When central banks tighten interest rates, there is always the risk that they may keep them too high for too long, throwing the economy into recession.

Furthermore, it is only after looking in the rear-view mirror that they realise they have gone too far.

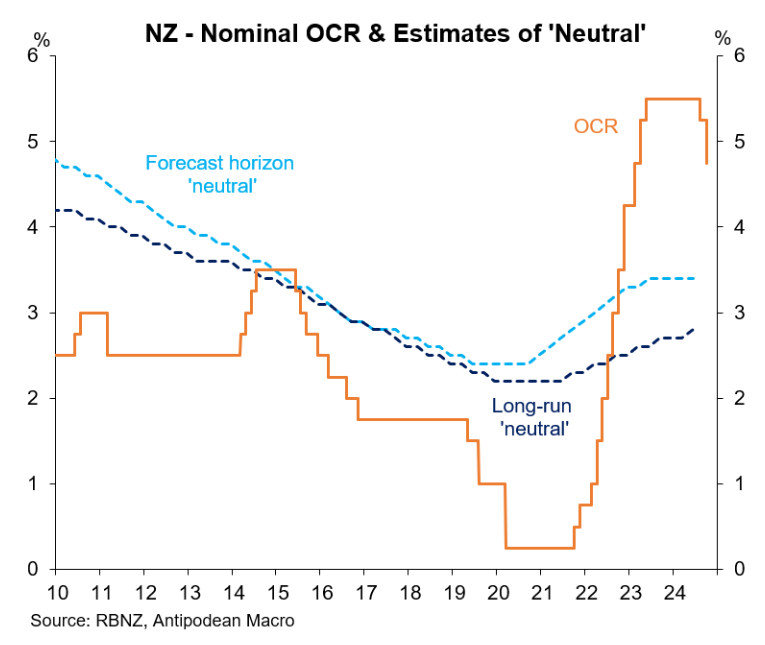

The Reserve Bank of New Zealand is likely experiencing such regret after delivering one of the world’s most extreme monetary tightening cycles, which saw the official cash rate peak at 5.50%.

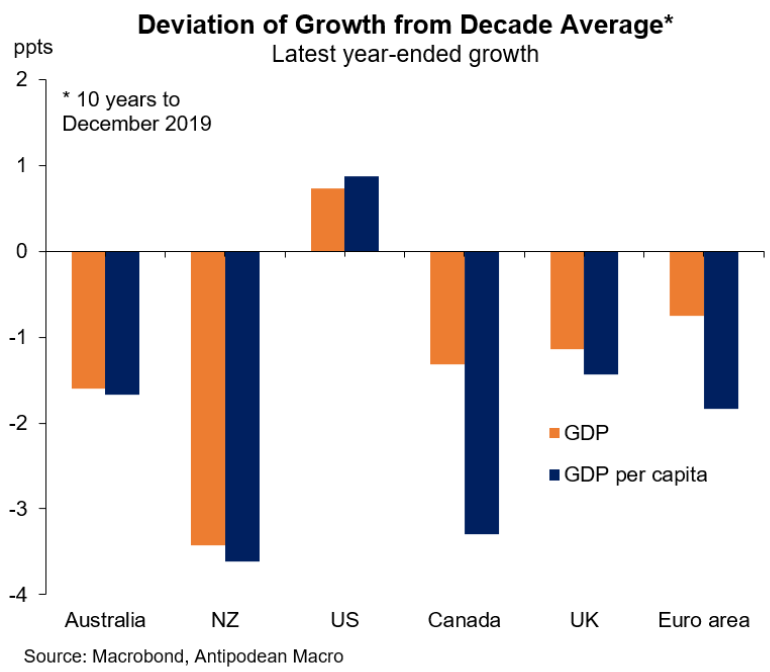

This monetary tightening triggered one of the most significant recessions in the developed world and New Zealand’s modern history, with per capita GDP decreasing by around 4% from its peak as of Q2 2024.

The Reserve Bank is now reversing track, delivering two consecutive rate cuts worth a combined 0.75%. However, New Zealand’s monetary policy remains highly restrictive, requiring deeper rate cuts.

