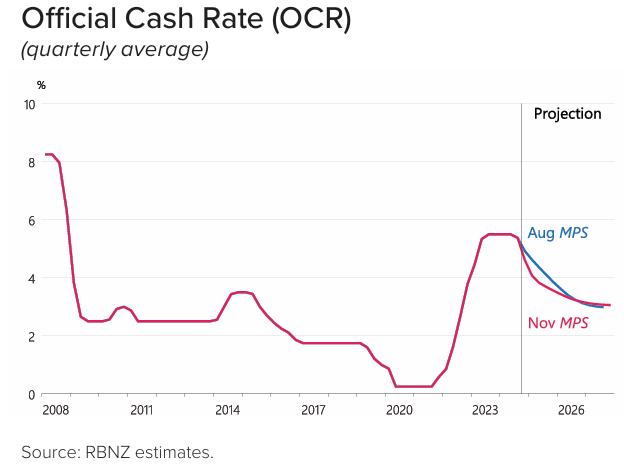

The Reserve Bank of New Zealand has cut the official cash rate by 0.5% at today’s monetary policy meeting.

It was the Reserve Bank’s third consecutive rate cut, bringing the official cash rate to 4.25%, down from a peak of 5.50%.

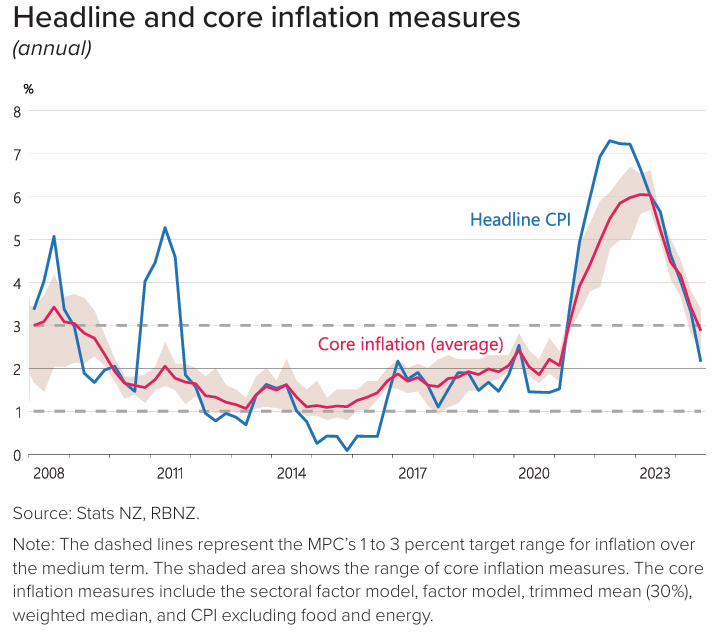

The Monetary Policy Statement (MPS) noted that “annual consumer price inflation has declined and is now close to the midpoint of the Monetary Policy Committee’s 1% to 3% target band”.

“Inflation expectations are also close to target and core inflation is converging to the midpoint. If economic conditions continue to evolve as projected, the Committee expects to be able to lower the OCR further early next year”.

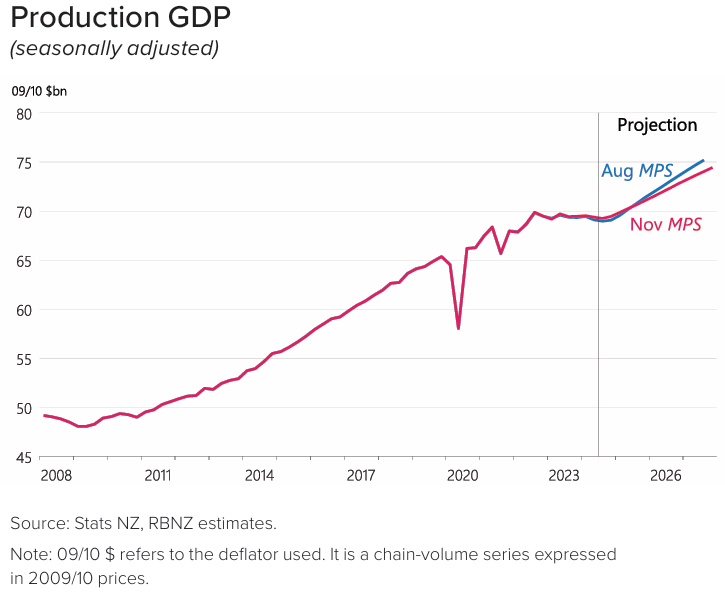

“Economic activity in New Zealand, measured by production GDP, declined by 0.2% in the June 2024 quarter”.

“Indicators suggest that economic activity declined further in the September 2024 quarter”.

“Economic growth is assumed to resume from the December 2024 quarter and increase over 2025, as lower interest rates support demand”, the MPS said.

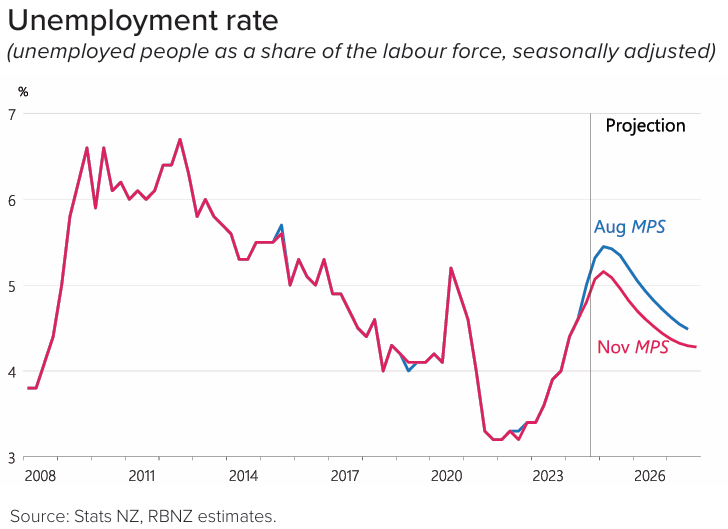

Meanwhile, “a wide range of measures of labour market pressure have eased substantially over the past year”.

The MPS also noted that the “outlook for the OCR over the medium term is similar to the August Statement”.

“Inflationary pressures are assumed to decline over the medium term, as a result of spare capacity in the economy and wage- and price-setters adapting to a low inflation environment”, the MPS says.