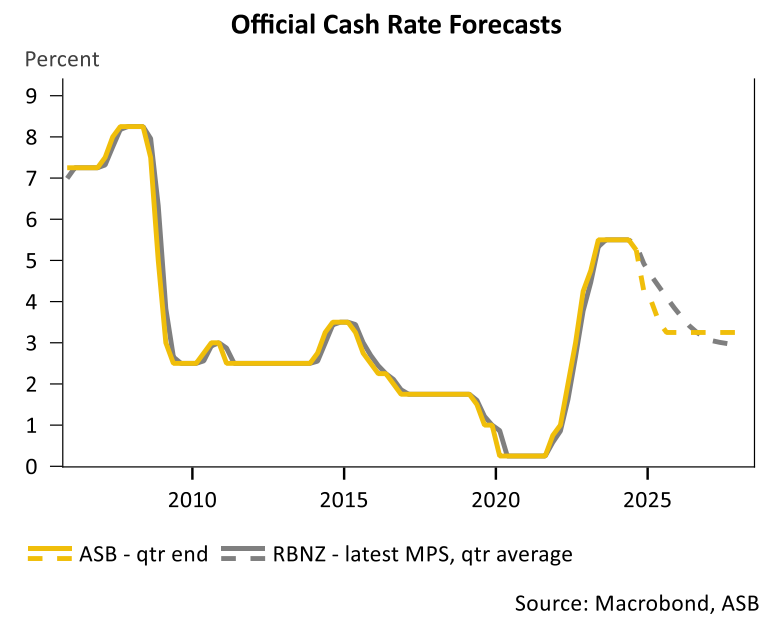

The Reserve Bank of New Zealand is expected to cut the official cash rate by 50 basis points this week, following 75 basis point reductions over the past two monetary policy meetings.

This would bring the official cash rate down to 4.25%, closer to neutral levels of between 3% and 4%, ahead of the long summer break.

Major bank ASB claims “the case for another sizeable cut remains almost as strong as it was in October and is the least-regrets path at present”.

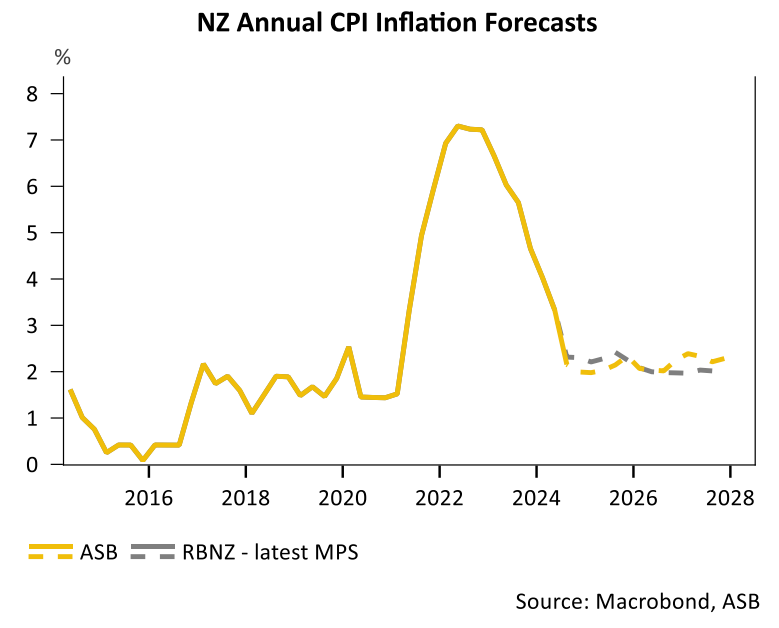

“With inflation back around the target mid-point and spare capacity starting to build up, the amount of monetary restraint needs to be quickly pared back. A 50bp cut would achieve that”.

“The OCR would still be comfortably above most estimates of the goldilocks ‘neutral’ interest rate, should signals over the next few months suggest inflation has gone back to being stubborn again”, ABS says.

As of Monday morning, financial markets were pricing 96 basis points of cuts combined over the November and February meetings, implying another likely 50 basis point cut in February.

ASB’s base case for February remains a 25 basis point cut, followed by three more similar cuts at consecutive meetings.

“With the process of monetary policy normalisation largely complete, we expect a higher hurdle to OCR moves over 2025. The speed of future cuts is likely to slow back down over 2025”, the bank noted in its preview.

“Our base case remains that the Reserve Bank will cut the OCR by 25bp at the first four meetings in 2025 and stop at 3.25%”.

ASB also expects the Reserve Bank to indicate that the pace of future cuts will be dependent on upcoming data and events and that the pace of cuts is likely to slow.

ASB’s forecast endpoint for the official case rate is little changed from the 3% signalled in the Reserve Bank’s past two Monetary Policy Statements.

“However, it will be the evolution of the economy and inflation pressures relative to the Reserve Bank’s current expectations that dictates the pace, and we see risks in both directions”, ASB said.