The Australian Bureau of Statistics (ABS) released its cost-of-living indices for the September quarter. The data showed the nation’s cost-of-living crisis has hit employee households the hardest.

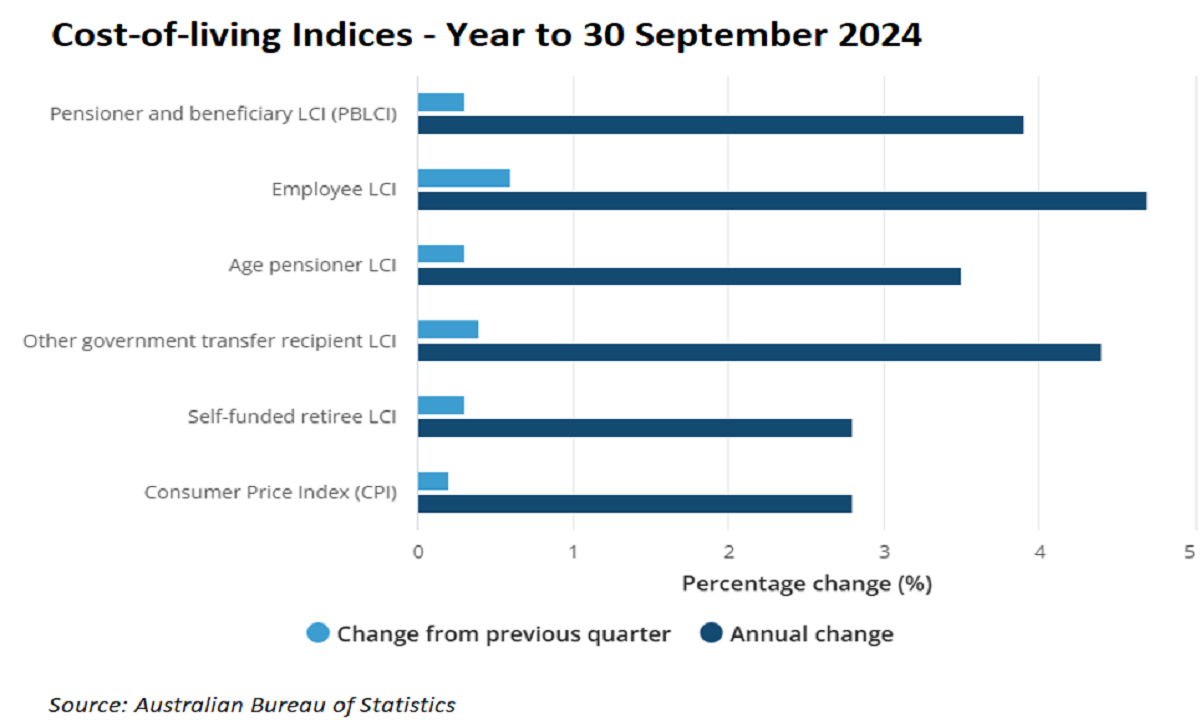

As illustrated in the following chart from the ABS, the cost-of-living for households headed by an employee rose by 4.7% in the year to September 2024, well above the headline CPI inflation rate of 2.8%.

