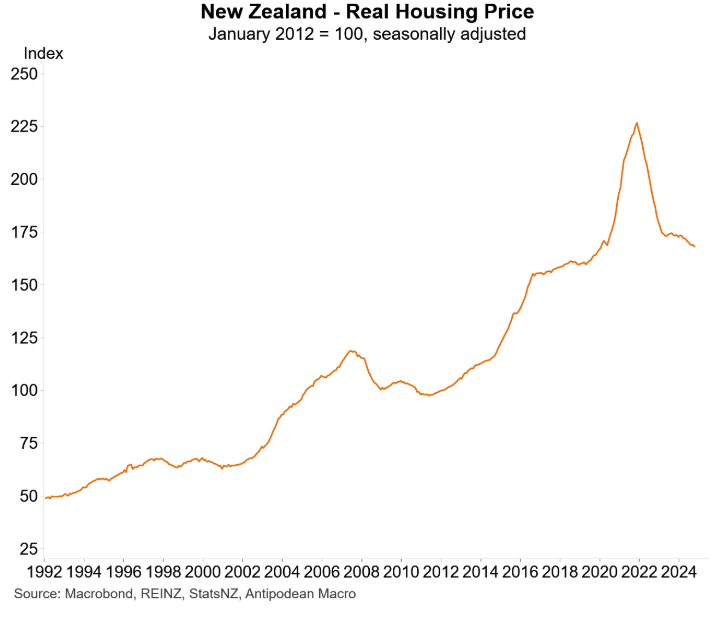

The Reserve Bank of New Zealand’s aggressive monetary policy, which raised the official cash rate to a high of 5.50%, continues to deflate the nation’s housing bubble.

Over the pandemic period, New Zealand experienced one of the largest increases in home prices in the world. However, the Reserve Bank’s aggressive monetary tightening, which began in late 2021, has successfully unwound these gains.

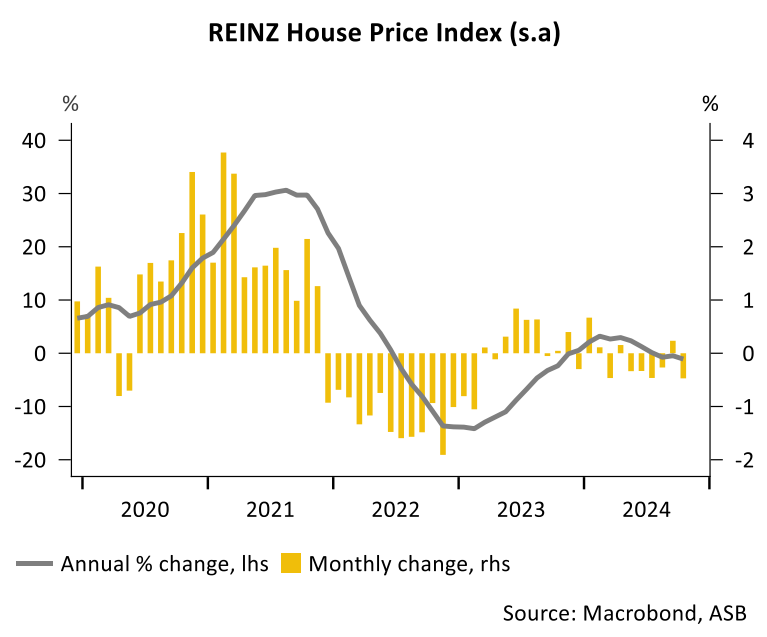

The Real Estate Institute of New Zealand’s (REINZ) House Price Index (HPI) is considered the nation’s leading measure of home values, since it adjusts for changes in composition.

The REINZ HPI fell by 0.5% in October to be down 1.1% annually.

As illustrated below by Justin Fabo at Antipodean Macro, real inflation-adjusted home values have returned to their pre-pandemic level.

