When central banks tighten interest rates, there is always the risk that they keep rates too high for too long, driving the economy into a tailspin.

Moreover, it is only when looking through the rear-view mirror that they recognise they went too far.

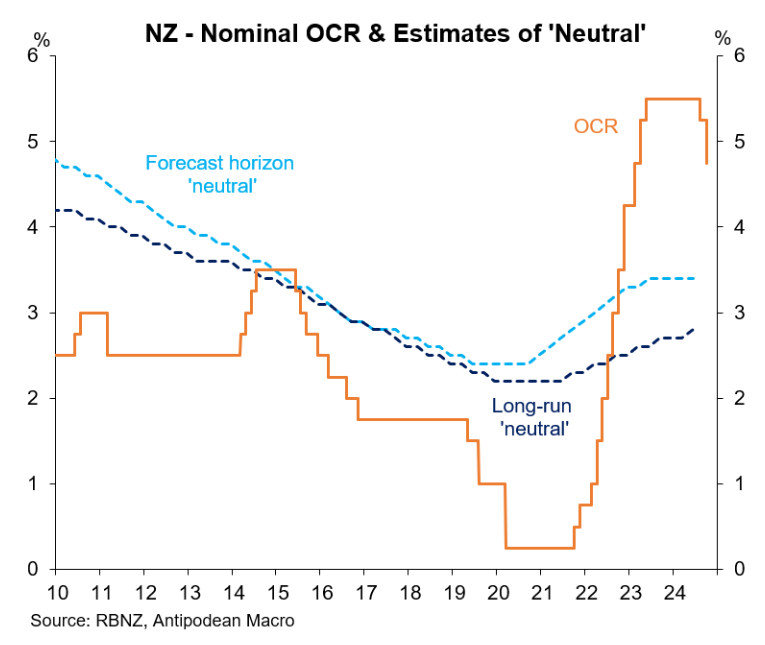

The Reserve Bank of New Zealand is experiencing such regret after embarking on one of the world’s most aggressive monetary tightening cycles, which saw the official cash rate peak at 5.50%.

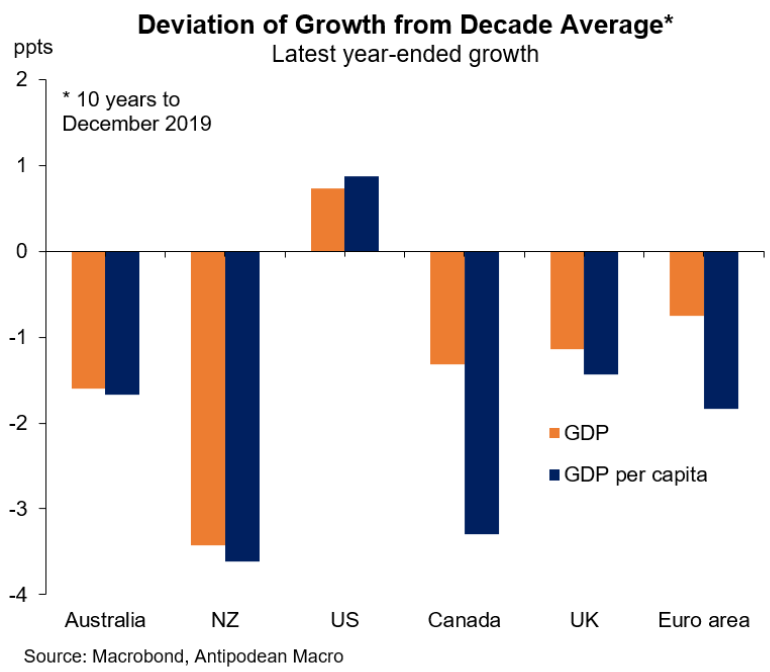

This monetary tightening engineered one of the deepest recessions in the developed world and in New Zealand’s modern history, with per capita gross domestic product falling by around 4% from its peak as of Q2 2024.

The Reserve Bank belatedly saw the error in its ways and cut the official cash rate by 0.75% over its last two monetary policy meetings. Even so, New Zealand’s monetary policy remains highly restrictive.

