Independent economist Tony Alexander has written a detailed report on the New Zealand economy, which is experiencing a historic recession.

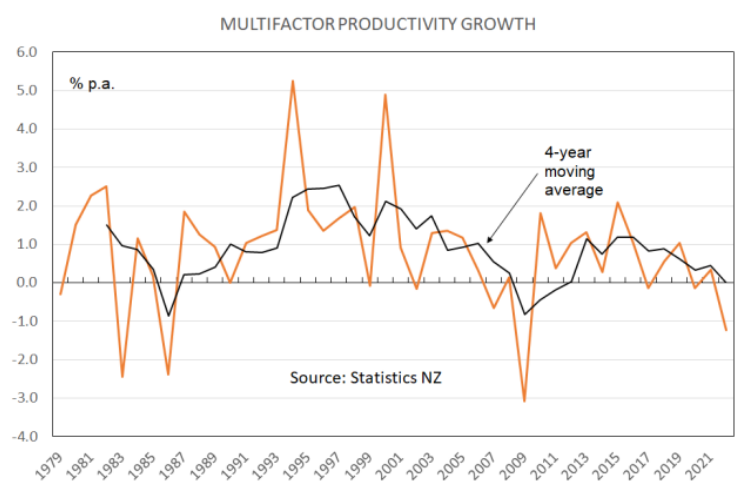

Alexander argues that the Reserve Bank’s interest rate cuts cannot offset New Zealand’s structurally poor economy and embedded low productivity growth. As a result, the recovery from the recession will inevitably be long and lacklustre.

“The speed of recovery in our economy will be muted and talk of a ‘rockstar’ economy is ridiculous”, Alexander argues.

“Slower growth, higher inflation. This is what you get in an economy bereft of productivity growth – early onset inflation when growth returns and higher average inflation for any given economic growth rate than with good productivity growth”.

Alexander argues that the New Zealand economy lacks diversification and sophistication, and is too reliant on China.

“We are not a rock star economy and at best may be folk singing. As an electorate we have voted against changes aimed at radically altering the fundamental nature of our economy since 1992”, he says.

“As a business sector we have failed to develop the many new large exporters which NZTE long hoped for with their efforts from many years ago”.

“Then it gets worse. 27% of our export receipts come from China but the outlook for China’s economy is not good. Incoming US President is set on further undermining China’s economic strength”.

“We have benefitted greatly from the Chinese economy over the past one to two decades. But we have now moved past peak China”, Alexander argues.

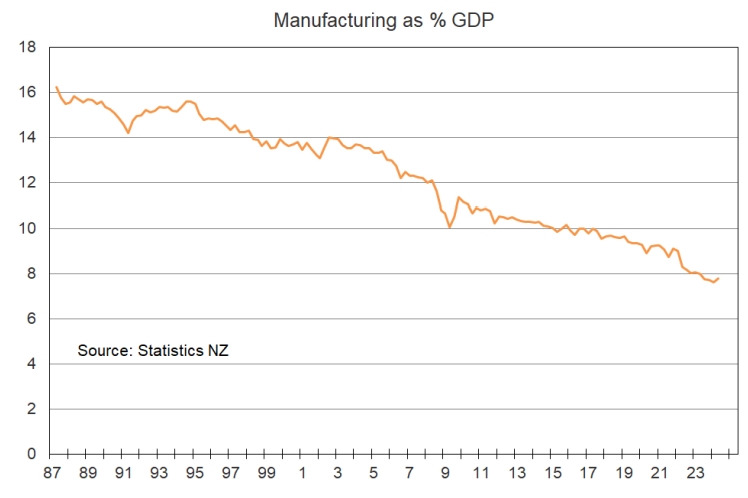

Much like in Australia, New Zealand’s manufacturing sector is in long-term structural decline and continues to worsen.

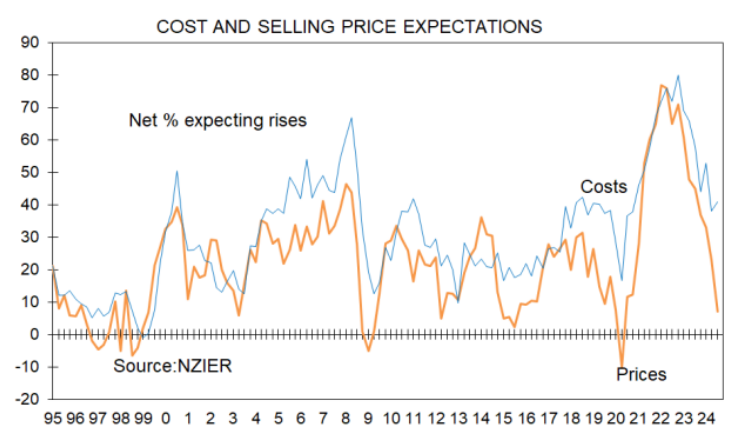

New Zealand businesses remain under pressure, with costs remaining stubbornly high while selling prices are rapidly moderating.

Only a net 7% of businesses surveyed by the NZIER’s Quarterly Survey of Business Opinion said they will raise prices over the next three months. “This is below the three-decade average of 21% and down from 45% a year ago”, notes Alexander.

“But a net 41% of businesses say that their costs are expected to rise in the next three months. This is above the 29% three-decade average and only down from 58% a year ago”.

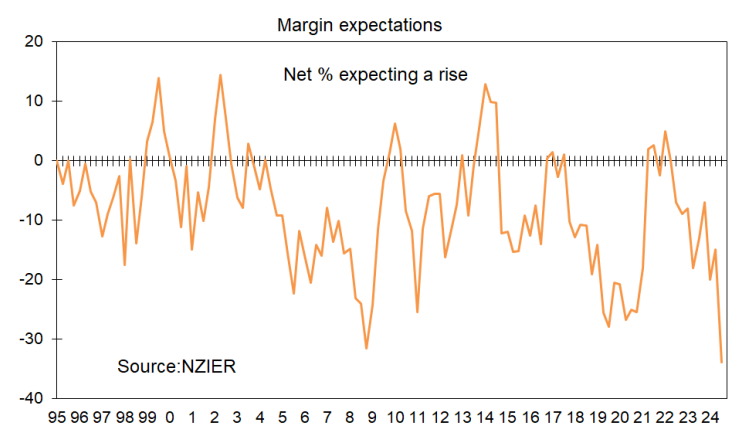

As a result, margin expectations are at their worst level since 1976.

“Many businesses have yet to be weeded out from our economy across all sectors, and as they close or amalgamate, the pace of our growth will be constrained”, argues Alexander.

Nevertheless, despite Alexander’s “caution not to expect a boom in our economy anytime soon”, he notes signs of a cyclical “recovery in NZ activity from low levels”.

Specifically, debit and credit card spending has rebounded modestly, residential real estate activity is firming, and an above-average net proportion of businesses plan to boost their capital spending and hiring in the next 12 months.

“That is, the foot is coming off the brake, but it is not going to be placed on the accelerator. This will limit not just the speed of upturn in our economy (in order to keep inflation in check) but also the extent and speed of price gains for the upward leg of the house price cycle”, Alexander argued.

Similar will be written about Australia when the RBA commences its monetary easing cycle next year.