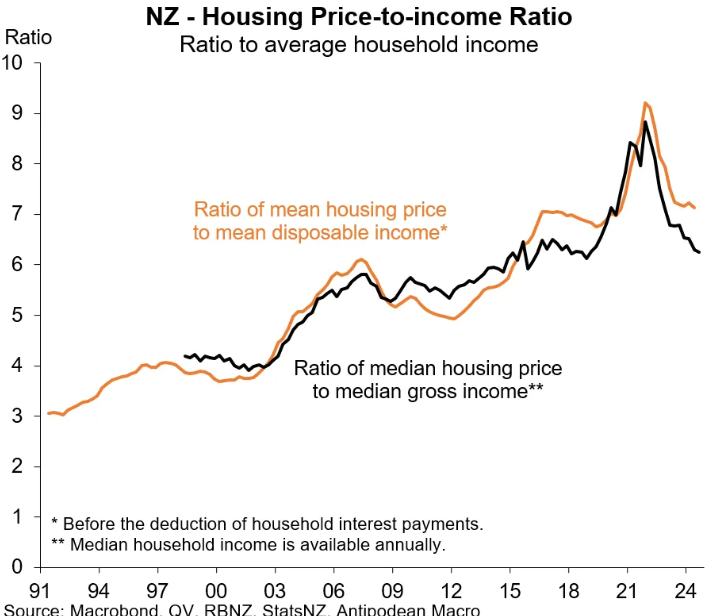

New Zealand’s median house price-to-income ratio has also fallen back to around 2018 levels.

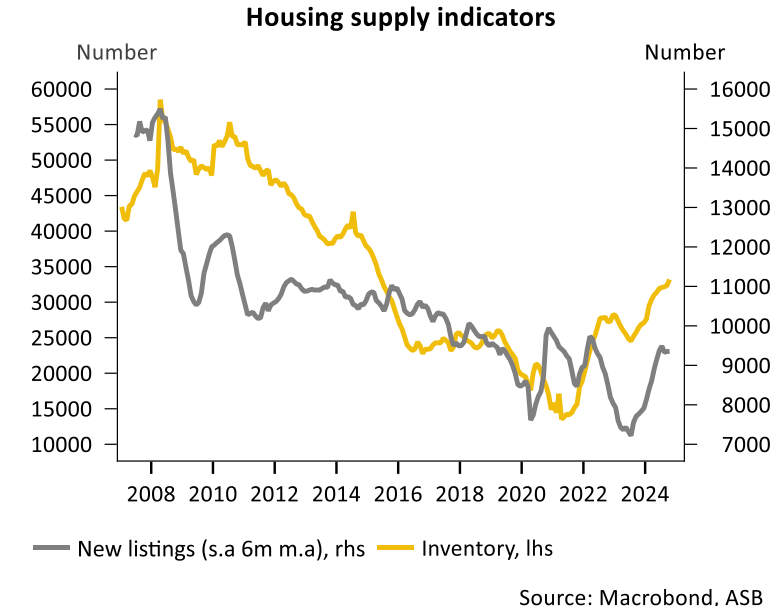

Meanwhile, elevated listings continue to weigh on prices.

New listings have continued to rise each month, increasing housing inventory levels to a decade-high. As illustrated in the following chart from ASB, the current housing stock exceeds 32,000 units, which is roughly 20,000 more than the trough at the height of the boom in 2021.

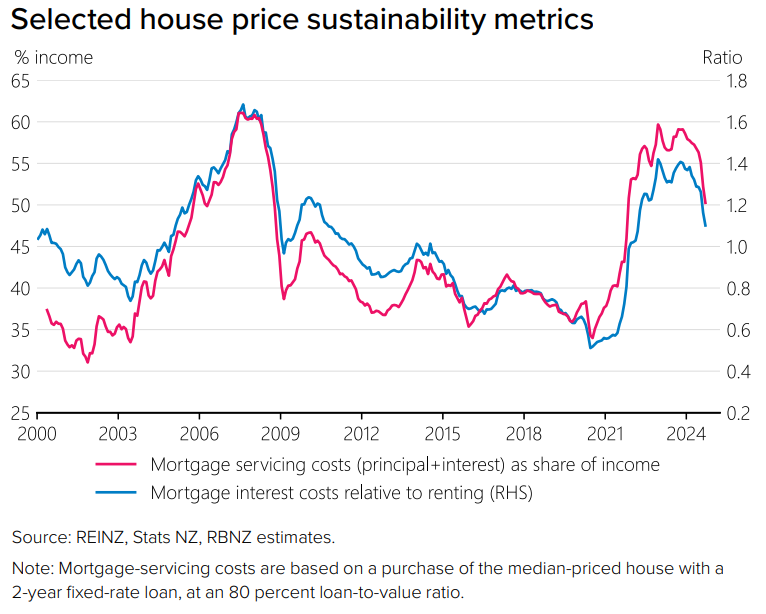

Despite the sharp decline in real home values back to pre-pandemic levels, the Reserve Bank’s Update on the Housing Market stated that purchasing a new home “remains relatively unfavourable compared with long-term averages”.

