

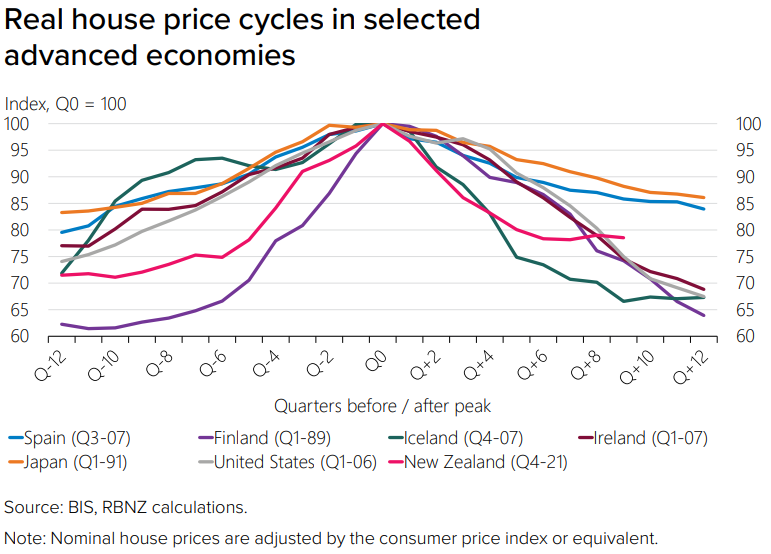

The Reserve Bank also notes that the country’s recent house price cycle “has been rapid compared to overseas examples”:

“Over the past five years New Zealand house prices have risen in real terms more rapidly, and declined more rapidly, than in many house price booms and busts in other advanced economies”, the Reserve Bank notes.

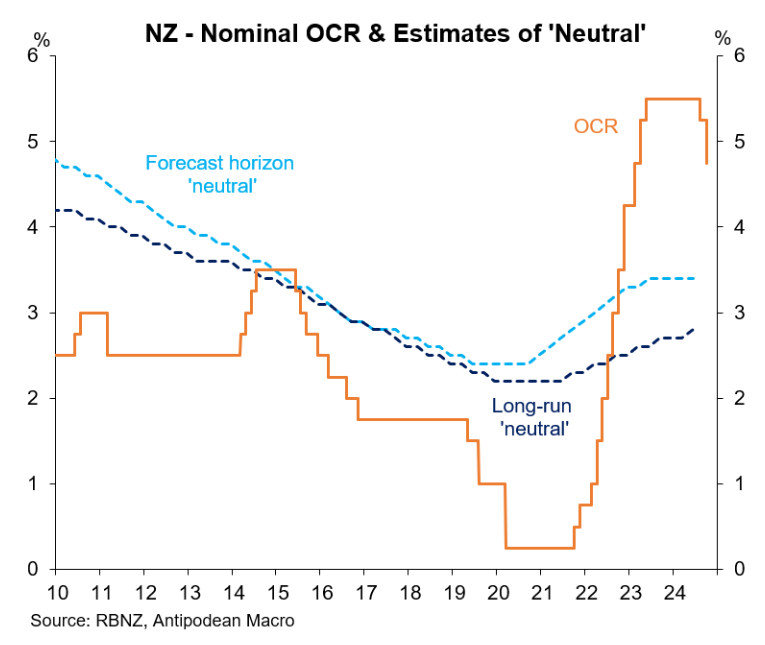

The Reserve Bank is currently in the midst of an easing cycle and has already reduced the official cash rate by 0.75%. However, monetary policy remains restrictive, with significant further rate cuts expected in the coming year.

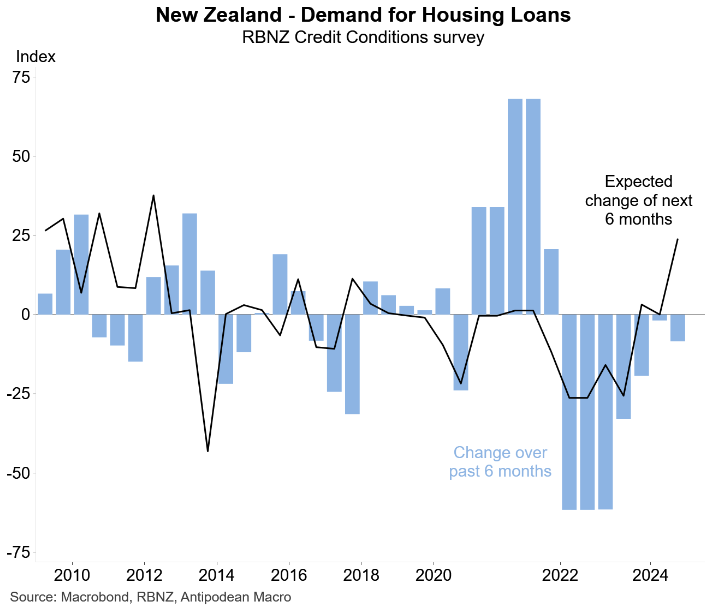

The lowering of interest rates will obviously spur mortgage demand and house price growth.

Indeed, the Reserve Bank’s Survey of Credit Conditions, released last month, suggested that mortgage demand will surge over the next 6 months:

In other words, the housing market looks set to rebound as the Reserve Bank cuts interest rates back to neutral levels.