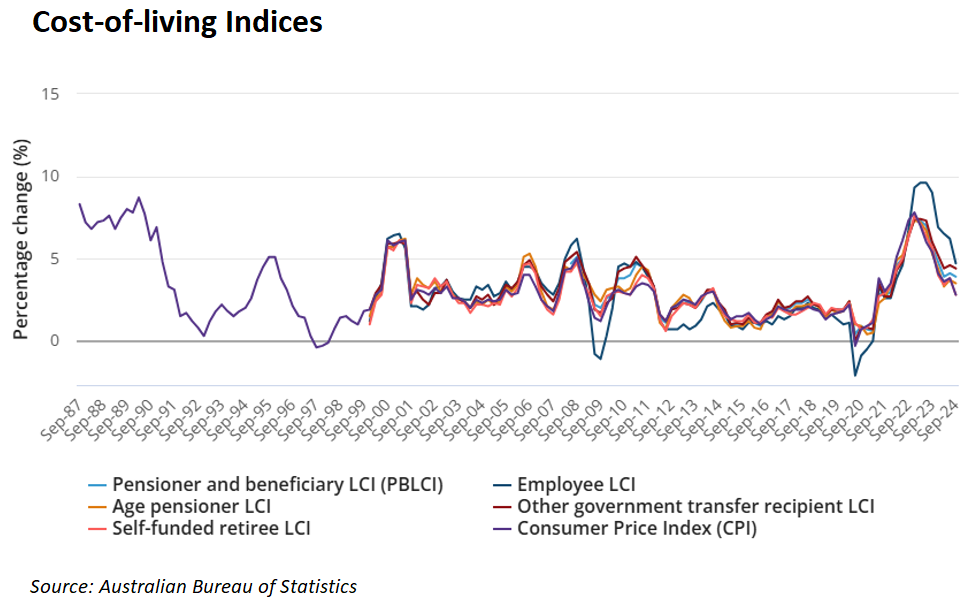

The following time series from the ABS shows that employees have experienced the highest cost-of-living since June 2022, when the Albanese government was elected.

In the nine quarters since June 2022, cost-of-living for employee households rose by 19.2%, versus a 12.1% increase for Age Pensioner households, an 11.8% rise for Pensioner and beneficiary households, a 12% increase for self-funded retiree households, and an 11.5% rise for Other government transfer recipient households.

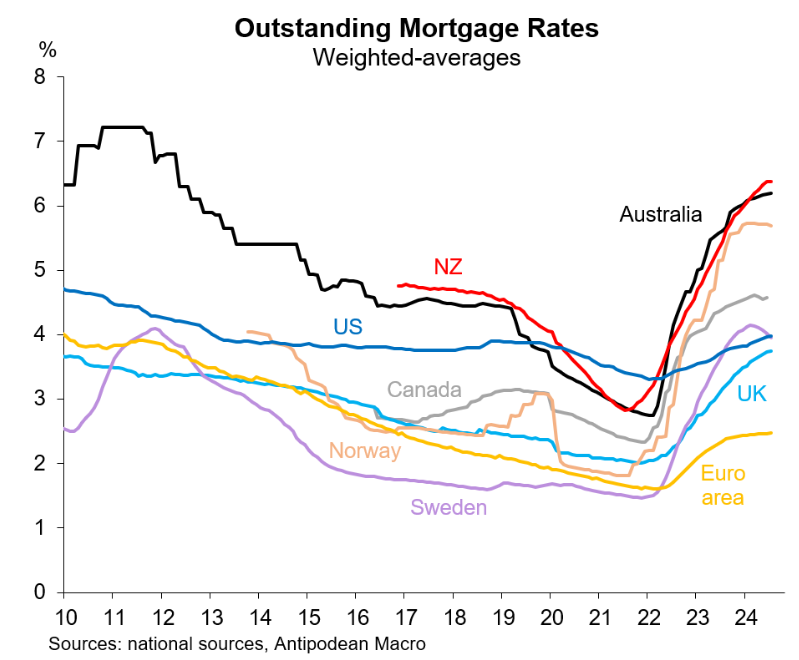

The primary reason why employee households have experienced a larger increase in their cost of living is because they are more likely to hold mortgages.