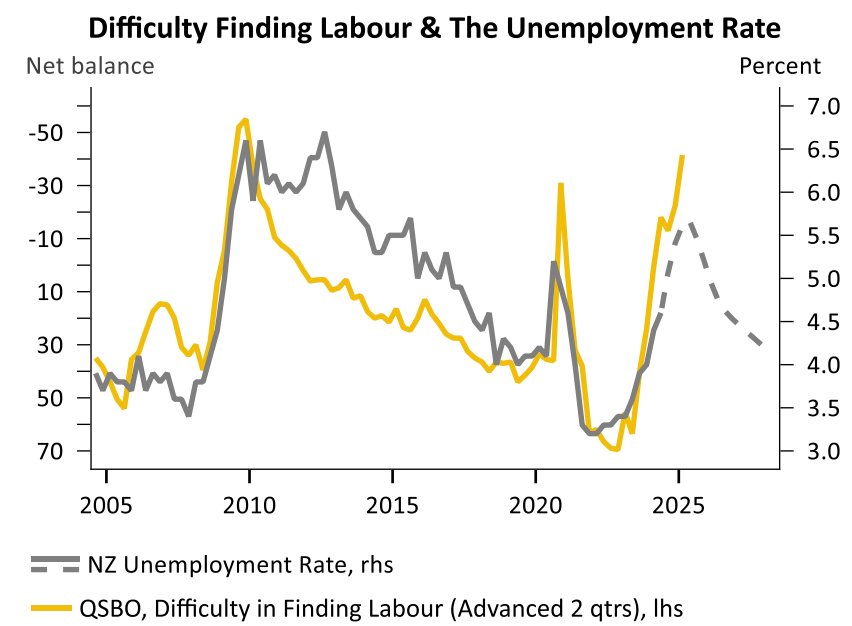

The impact has been especially severe on New Zealand’s labour market.

New Zealand’s unemployment rate rose to 4.6% in the June quarter and Big Four bank ASB predicts that the “protracted slowdown for economic activity” will lift unemployment to 5.1% in the September quarter, its highest level in four years, before peaking at near 6% by mid-2025.

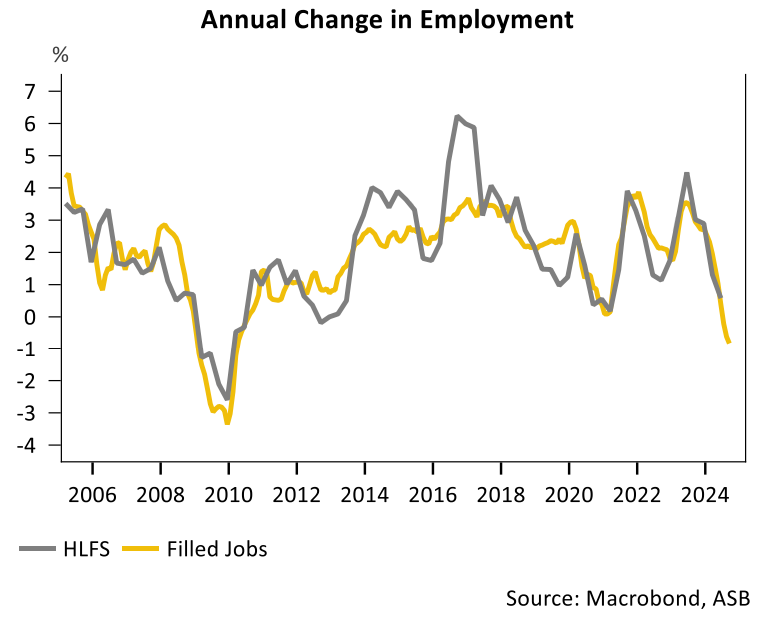

ASB also expects total employment to contract by 0.5% and wage growth to moderate sharply.

The commentary from ASB is especially bearish.