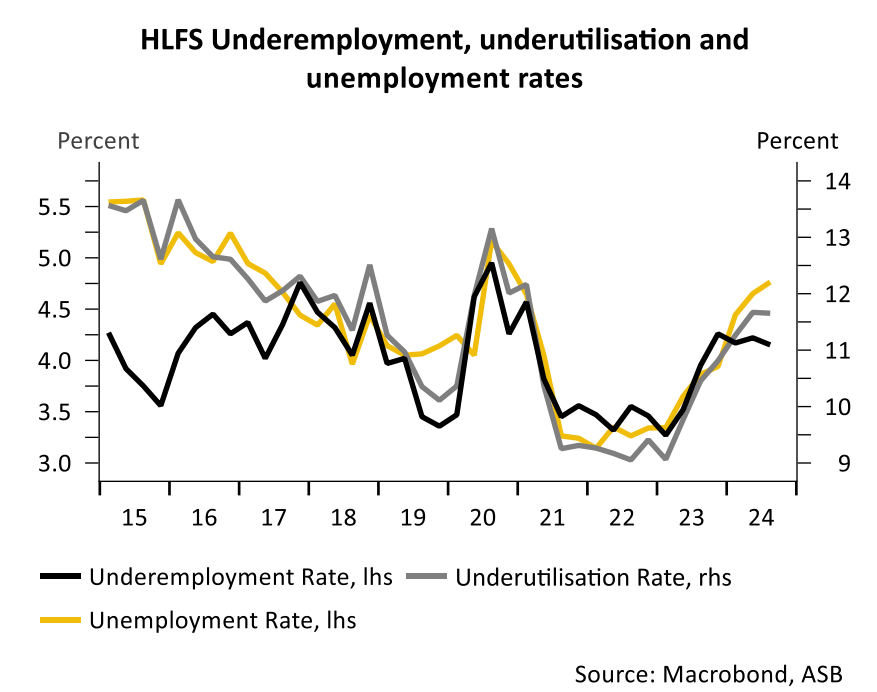

This week’s Q3 labour force release from Statistics New Zealand revealed the impact of the Reserve Bank’s aggressive monetary tightening.

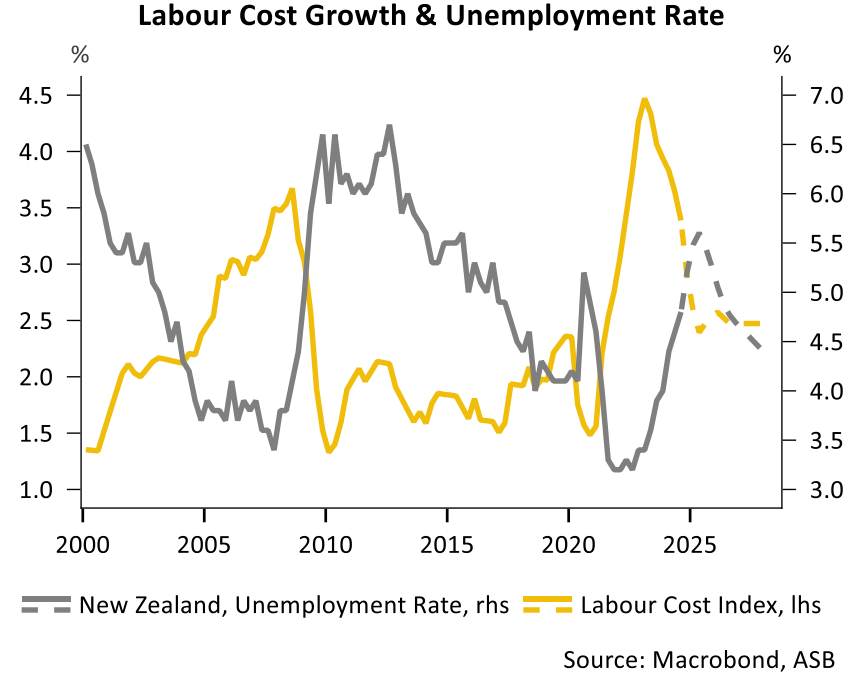

The figures showed that the protracted activity downturn is now catching up with the labour market, with employment levels contracting by 0.5% over the quarter and the unemployment rate rising to 4.8%, the highest in four years.