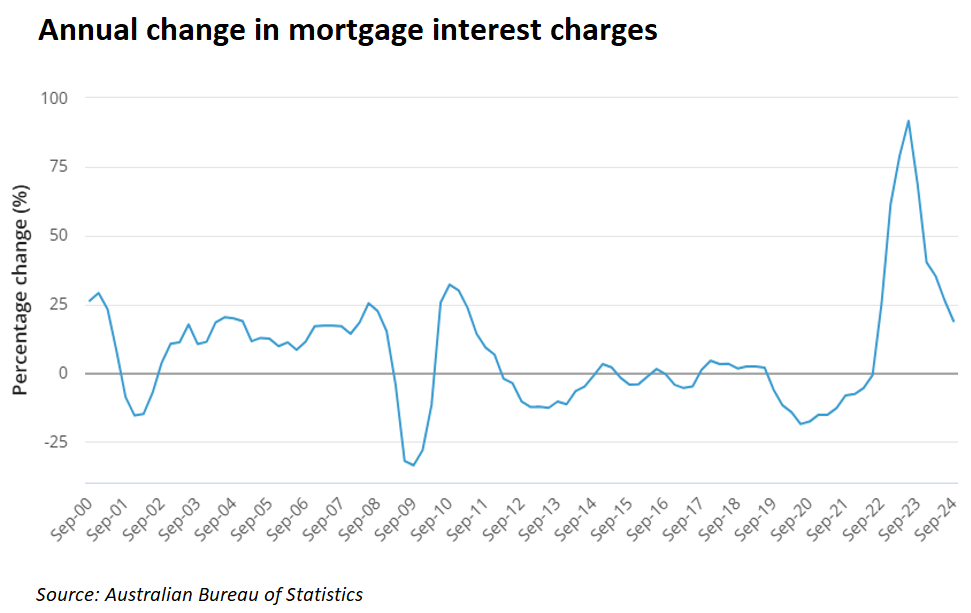

Annual mortgage interest charges have risen enormously since the Reserve Bank of Australia (RBA) commenced its monetary tightening cycle in May 2022.

As noted by the ABS:

Mortgage interest charges rose 18.9% over the year, continuing the downward trend in mortgage interest charges inflation from a peak of 91.6% in the June 2023 quarter.

The Reserve Bank of Australia’s (RBA) decision to keep the cash rate on hold since November 2023 was the main contributor to the easing in annual growth.

However, mortgage interest charges remained elevated compared to recent years, as some fixed rate loans continued to rollover into higher variable rate loans.

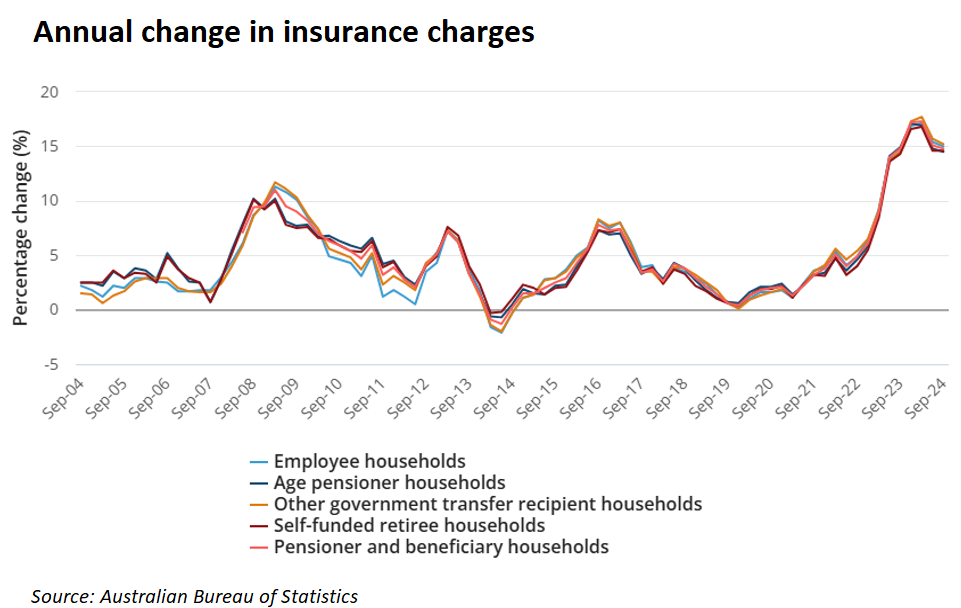

Insurance charges have also become a major cost-of-living thorn in the sides of Australians, recording a ~15% rise in the year to September across all cohorts.

Employee households are the segment of the population that has been most impacted by rising mortgage repayments, rents, and income taxes.

As a result, they have experienced the largest rise in cost-of-living since the Albanese government came to office.