“The Q3 NZIER QSBO business survey showed a sizeable deterioration in experienced hiring (to -33, the lowest since 2009), with firms also planning on cutting staff in the next 3 months (hiring intentions -10)”…

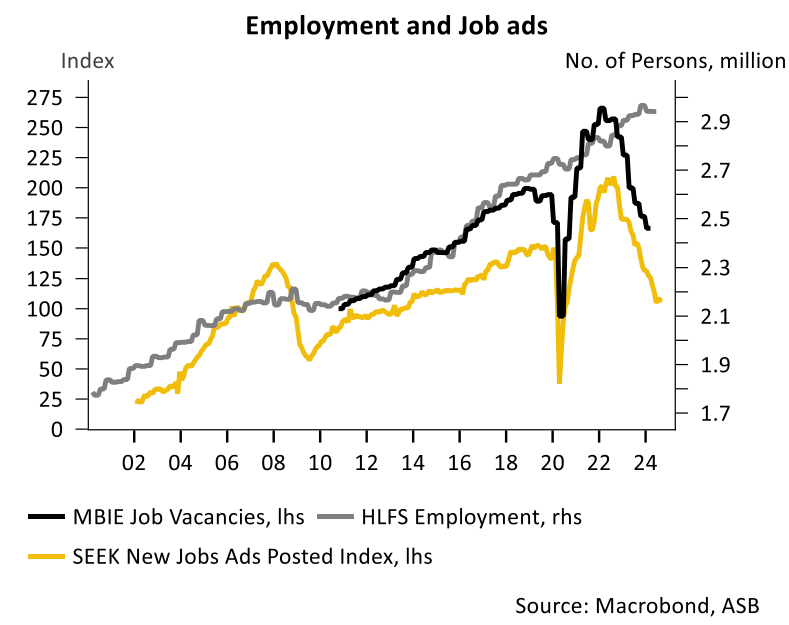

“Job advertising has continued to cool, with Seek job ads and MBIE job vacancies around 30% down on a year ago”…

“Firms still find it reasonably easy to obtain unskilled (net 57% easy) and skilled staff (net +26% easy), the highest since 2009. Announced public sector job cuts (more than 7,000 roles to date have been announced) should start to dampen hiring”.

The only upside is that the sharp slowing in net overseas migration will temper labour supply growth and the rise in the unemployment rate.

“According to Statistics NZ, the working age population rose just 0.3% in Q3, (1.8% yoy) and with downward historical revisions. Linked to this is sharply cooling net immigration of working age persons”.

“This inflow is set to further cool, which will cap the growth in the available labour pool and expected future climb in the unemployment rate”.

ASB warns that “few signs of imminent economic recovery are evident, with the demand for workers expected to remain weak heading into 2025”.

“Soft demand and the weak backdrop for corporate profitability is slowing business activity”, ASB says. As a result, “overall employment levels are expected to edge lower until a modest recovery takes place from mid-2025”.

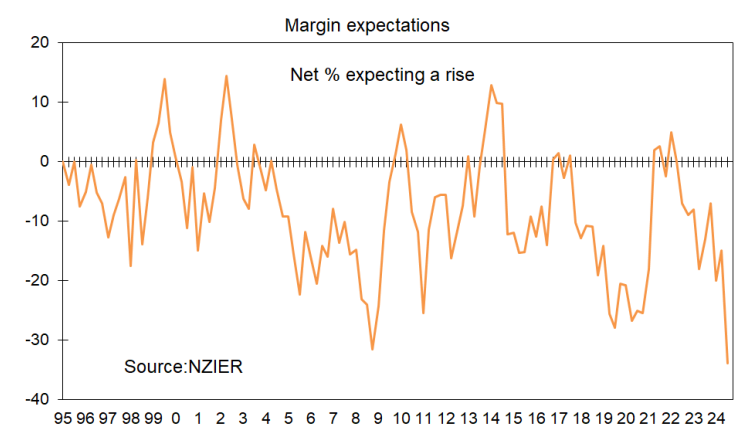

Separate NZIER survey data compiled by independent economist Tony Alexander shows that firm margin expectations have collapsed to their lowest level since 1976.

The upshot is that ASB believes that the weak labour market data “should encourage the continued frontloading of monetary policy easing”.

As a result, ASB anticipates another 0.5% rate cut at the Reserve Bank’s November meeting, then additional easing in 2025.