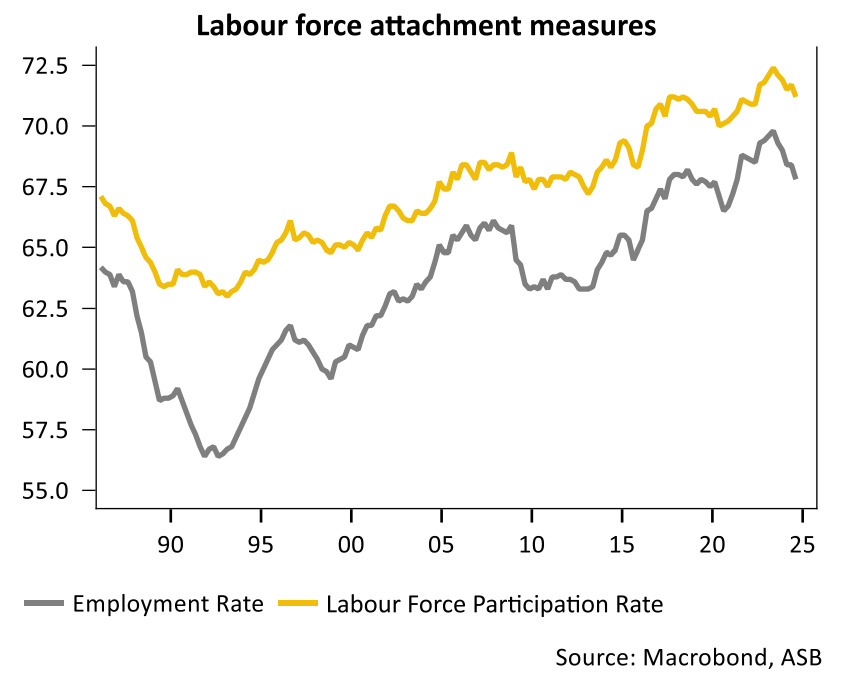

New Zealand’s unemployment rate would have risen further if not for the sharp fall in participation to 71.2% of the working-age population, the lowest level in two years (71.7% in Q2).

The fall in participation was especially hefty for younger age groups.

Meanwhile, the 0.5% contraction in employment was driven by full-time employment (-0.7% QoQ and -0.7% YoY).

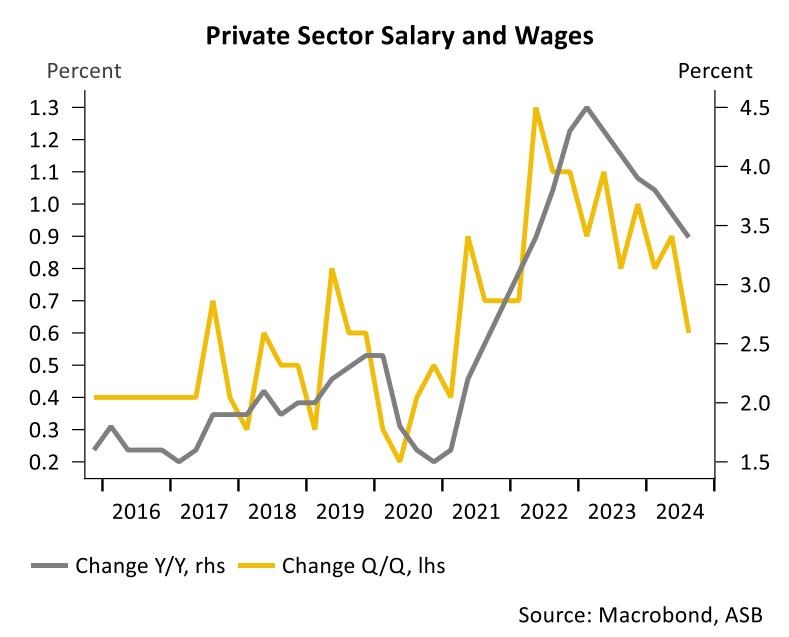

New Zealand’s wage growth also cooled more than expected.

Major bank ASB expects New Zealand’s labour market to deteriorate further alongside the weak economy:

The balance of power is shifting away from employees, with employment levels contracting and the unemployment rate rising to 4.8% of the labour force, the highest in 4 years.

The unemployment rate could have been much higher (in the low 5’s) if it were not for sharply falling labour force participation, suggesting potential job seekers are finding it that much harder to find work.

The labour market is expected to continue to soften given a subdued outlook for economic activity and likely cost-cutting by firms struggling to rebuild profitability.

Slowing growth in the working-age population and a likely discouraged worker effect should keep labour force growth low and dampen the increase in the unemployment rate.

Despite a lower than expected starting point the unemployment rate is set to approach 5.5% by mid-2025. Labour cost increases were weaker than expected and should soften further heading into 2025.

We do not expect to see discernible signs of improvement in hiring until well into 2025.

The upside is that ASB expects the Reserve Bank to front-load the pace of monetary easing to normalise the economy:

The Q3 labour market figures and the softening labour market prognosis should prompt the continued frontloading of monetary policy easing…

We expect the RBNZ to continue frontloading monetary policy easing, with a 50bp cut in November, and with the 4.25% OCR much closer to the circa 3-4% neutral OCR zone.

OCR moves in 2025 will be heavily conditional on the economic outlook.

We assume a gradual path of OCR cuts over 2025 and a 3.25% OCR endpoint, but note that the economy and the OCR could go down a number of different paths.