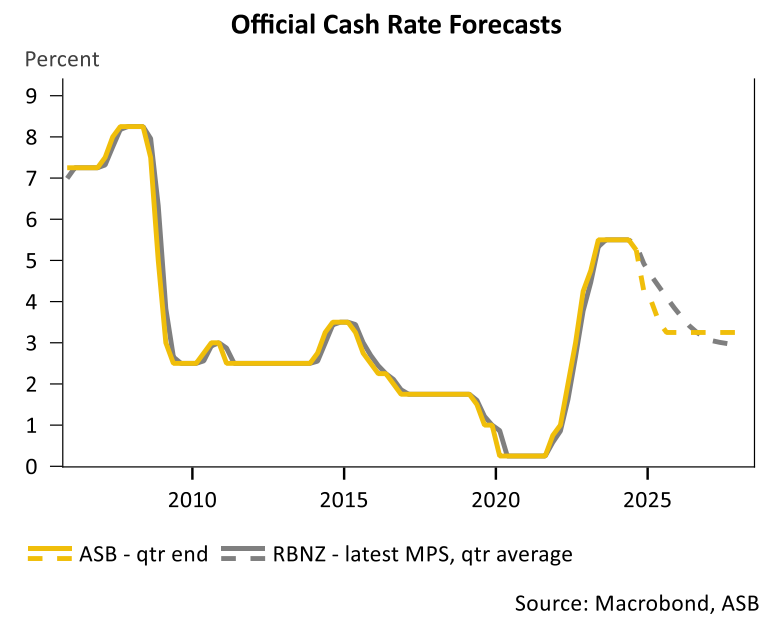

The Reserve Bank of New Zealand is expected to cut the official cash rate by 0.5% this week to 4.25%.

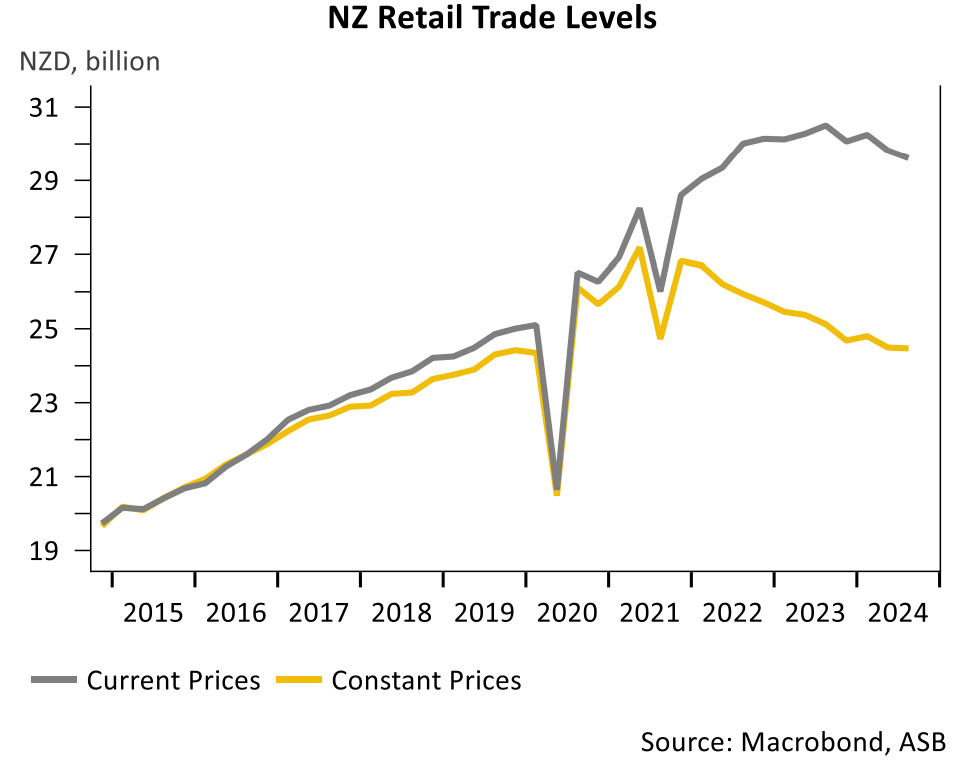

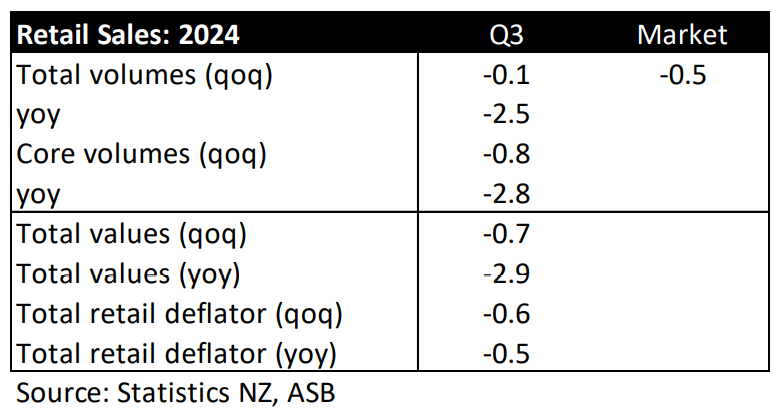

Retail sales data released by Statistics NZ on Monday highlighted why rates need to come down, with real retail volumes falling 0.1% in Q3 to be down 2.8% annually.

Core sales volumes declined by a steeper 0.8% in Q3 and by 2.9% annually.

In value terms, retail sales declined by 0.7% in Q3 to be 2.9% lower annually.