“House prices remain stretched for prospective buyers, and are around the top of our estimate of sustainable levels”, the Reserve Bank noted.

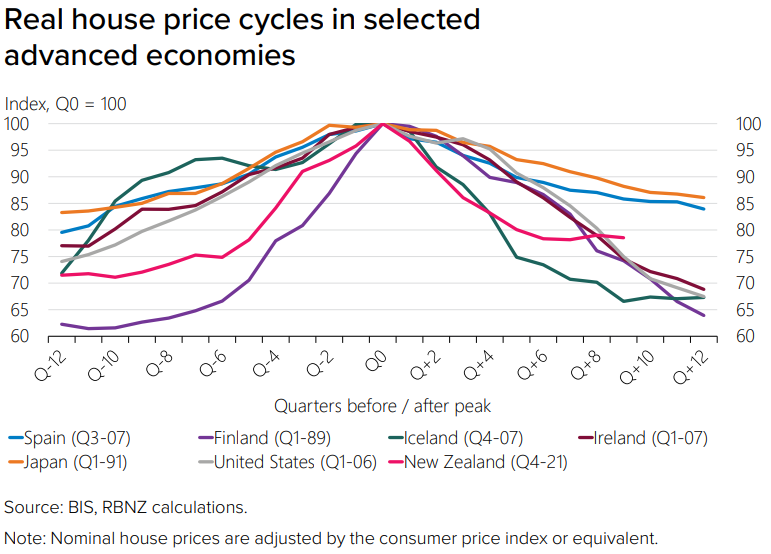

The Reserve Bank also noted that New Zealand’s home values both rose and fell more rapidly compared to other advanced economies.

“Over the past five years New Zealand house prices have risen in real terms more rapidly, and declined more rapidly, than in many house price booms and busts in other advanced economies”, the Reserve Bank said.

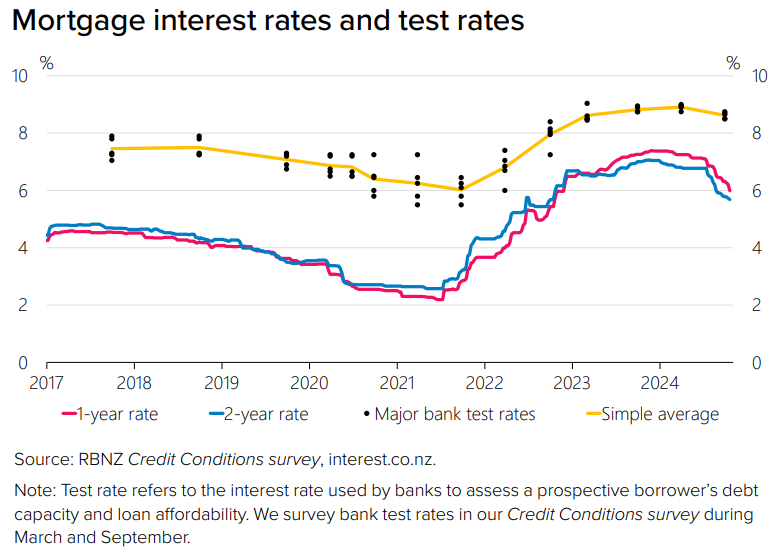

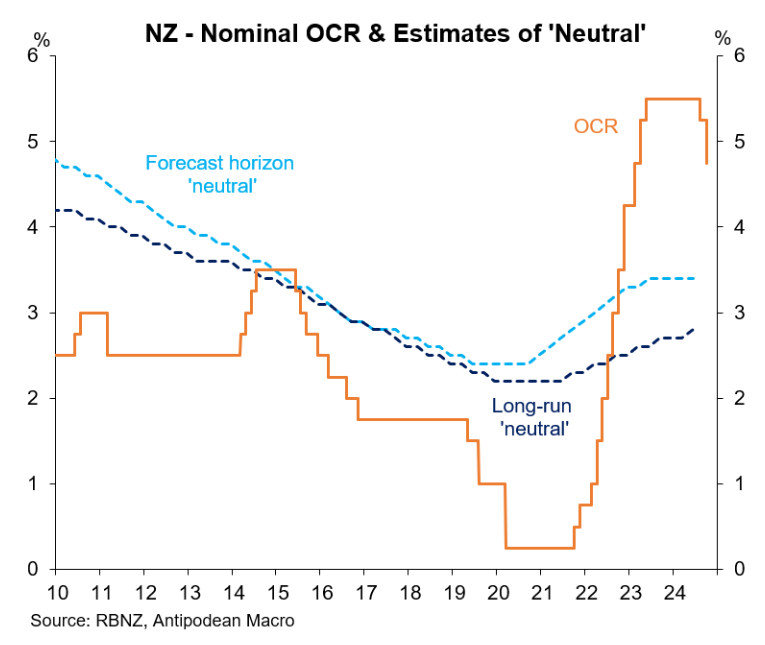

The Reserve Bank has only recently begun an easing cycle, lowering the official cash rate by 0.75%. However, monetary policy settings remain restrictive, with more rate cuts expected over the coming year.

Major bank ASB expects the Reserve Bank to deliver another 50bp cut in November, which will continue to support the housing market over the rest of 2024 and into early 2025.

Given the weak economy and cooling inflation, ASB also expects further easing in monetary policy in 2025, with the official cash rate to reach a 3.25% endpoint, which is around the forecast horizon neutral setting.

Further falls in mortgage rates, following the official cash rate cuts, are expected to bolster the housing market, despite several ongoing headwinds.

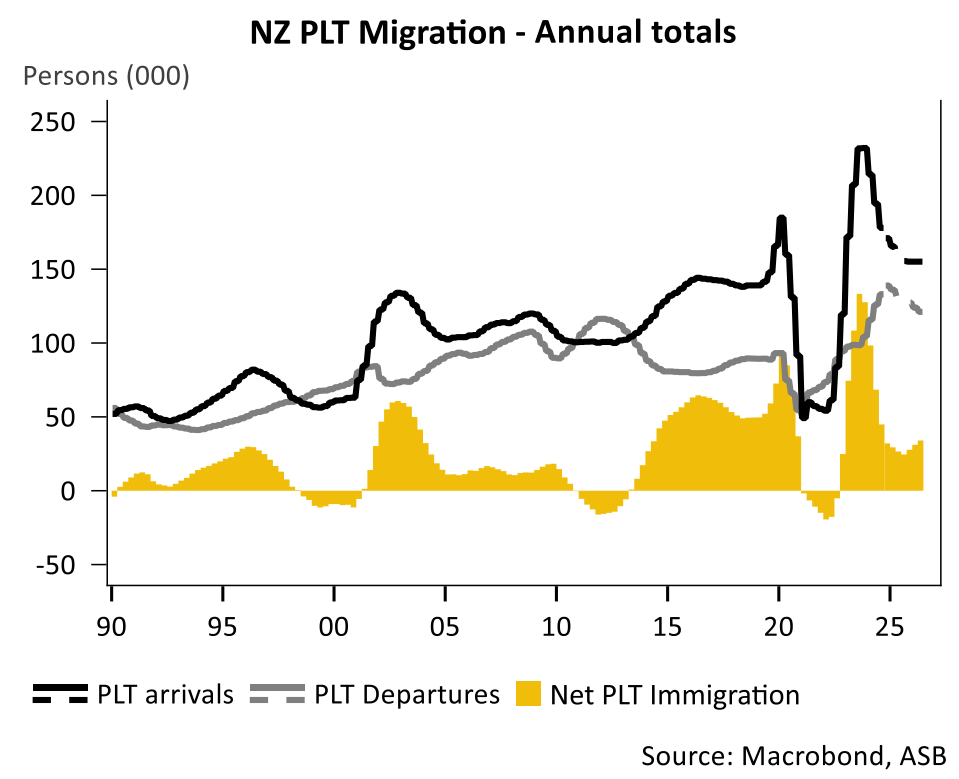

The largest of these is the sharp slowdown in New Zealand net migration, which has been driven by citizen departures to other countries including Australia.

“Taking all these factors into account, we anticipate that the housing market recovery will become more pronounced in the latter half of 2025”, ASB notes.

“By then, sales activity should strengthen sufficiently to counterbalance the high levels of housing stock on the market, which is crucial for the short-term trajectory of house prices”.