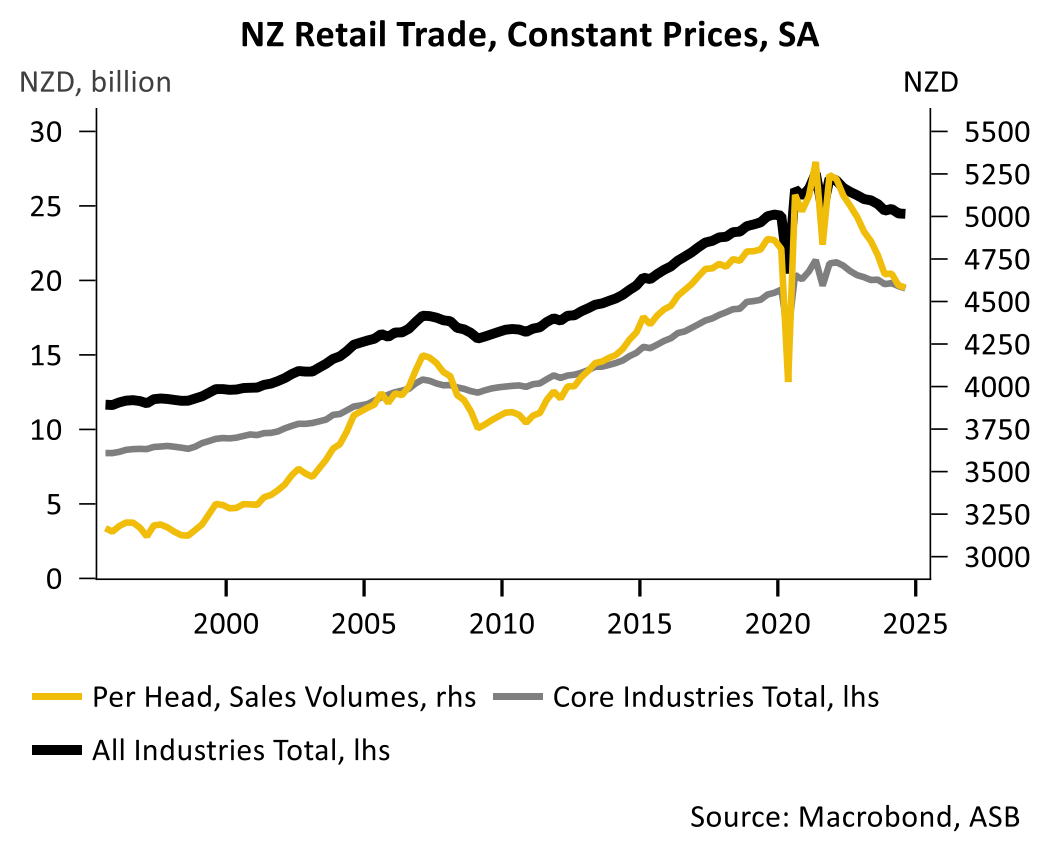

Per-capita sales values have fallen an extraordinary 13.9% from their mid-2021 peak. In volume terms, per capita retail sales fell a further 0.3% in Q3 and were tracking at their lowest level in 8 years (excluding the pandemic).

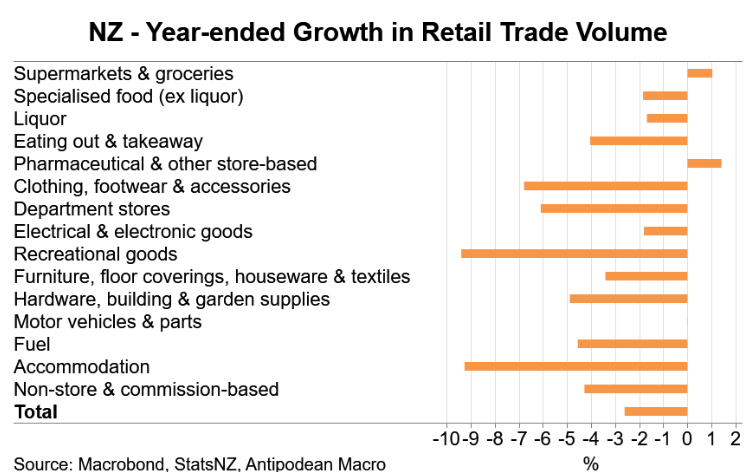

The following chart from Justin Fabo at Antipodean Macro shows that almost every category other than essentials like groceries and medicines recorded falling sales.

As shown in the first table above, the retail sales deflator fell over the quarter and on an annual basis.

“This development should provide the Reserve Bank with more confidence that inflation has been well contained”, major bank ASB noted.

In its commentary on the results, ASB tipped another poor quarter for sales, followed by a tepid recovery next year:

The prospects for the retail sector have not changed significantly over the past quarter. In fact, there have been no material changes in the headwinds facing the sector. The latest data still show inbound tourism levelling off, while net migration inflows continue to ease, with the risk of negative inflows becoming more of the norm for 2025.

Meanwhile, the key challenge facing household spending is the further weakening of the labour market in the short term. The unemployment rate hit 4.8% in Q3 and is projected to reach 5.5% by mid-2025, alongside slowing wage growth.

However, there are also some offsetting factors, including income tax relief, further cooling of inflation, and – of course – the ongoing reduction of interest rates…

Taking all these factors into consideration, we anticipate another patchy Q4 for the retail sector, before looking ahead to a more pronounced recovery over 2025.

As a result, ASB tips four consecutive 0.25% rate cuts in 2025 to a trough of 3.25%.